- US2000 is the top gainer among U.S. indices today, up 0.9%.

- Trump is considering three more candidates for the position of Federal Reserve Chair.

- Scott Bessent says U.S. interest rates should fall by as much as 175 basis points.

- The U.S. dollar is losing ground, while precious metals futures are rising; in the large-cap market, AMD stands out with a 6% gain, along with fashion company Capri Holdings.

US2000 (D1 chart)

Russell 2000 futures (US2000) are climbing to 3,313 USD, a level last seen in February 2025. The index is currently testing key resistance zones linked to supply concentration and price reactions. EMA50 (orange line) remains the key support level.

Source: xStation5

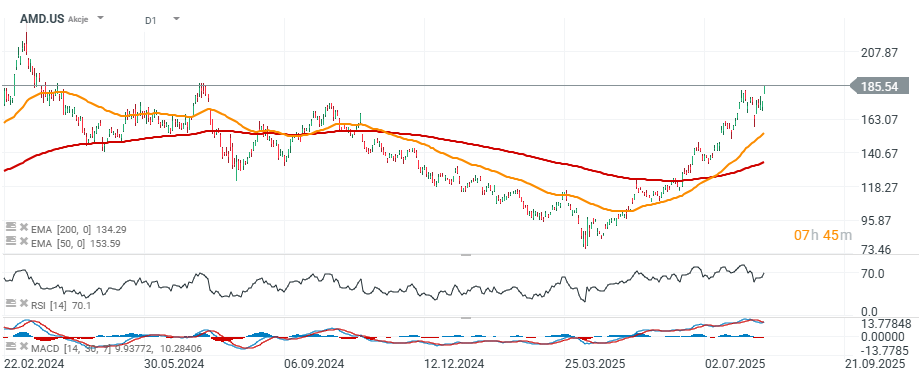

AMD (AMD.US) shares are up nearly 6% to 185 USD, matching local highs from July 2024. Citi analysts today maintained a ‘neutral’ rating on the stock.

Source: xStation5

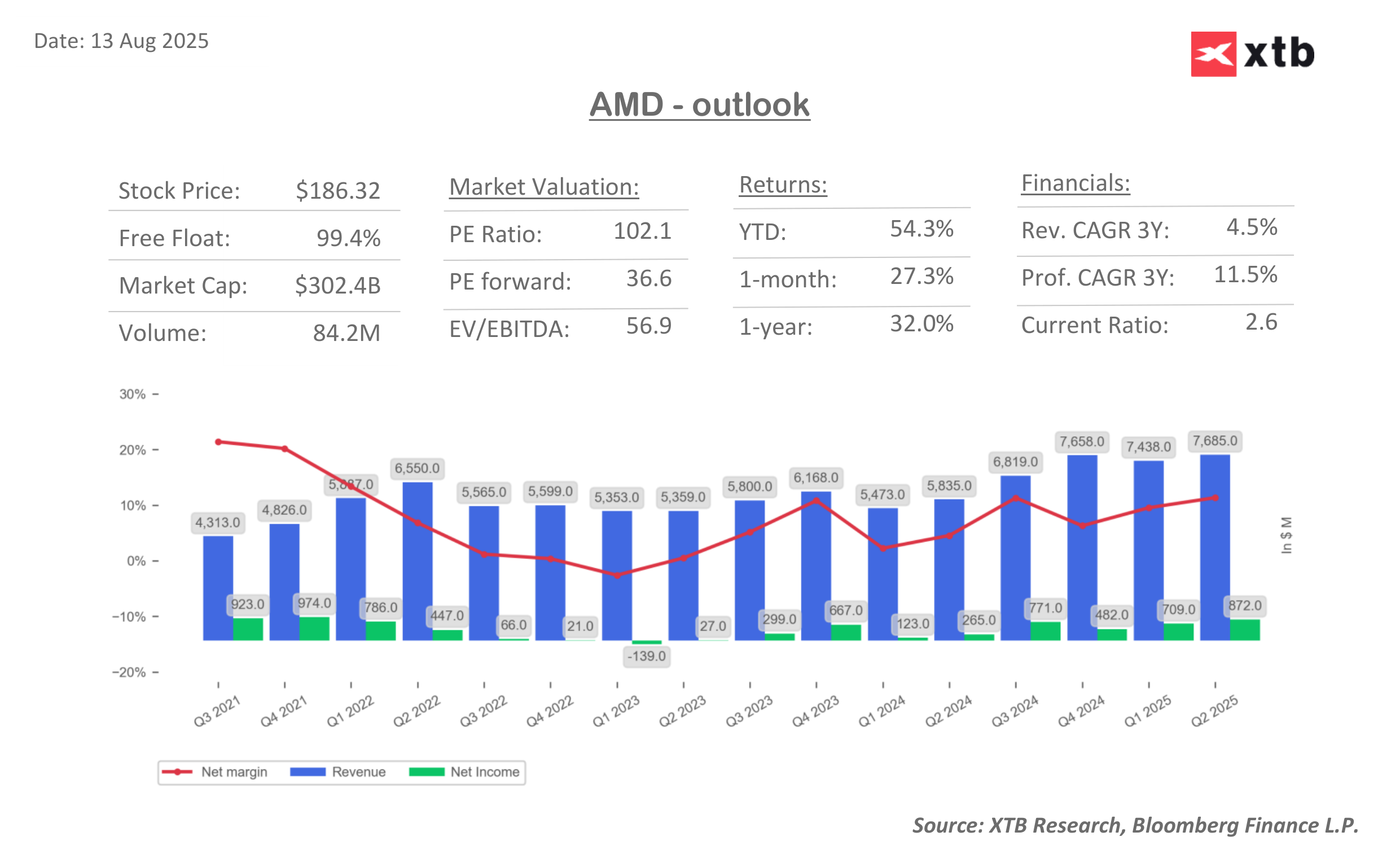

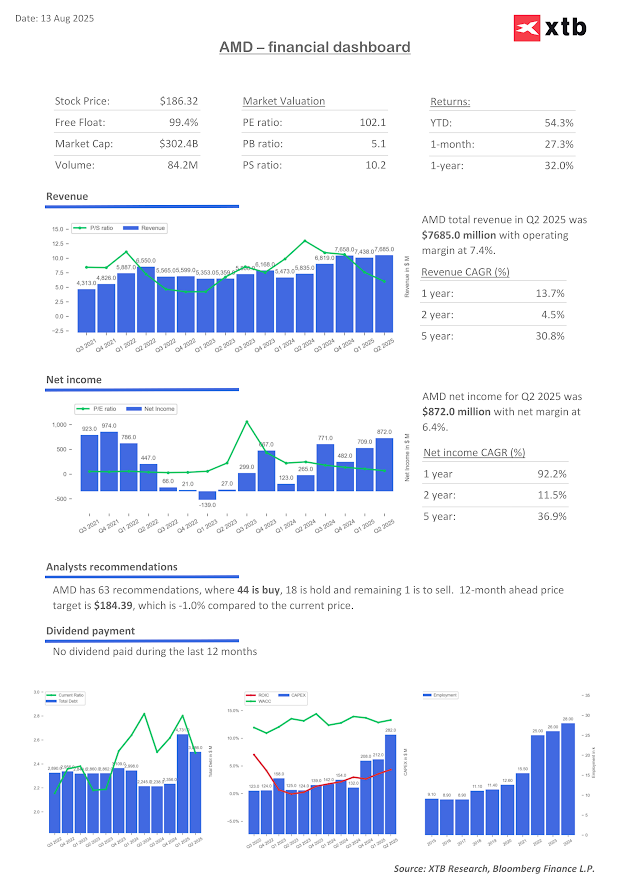

While AMD was relatively attractively valued six months ago, today the stock is approaching all-time highs, with investors paying a massive premium—100 times annual earnings and 37 times expected 12-month profits. The market, however, believes the company will capture a significant share of the AI chip market, which could materially and sustainably improve profitability.

Source: XTB Research, Bloomberg Finance L.P.

Company News

-

C3.ai Inc. (AI.US) slips after Oppenheimer downgraded the stock from “outperform” to “market perform,” following recent preliminary results viewed as weak.

-

Cadre Holdings Inc. (CDRE.US) falls after BofA Global Research cut its rating on the safety equipment maker from “neutral” to “underperform,” citing concerns about “slow growth and the current M&A environment.”

-

Capri Holdings (CPRI.US) gains 7% after JPMorgan upgraded the Michael Kors owner from “neutral” to “overweight,” noting that fewer markdowns and tariff mitigation measures should boost earnings.

-

HanesBrands (HBI.US) drops nearly 6% after Gildan Activewear agreed to acquire the company in a deal with an implied equity value of about $2.2 billion. Gildan shares see slight gains.

-

Intapp Inc. (INTA.US) jumps over 20% after the software services company reported fourth-quarter results beating expectations and issued a well-received outlook.

-

KinderCare (KLC.US) plunges 20% after the childhood education company reported disappointing Q2 results, citing lower-than-expected enrollment and cutting its full-year forecast.

-

Lumentum (LITE.US) rises 4% after the optical and photonic products maker posted better-than-expected Q4 results, prompting an analyst upgrade.

-

Palo Alto Networks (PANW.US) gains nearly 2% after Deutsche Bank upgraded the cybersecurity firm from “hold” to “buy.”

-

SimilarWeb (SMWB.US) surges over 20% after the web services company reported Q2 revenue above expectations and raised its full-year adjusted operating profit forecast.

-

Webtoon (WBTN.US) soars over 30% in premarket trading after the digital comics platform announced a deal with Disney (DIS.US) to bring around 100 series to its English-language app.

Daily Summary: Middle East Sparks Oil Market

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

Oil Under Pressure as G7 Decision Remains Pending

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.