- U.S. indexes open up as much as 1.00% higher.

- Technology companies are again the leaders in growth.

- Apple and Alphabet about potential AI Gemini integration.

- High hopes around Nvidia conference.

The beginning of the new week on Wall Street looks interesting. At the opening of the cash session, U.S. indexes are gaining even 1.50%. US500 is quoted 0.90% higher at 5230 points, US100 gains nearly 1.50% to the level of 18340 points, and US2000 loses 0.15% to 2060 points. Nonetheless, we also observe a slight increase in the value of the dollar (USDIDX) and a renewed rise in the yield of U.S. bonds to the level of 4.32%.

Source: Bloomberg Finance L.P.

Source: Bloomberg Finance L.P.

In the market, we observe high interest in information coming from the technology and AI sector on one hand, and nervousness ahead of the upcoming Fed and BoJ decisions on the other. Today, the 4-day Nvidia GTC conference began, which will last until March 21, i.e., Thursday. Market interest and hopes are definitely high. In the first part of the session, we observe increases in technology sector companies, especially AI and GPU. Investors hope for progress in chip development, the announcement of a new GPU model, and new partnerships formed at the conference between companies. On the other hand, we can also notice that part of the capital in the market is returning to safe assets such as the dollar and bonds. This week, Fed and BoJ will publish their decisions, and in both cases, the opinion of the central banks will be extremely important. Hawkish Powell may restore markets to balance, while from BoJ, an expectation is there that it will make a historic interest rate hike.

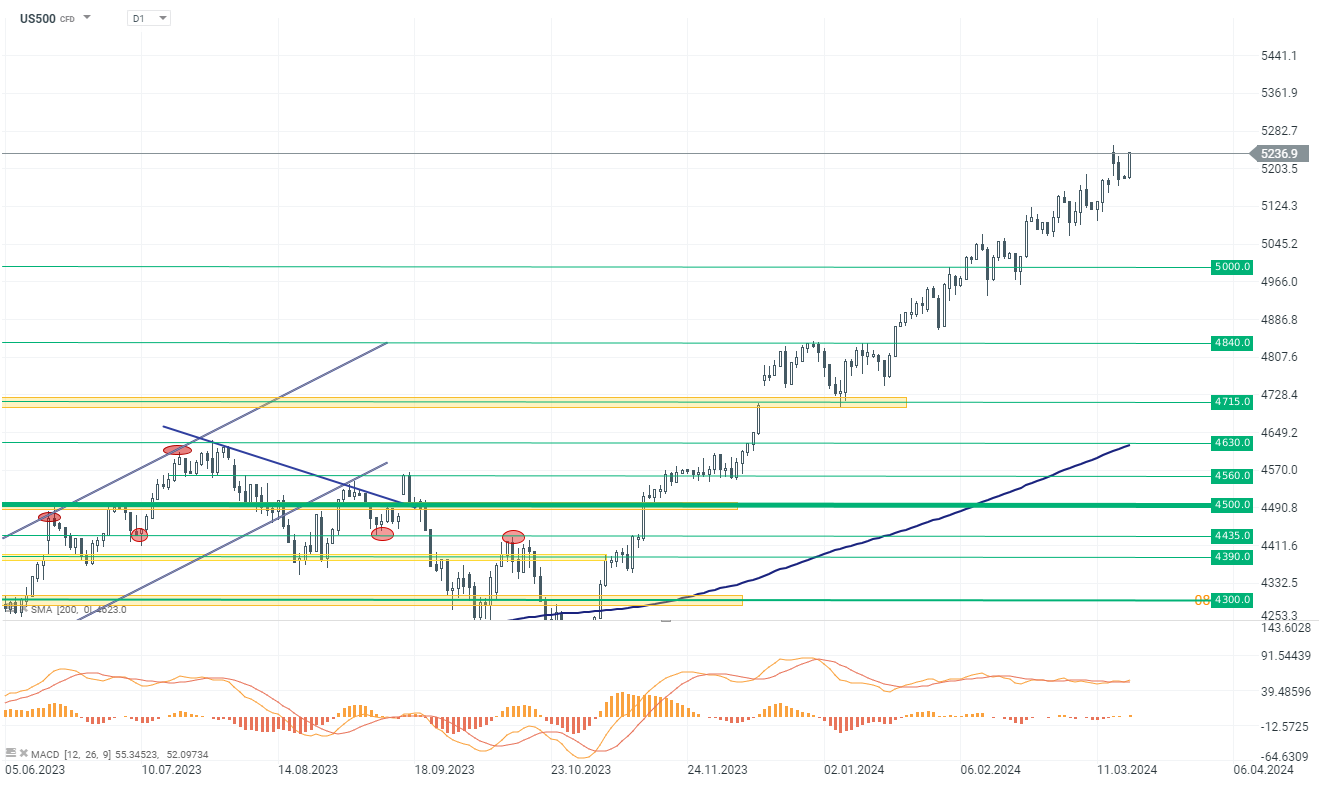

US500

The index continues its upward journey, and the long-awaited correction still does not occur. Since the end of January, quotes have been moving in a very narrow and dynamic upward channel, and every few sessions, they set new ATHs (All-Time Highs).

Source: xStation 5

Company News

Alphabet (GOOGL.US) gains as much as 6.50% following reports of Apple's interest in licensing Google's Gemini suite of AI tools for future iPhones. Gemini includes chatbots and coding assistants, and its integration is expected to introduce new features in iPhones later this year.

source: xStation 5

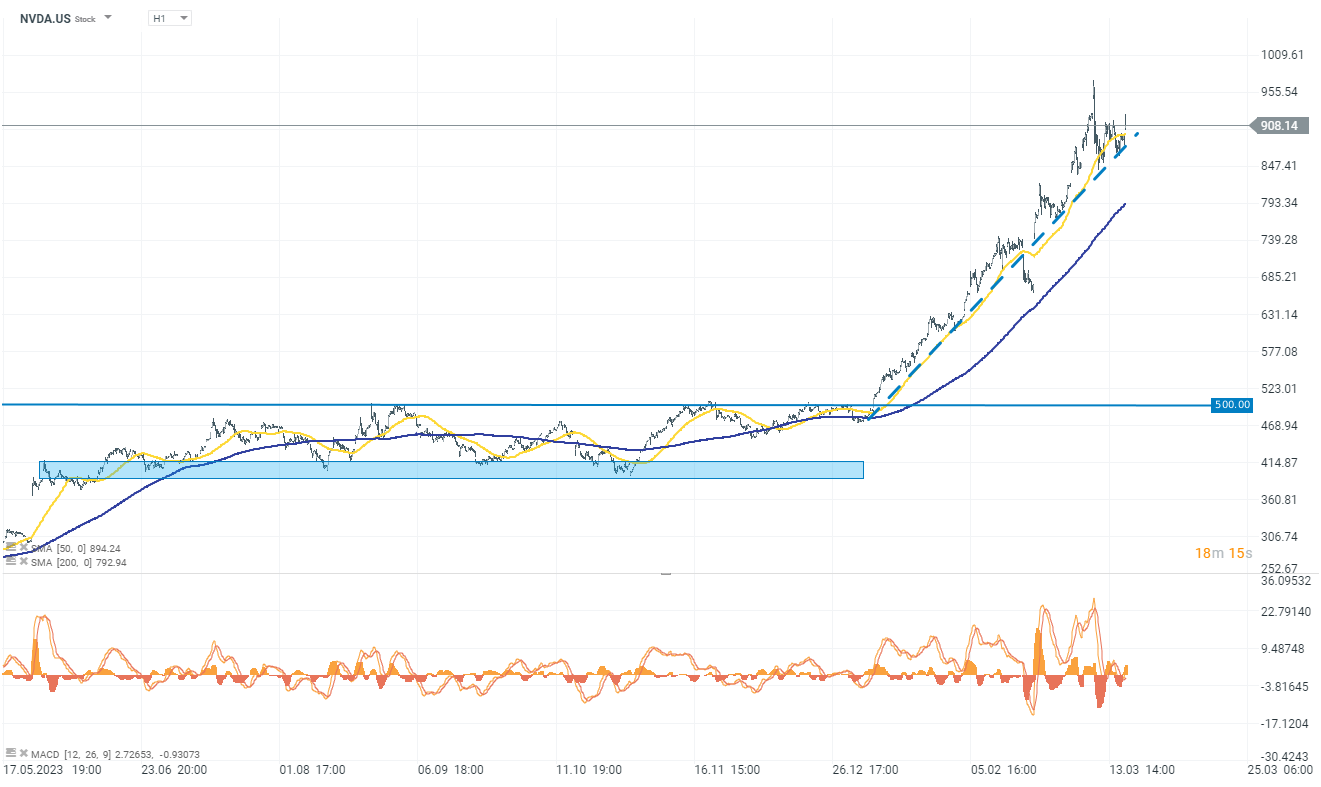

Nvidia (NVDA.US) Shares increased by 3.40% in anticipation of its annual GTC conference and CEO Jensen Huang's keynote. Wall Street's focus is on Nvidia's new Blackwell B100 AI chip. The B100 is set to be a significant development in the AI industry, and investors are keen on details like pricing, memory usage, and release date. HSBC raising Nvidia price target to $1,050.

Source: xStation 5

Intuitive Surgical's (ISRG.US) obtained the FDA's 501(k) clearance of the da Vinci 5, their new multiport robotic system. CEO Gary Guthart expressed satisfaction with this advancement. Analysts are optimistic about the system's impact on the company's long-term financial profile and see it as a catalyst for a multiyear revenue driver.

Shift4 Payments (FOUR.US) fell almost 10% after a memo from CEO Jared Isaacman indicated that buyout offers undervalued the company. The board deemed these offers as insufficient.

Daily Summary: Trump signals restraint over Greenland, easing market jitters

⏫US500 climbs over 1%

US OPEN: Trump pivot lifts Wall Street sentiment

Nvidia chart warning?🔎 Head-and-shoulders pattern takes shape

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.