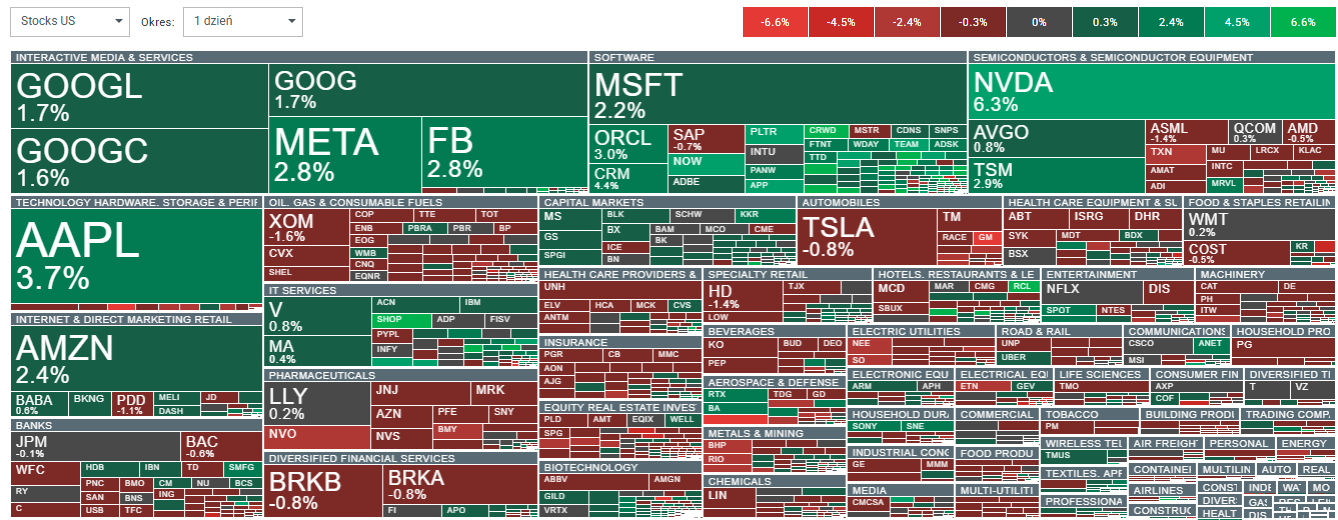

Futures on Nasdaq 100 (US100) are up nearly 1.2% as BigTech stocks recover losses following yesterday's sell-off. Nvidia is surging over 6%, while Meta, Taiwan Semiconductor, and Apple are gaining between 2.8% and 3.8%. As shown on the dashboard below, overall sentiment across the US stock market outside the technology sector is mixed after weaker-than-expected macroeconomic data released today.

- Durable goods orders in the US fell by -2.2% month-over-month in December 2024, with November’s data revised down from -1.2% to -2%. Similarly, the Conference Board Consumer Confidence Index for January disappointed, as investors had expected a reading around 106 but received a figure of 104.1, with a notable weakening in the assessment of current conditions. Despite this, the US dollar has strengthened significantly ahead of tomorrow’s Fed decision, scheduled for 7 PM GMT. Bitcoin is gaining slightly, once again reaching the $102,000 level.

- The CEO of Scale AI claims that DeepSeek held nearly 50,000 Nvidia H100 AI chips, but the company did not report this. According to a Wedbush note: "Bears missed the historic rally in tech stocks over the last 2 years and will miss the next 2 years, endlessly waiting for a black swan to end the AI Revolution trade. From Fed days to rumors of Nvidia Blackwell delays to Tokyo Black Monday… today is no different with DeepSeek… a buying opportunity." Today, OpenAI launched ChatGPT Gov in the US, tailored for US government agencies. On the other hand, it remains uncertain whether DeepSeek will negatively impact infrastructure providers’ backlogs and future revenues.

Source: xStation5

Source: xStation5

US100 is one step closer to testing the EMA200 on the hourly interval, recovering nearly 50% of yesterday's declines.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.