- Wall Street opens lower

- The dollar gains for the third consecutive session

- Bond yields are losing

- Investors await tomorrow's CPI data and FOMC decision in uncertainty

On the day before the FOMC decision and CPI report, emotions in the markets are noticeable. Investors are choosing less risky assets like the USD dollar to wait out the two key events tomorrow. First, the US CPI report will be published, followed by the Fed's decision.

Today, however, marks the start of the two-day meeting. Expectations indicate over a 99% probability of keeping interest rates unchanged. However, investors' attention will focus on Fed Chairman Jerome Powell's speech and the timing of the potential first rate cut this year.

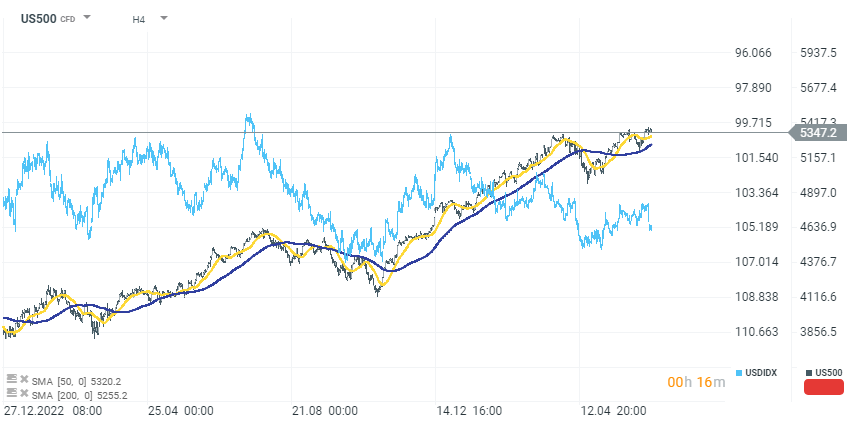

USDIDX (D1 interval, inverted)

The dollar started strengthening last week after the NFP data was published on Friday. The stock market and USD are negatively correlated, so the significant increase in USDIDX in recent days may continue to pressure indexes, including the US500.

Source: xStation 5

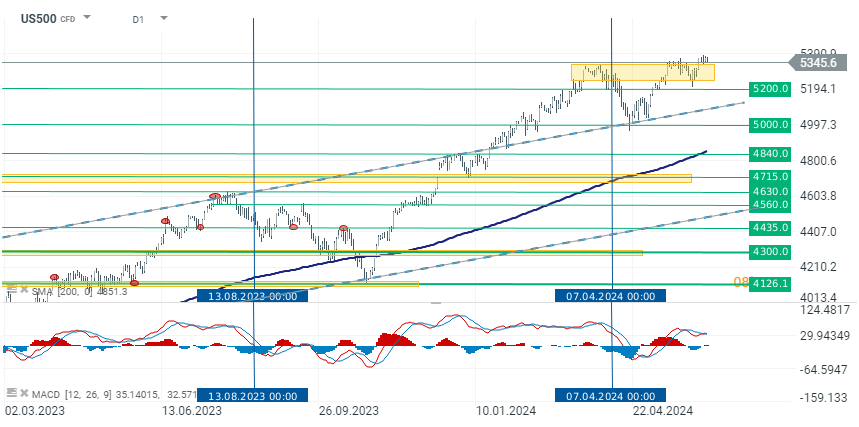

US500 (D1 intervals)

Despite nervous market sentiment, the two main indices on Wall Street, US500 and US100, are not showing significant declines. Instead, we can observe price consolidation around historical highs, awaiting a downward or upward catalyst tomorrow.

Source: xStation 5

Company News

Oppenheimer raised Nvidia's (NVDA.US) stock price target to $150 from $110 after its shares began trading post a 10-1 stock split, maintaining an Outperform rating. In the new model analysts reflected the increased share count and introduced CY26 estimates, noting key future product launches and CEO Jensen Huang's recent highlights at Computex 2024.

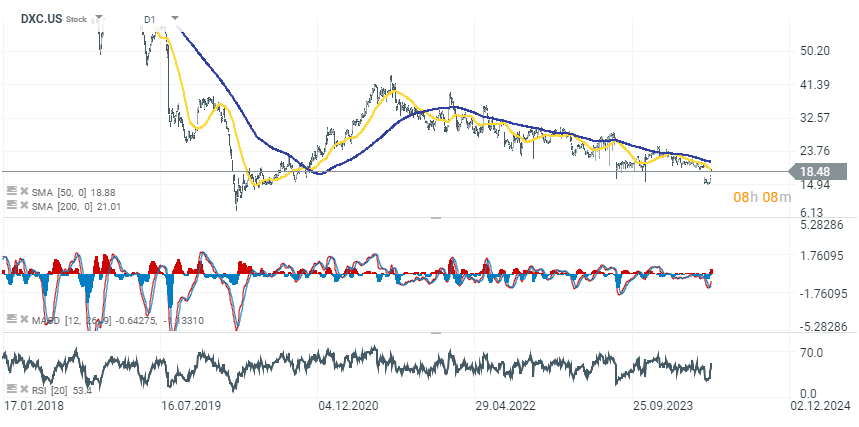

DXC Technology (DXC.US) gains over 9.00% after reports that Apollo Global (APO.US) and Kyndryl (KD.US) are discussing a joint bid for the information technology services firm, with an expected acquisition offer between $22 and $25 per share. DXC, with a market cap of $3B, is also selling its insurance software business for over $2B and may remain independent.

Source: xStation 5

Yext (YXT.US) fell more than 11% after missing Q1 consensus estimates and providing a disappointing outlook. The company expects Q2 revenue between $98M and $98.4M, below the consensus of $98.4M, and lowered its FY2025 revenue outlook to $394M-$396M from a prior view of $400M-$402M. Yext also announced plans to acquire Hearsay Systems for $125M, with an additional $95M if performance targets are met.

Array Technologies (ARRY.US) drops over 10% after CFO Kurt Wood announced his intention to step down at the end of the second quarter to pursue other business interests.

US OPEN: US500 tests record highs as technology sector leads gains

Three Markets to Watch Next Week (26.12.2025)

Morning wrap (26.12.2025)

US OPEN: Holiday season extinguish volatility despite political risks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.