Wall Street indices dropped to 1-month lows as banking concerns returned to the markets following Q1 2023 earnings release from First Republic Bank (FRC.US). Bank acknowledged that it has suffered from an intense $100 billion deposit flight during the SVB-induced turmoil and has been close to collapse. What made things worse and more worrisome was management's refusal to take and answer analysts' questions during an earnings call. Shares of First Republic Bank are trading over 40% lower on the day as worrying media reports on the company continue to mount. It was reported that First Republic Bank may have to sell assets worth up to $100 billion in order to repay emergency loans. Rating agencies warned any strategic options for the bank would most likely be challenging and costly to investors. To sum up, there seems to be a real risk of the third US bank collapsing in 2023!

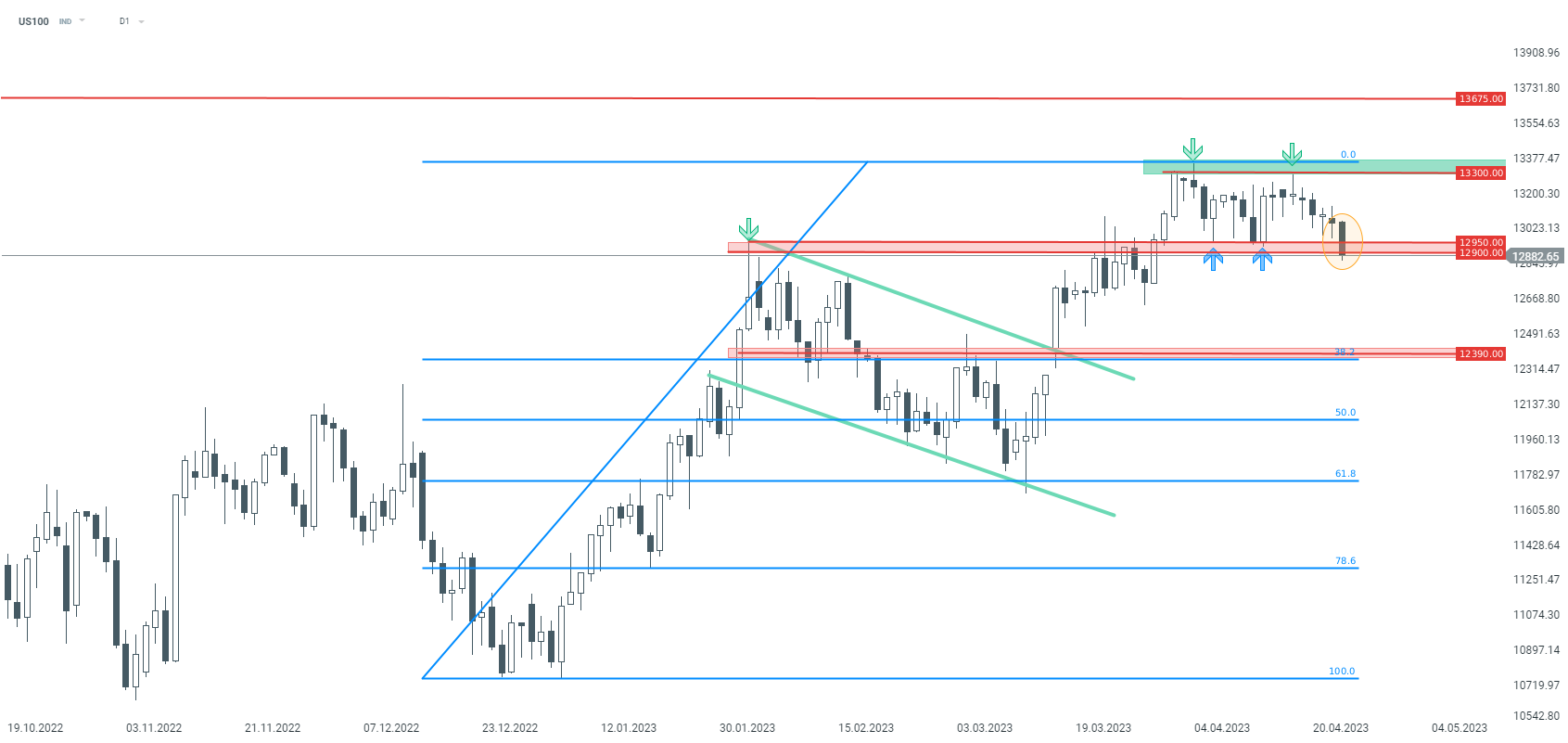

Taking a technical look at US100 at D1 interval, we can see that the index has been trading in a range recently with 12,900 pts support serving as lower limit and 13,300 pts resistance as the upper. Should we see a break below the lower limit, the sell-off may deepen and potentially extend towards the next major support in the 12,390 pts area, marked with previous price reactions and 38.2% retracement. On the other hand, should bulls regain strength and defend 12,900 pts area, a recovery move towards the upper limit of the range at 13,300 pts may be on the cards.

US100 at D1 interval. Source: xStation5

US100 at D1 interval. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.