-

Wall Street indices trade lower

-

A double top on US2000 chart

-

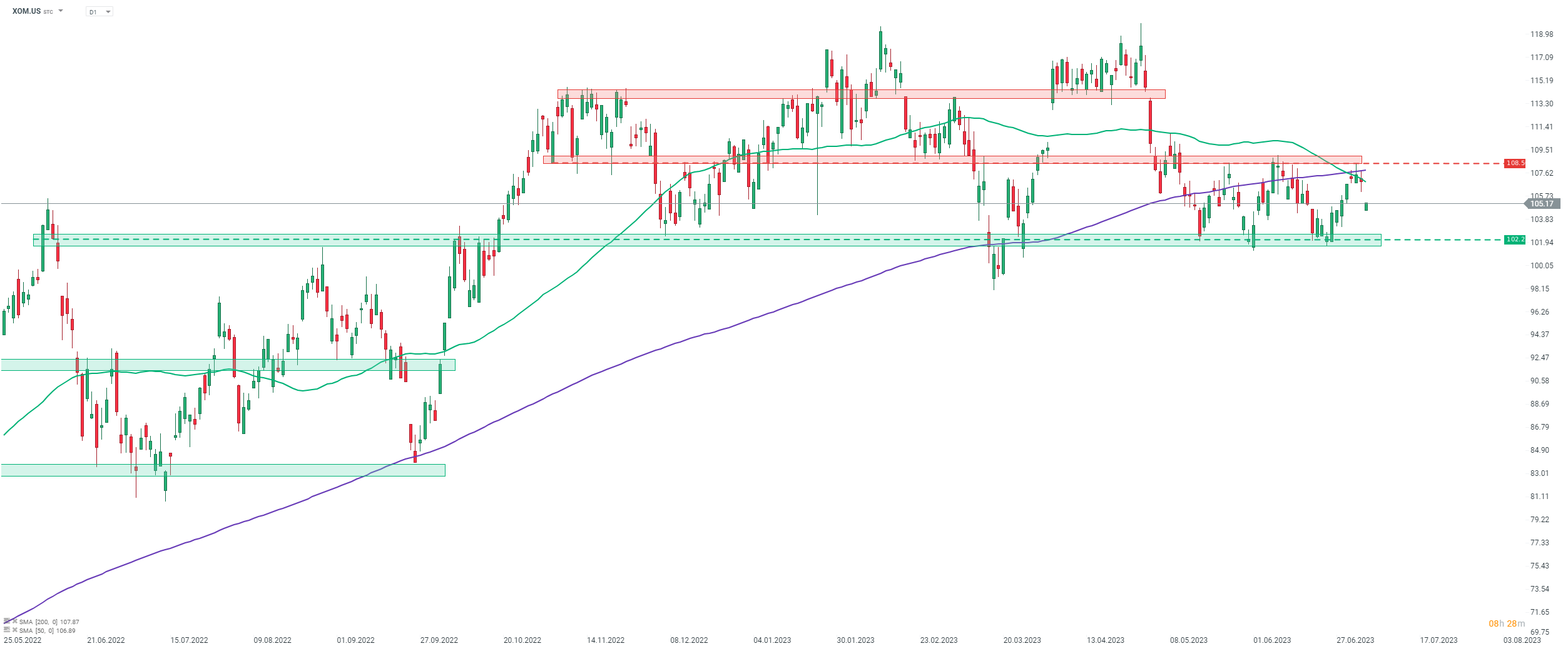

Exxon Mobil drops after issuing profit warning

Wall Street indices launched today's trading lower. This can be seen as a reaction to a rather hawkish FOMC minutes released yesterday, that showed some FOMC members pushing for a 25 basis point rate hike at the June meeting. Also, labor market data released today added to hawkish sentiment in the markets.

There are a number of macro reports from the United States scheduled for release today and those that were already released surprised positively. ADP report showed a massive 497k jobs gain for June while Challenger report showed lay-offs in June dropping to a 7-month low. Two final pieces of US data scheduled for today - services ISM for June and JOLTS report for May - will be released at 7:00 pm BST.

Source: xStation5

Source: xStation5

Small cap Russell 2000 (US2000) is one of the worst performing Wall Street indices as of late. While the index has managed to recover from declines that occurred during the first half of June, it has later once again failed to break above the 1,915 pts resistance zone. As a result, the double top was painted on the chart. Neckline of the pattern can be found in the 1,820 pts area and a break below this zone would pave the way for a deeper decline. On the other hand, it should be noted that the sequence of higher lows is still present on the chart and therefore the uptrend structure has not been broken yet.

Company News

Fidelity National (FIS.US) trades higher at the beginning of today's Wall Street session. It was announced today that GTCR, private equity firm, agreed to purchase a 55% stake in Worldpay, a payment processing company, from Fidelity. Deal values Worldpay at $18.5 billion and FIS will receive an upfront, net payment of around $11.7 billion once the transaction closes. GTCR committed to invest up to $1.25 billion in Worldpay growth. Deal is expected to close in Q1 2024.

Exxon Mobil (XOM.US) warned that lower gas prices as well as lower refining margins will result in Q2 2023 earnings being around $4 billion lower than in Q1 2023.

Meta Platforms (META.US) traded slightly higher at the beginning of the session after company premiered its new text-based communications app - Threads - which is seen as a potential rival to Twitter. We have written more about the app in one of our earlier posts today.

Perion Network (PERI.US) surges after release of flash results for Q2 2023. Company announced that it has generated $176.0 million in sales during April - June 2023 period. This is slightly higher than $170 million expected by the market.

Analysts' actions

- American Express (AXP.US) was downgraded to "neutral" at Baird. Price target set at $185.00

- Keurig Dr Pepper (KDP.US) was upgraded to "outperform" at Morgan Stanley. Price target set at $36.00

- Simon Property Group (SPG.US) was upgraded to "outperform" at Wolfe. Price target set at $127.00

- Neurocrine Biosciences (NBIX.US) was upgraded to "market perform" at BMO. Price target set at $96.00

- Affirm Holdings (AFRM.US) was downgraded to "underweight" at Pipe Sandler. Price target set at $11.00

Exxon Mobil (XOM.US) drops today after issuing a profit warning for Q2 2023. Stock pulls back after the failed attempt at breaking above the $108.50 resistance zone. Should sellers remain in control, stock may look towards the $102.25 support which marks the lower limit of a recent trading range. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.