Nasdaq100 (US100) futures are slightly down by 0.35%. The lower volatility is due to the upcoming key financial reports after today's session and other macro publications later in the week.

- After the close of the cash session, Microsoft (MSFT.US), Alphabet (GOOGL.US), and AMD (AMD.US) will publish their results. Investor expectations are high, and the companies must prove that the recent increase in valuations was justified. Particularly interesting will be the forecasts for 2024 and 2025.

- Nasdaq remains close to historic highs, but market uncertainty is noticeable. We are observing an increase in the value of the dollar and slight declines in indices.

- Besides the reports after today's session closure, investors are also looking forward to tomorrow's Fed decision and labor market reports.

- Today's JOLTs data were higher than expected, but a year-to-year decline is noticeable. JOLTs are close to recent period lows but remain significantly above pre-pandemic highs.

US100 is down 0.36% ahead of the results, but the price is still near historic highs and remains in a strong upward trend. The MACD indicator shows a slight divergence, but despite weakening momentum, we are still in a zone indicating an upward trend. In case of a deeper correction, it's important to monitor levels set by the lower limit of the upward channel, which is currently around 17200 points.

Source: xStation 5

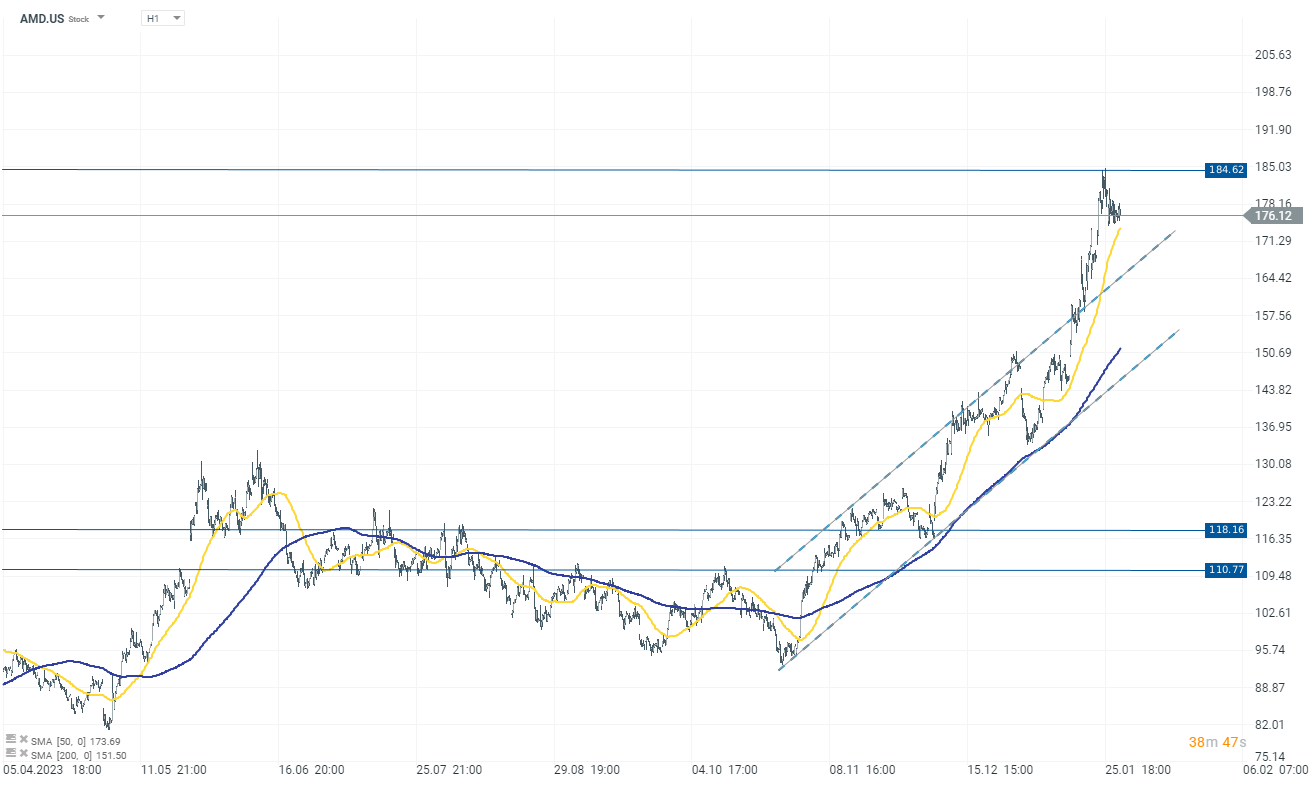

AMD (AMD.US)

Shares are down 0.40% ahead of the results but remain around historic highs. The company benefits from the ongoing dynamic growth of the AI market, and the share price reflects this. After breaking upward from the ascending channel, the share price consolidates around 176 USD.

Source: xStation 5

Alphabet (GOOGL.US)

Google shares are down 0.35%, still maintaining above the previous historic highs around 151 USD.

Source: xStation 5

Microsoft (MSFT.US)

Microsoft shares are significantly above the previous historic high and also gained 0.05% today. Subsequent upward waves are supported by the upward trend line (blue line).

Source: xStation 5

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.