Wall Street retreats from record highs achieved on Friday as markets await speeches from Federal Reserve members for clues regarding the future moves in the US monetary policy (US30: -0.3%, US2000: -0.3%, US100: +0.1%, US500 flat).

Despite delivering its first rate cut in 2025, Fed Chair Jerome Powell stated that he is comfortable with the current policy stance, signaling that after the recent adjustment the space for a truly dovish pivot remains limited. This has been further reiterated by Fed St. Louis President, Alberto Musale, who sees current policy as between moderately restrictive and neutral.

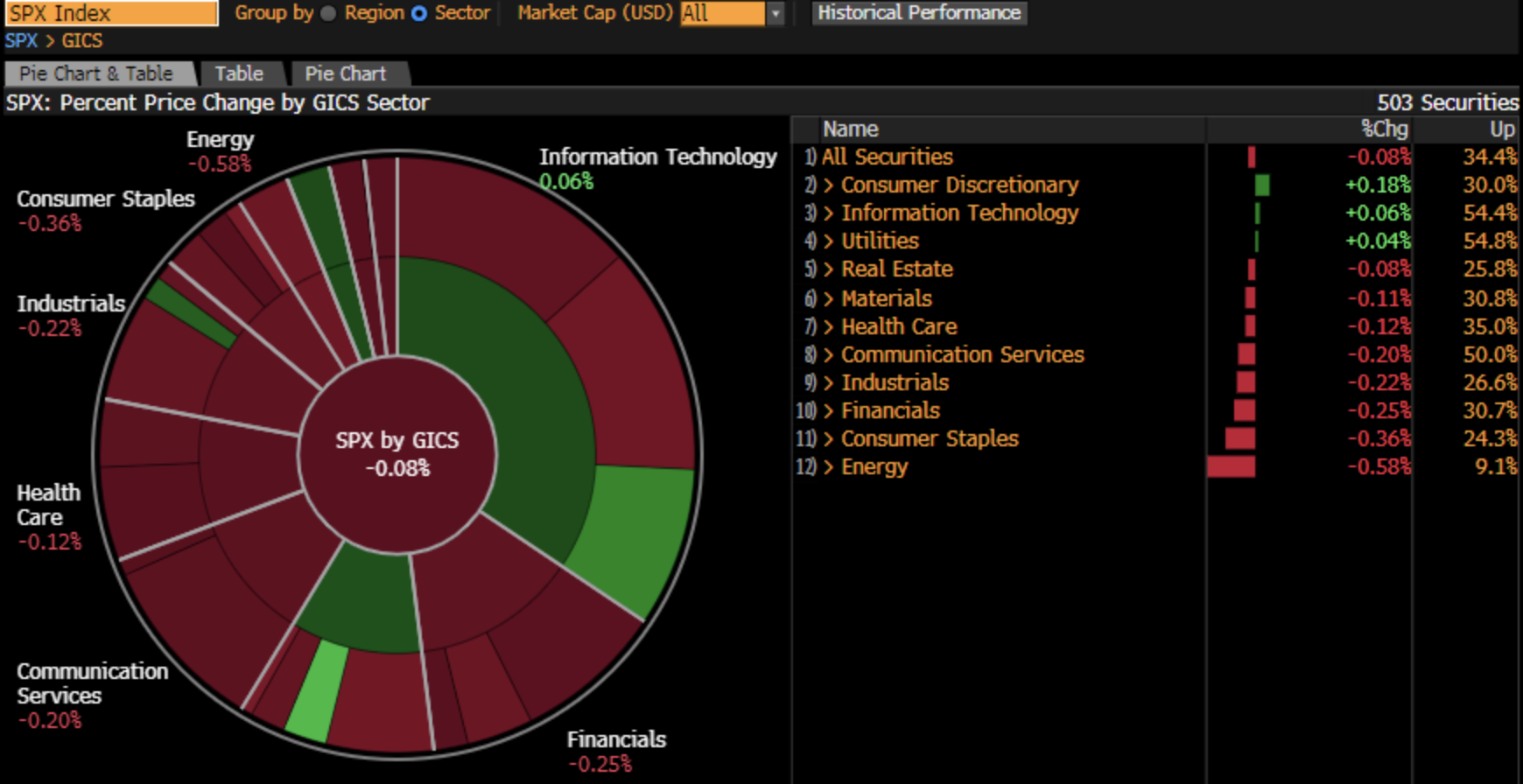

The majority of S&P 500 sectors are posting losses, with energy and consumer staples leading the declines. Market-wide selling is also reflected in gains for precious metals, with gold up 1% and climbing above $3,700, signaling a clear risk-off sentiment amid monetary policy uncertainty.

Surprisingly, the IT sector is bucking the trend despite recent changes to U.S. professional visas, which raise the cost of new permits to $100,000. The tech industry relies heavily on talent brought in through these visas, which account for over half of all such permits issued.

Performence of S&P 500 sectors. Source: Bloomberg Finance LP

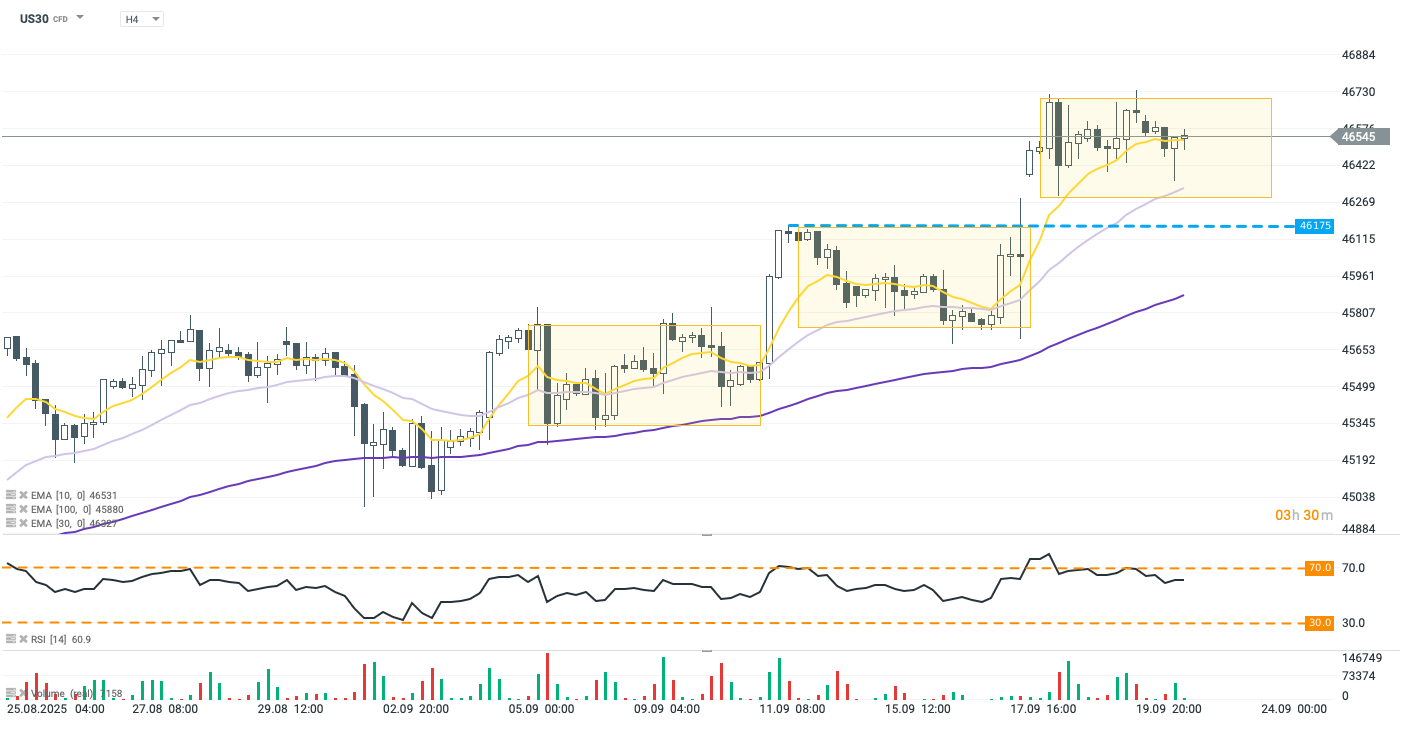

US30 (H4)

The DJIA is currently underperforming the other major U.S. indices, the S&P 500 and Nasdaq 100, reflecting a broad market correction from recent all-time highs. Only nine Dow components are trading in the green, with Apple (+3%), IBM (+1.5%), Nike (+1%), and American Express (+0.9%) as the main gainers. The US30 contract has broken well below the 10-period exponential moving average (EMA10, yellow), though dip buyers have supported a mean reversion. The lower edge of the 400-pip wide geometry aligns with the EMA30 (light purple), which should act as a key support if selling pressure resumes.

Source: xStation5

Company news:

-

Amer Sports shares tumbled 5.4% after Chinese authorities launched a probe into Tibet fireworks. The investigation raised investor concerns over potential regulatory risks in China, hitting sentiment toward the sports equipment maker. The sharp drop reflects broader market sensitivity to geopolitical and compliance-related developments.

-

Compass trades 2% higher after the company announced the merger with Anywhere Real Estate in a $10 billion deal, making Compass the largest U.S. residential brokerage by far. Anywhere shareholders will get 1.436 Compass shares each, valuing the stock at $13.01. The deal closes in 2026, with Compass CEO Robert Reffkin leading the combined company.

-

Kenvue plummets 6.3% after CEO Kirk Perry reportedly met Robert F. Kennedy Jr. to dissuade him from citing Tylenol as an autism cause in an upcoming report, WSJ said. Shares had fallen 9% after earlier reports of potential links. Kenvue maintains acetaminophen is safe, while lawsuits over the claims remain ongoing.

-

MBX Biosciences shares surged 120% after its once-weekly hypoparathyroidism drug, canvuparatide, met the main goal in a Phase 2 trial. 63% of treated patients hit the endpoint versus 31% on placebo, with strong safety data. MBX plans a Phase 3 trial in 2026 to advance the potential therapy.

-

Oracle named Clay Magouyrk and Mike Sicilia as co-CEOs, with Safra Catz shifting to Executive Vice Chair after leading since 2014. The $877B firm credited its cloud and AI focus for strong growth. Oracle also recently secured a $300B OpenAI cloud deal, reinforcing its AI-driven strategy.

-

Additionally, Oracle will secure and retrain TikTok’s U.S. algorithm under a Trump-backed deal, ensuring American buyers control the platform after ByteDance’s divestiture. U.S. user data will be stored in Oracle-managed cloud servers, isolating it from China. Oracle will continuously monitor the algorithm to prevent manipulation and maintain security.

-

Pfizer is acquiring Metsera for up to $7.3 billion to enter the weight-loss drug market. The deal offers $47.50 per share plus up to $22.50 more if Metsera’s obesity treatment meets clinical milestones. Metsera shares jumped 60% premarket, and the transaction is expected to close in Q4. The stock is up 2.4%

IBM Earnings Preview: Will grandfather of IT industry deliver expectations?

Teledyne Technologies – Strong results but shares fall over 5%

BREAKING: Oil inventories fell despite increase expectations. WTI trades below 59 USD

Texas Instruments tumbles down after earnings, what went wrong?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.