- Wall Street extends bullish momentum despite weaker macro data

- US labor market remains strong

- C3.ai plummets after new revenue forecasts

- The House passed debt-limit legislation

S&P 500 futures showed minimal movement following the passage of debt-limit legislation in the House, a collaborative effort between President Joe Biden and Speaker Kevin McCarthy. The legislation aims to control government spending until the 2024 election and prevent a disruptive default by the United States. Traders are eagerly anticipating the resolution of the debt ceiling case and the release of the US Non-Farm Payrolls report tomorrow, as these events have the potential to influence the Federal Reserve's interest rate decision for June.

In May, private payrolls exceeded economists' projections, with ADP reporting a growth of 278k jobs compared to the estimated 180,000. Moreover, the number of jobless claims filed last week was lower than expected. These positive indicators highlight the continued robustness of the labor market, a key area of the economy. However, there are concerns that this sustained strength could lead the Federal Reserve to contemplate another interest rate hike at its upcoming policy meeting later this month.

ISM manufacturing index dipped -0.2 ticks to 46.9 in May after bouncing 0.8 ticks to 47.1 in April. This is a seventh consecutive month in contraction (below 50), reflecting the gloom in manufacturing.

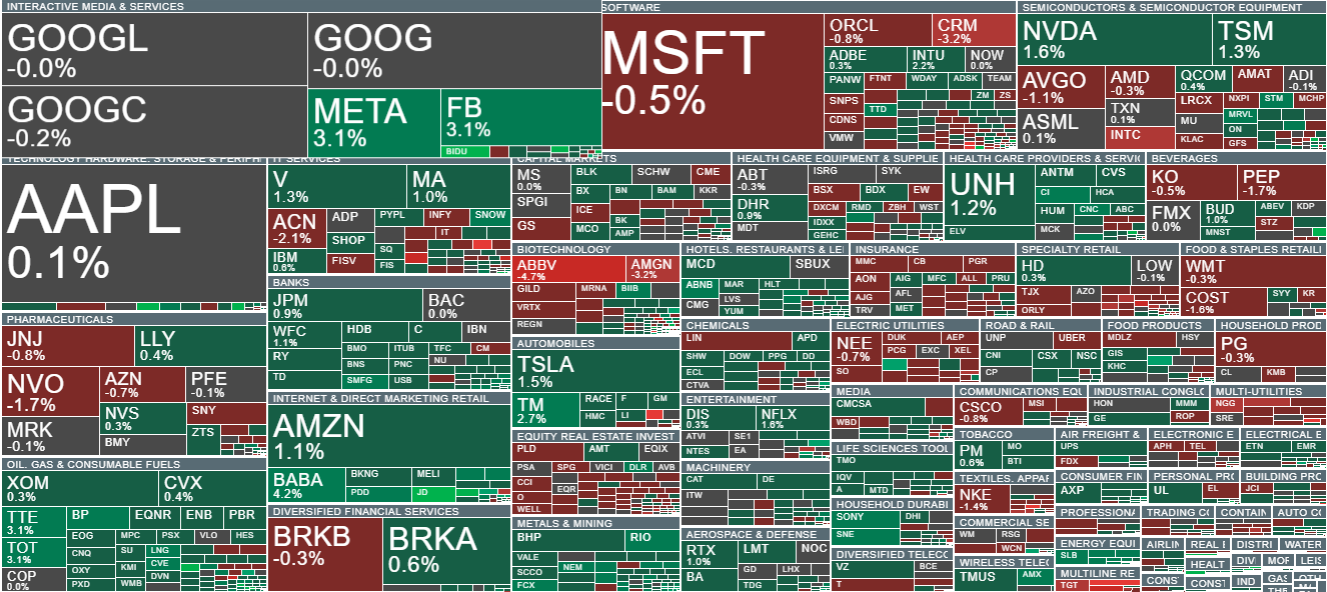

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Nvidia (NVDA.US) and Amazon (AMZN.US). Source: xStation5

Shares of S&P500 companies, volume reflects market capitalization. Gains are being made by META (META.US), Nvidia (NVDA.US) and Amazon (AMZN.US). Source: xStation5

US500 index is currently trading at 4200 points, which serves as a support level. The price is hovering around the upper resistance of a bear market downward trend channel, indicating a critical juncture. The direction of the index will largely depend on the upcoming price action. Notably, there has been recent rejection from this level, and the price is currently experiencing some struggles as well. It has retraced from this week's highs at 2048 points. If the price break below the current support level, the next support line to watch for is at 4164 points. Traders and investors will closely monitor these levels to gauge the index's future movement.

US500 index is currently trading at 4200 points, which serves as a support level. The price is hovering around the upper resistance of a bear market downward trend channel, indicating a critical juncture. The direction of the index will largely depend on the upcoming price action. Notably, there has been recent rejection from this level, and the price is currently experiencing some struggles as well. It has retraced from this week's highs at 2048 points. If the price break below the current support level, the next support line to watch for is at 4164 points. Traders and investors will closely monitor these levels to gauge the index's future movement.

Company News:

- C3.AI (AI.US) plummets as much as 12% due to disappointing guidance for the fiscal first quarter. Company published revenue forecasts for next quarter and FY24 that disappointed analysts and prompted D.A. Davidson to cut the stock to neutral from buy.

- Nordstrom (JWN.US) initially rallied almost 5.0% and then price back to the base after the department-store chain reported better-than-expected quarterly revenue and profit. Analysts were optimistic about the improvements at the retailer’s off-price Rack stores.

- Salesforce Inc. (CRM.US) shares are down 3.0% after the software company reported its Q1 results and gave a forecast showing the company isn’t growing as fast as it used to. Analysts noted, in particular, the slowdown in contracted sales, though many continue to be positive on its long-term prospects.

- Veeva Systems (VEEV.US) shares are up more than 17% after the application software company reported Q1 results that beat expectations and raised its full-year forecast. Analysts said the company appears to be navigating well through macro weakness.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.