Tuesday’s session was not favourable for buyers. A sell-off in bonds, triggered by growing investor concerns, dragged stock markets worldwide lower. S&P 500 futures at times lost more than 1.5%. Today’s session opens with a correction of that nervous decline. S&P is up 0.3% and NASDAQ is up 0.7%.

The market managed to reverse most of yesterday’s losses, but the U.S. session still ended in the red. The main U.S. stock index fell about 0.6%. Key risk factors were mounting investor fears about maintaining strong results amid a weakening economy. Some also expressed concerns over the health of the current president and priced in his potential resignation. The tipping point came with a sudden sell-off in G7 bonds, as investors appear to be pricing in long-term risks and inflation.

Today, positive sentiment is being fuelled by tech companies, dovish comments of Waller and weak labor market data giving hope for sooner and deeper rate cuts.

Macroeconomic Data:

The U.S. Bureau of Labor Statistics published today’s much-anticipated employment data. Investors expected further cooling of the labor market, but readings turned out to be even worse than expected.

Job Openings:

- Published: 7181k (Expected: 7.382k, Previous: 7.437M)

Later in the day, the market will await a speech from FOMC member Kashkari as well as the release of the Beige Book.

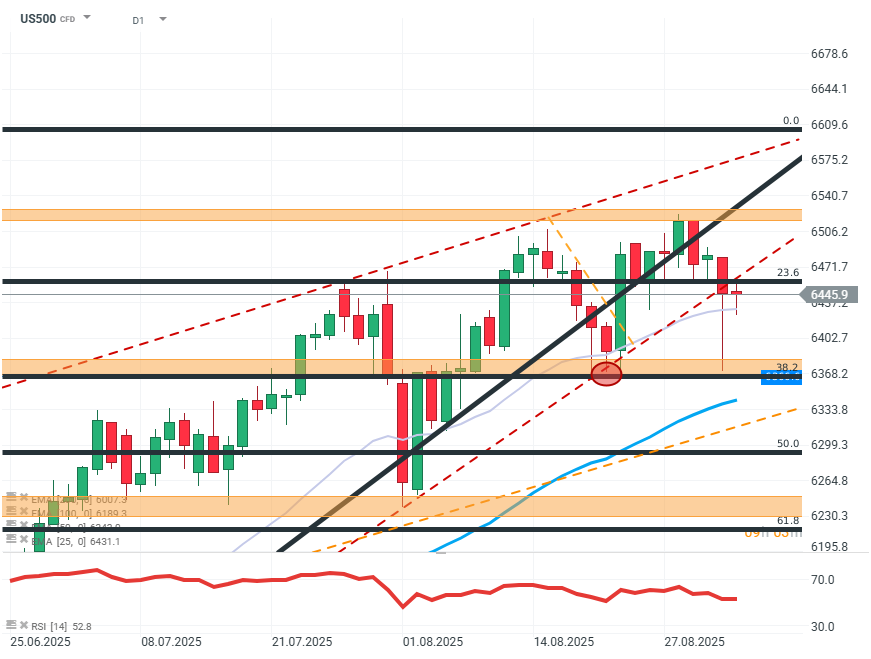

US500 (D1)

Source: Xstation

On the chart, one can observe the relative strength of buyers who, despite a sharp and sudden decline, easily defended the support level around the 38.2 FIBO retracement. The price quickly returned to the area near the lower boundary of the medium-term uptrend, but failed to move back into the rising channel. Given the current chart situation, a likely scenario is price consolidation between the last peak and the resistance zone around $6,360. On the other hand, the sharp and sudden drop may signal a shift in sentiment and a trend reversal to bearish.

Company News:

Alphabet (GOOGC.US) / Apple (AAPL.US) — Tech stocks are rallying after a key court ruling. In an antitrust lawsuit, the court decided Google would not be forced to split its business into smaller companies and will retain the ability to promote its search engine as default. In return, the company is obliged to share collected data with competitors. Alphabet shares are up over 6% and Apple is up 3%.

Kraft Heinz (KHC.US) — The food producer is recovering some of the previous session’s losses after receiving an upgraded rating from Morgan Stanley. Shares are up more than 1% in pre-market trading.

Zscaler (ZS.US) — The software maker is down more than 3% at the open despite reporting strong Q2 2025 results. The results beat investor expectations, and the company also issued an optimistic outlook.

Dollar Tree (DLRT.US) — The retailer released its results, beating analyst expectations with growth in EPS, revenue, and sales. The company also projected solid future growth. However, the results and forecasts did not please investors. Shares are down nearly 9%.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.