The Fed's minutes have been interpreted as another hint towards a rate hike, although there seems to be significant disagreement among bankers. Nonetheless, since yesterday, we've been witnessing increased selling in American contracts, although today, as time passes, there is a desire to recover losses. However, this might change after the start of the Wall Street session at 3:30 PM.

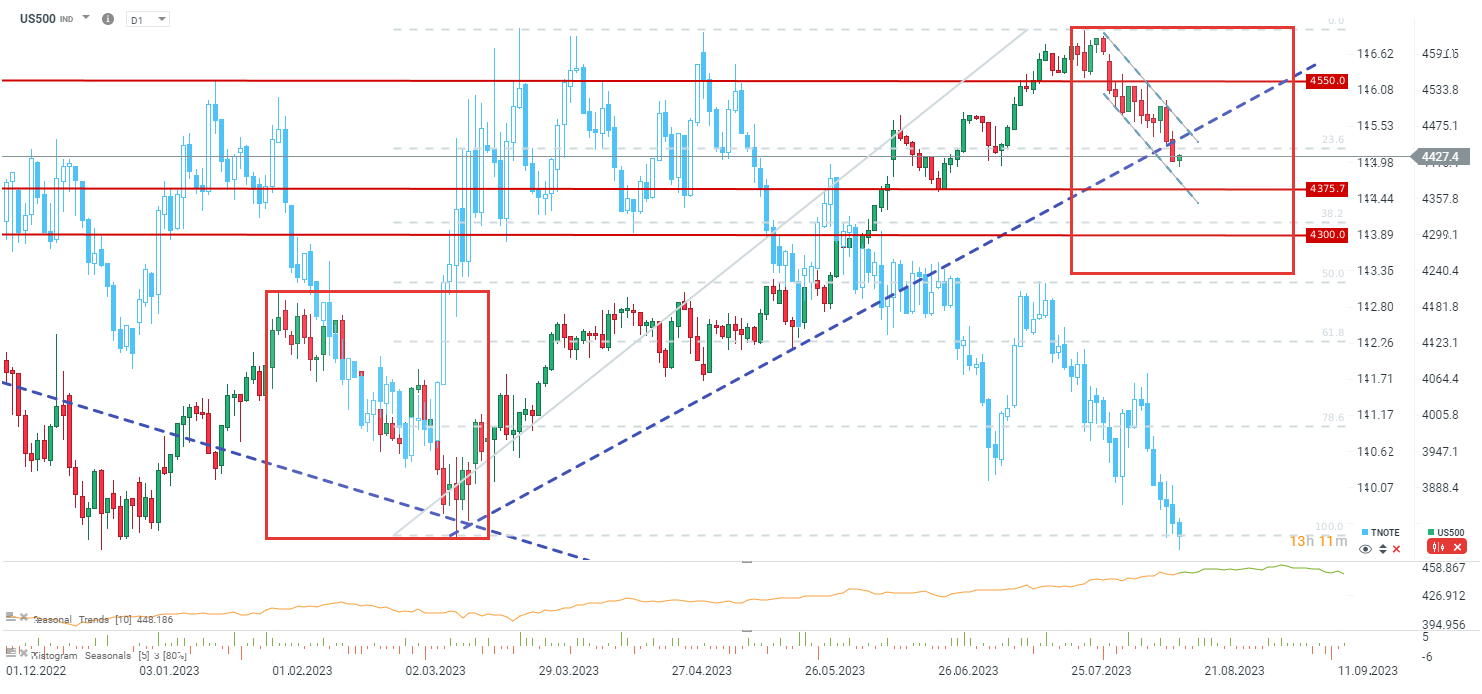

The US500 index has broken the upward trendline and is currently below the 23.6% retracement of the last upward impulse that began in March. At the same time, it's noticeable that within the current corrective decline in the upward trend, there is a sustained downward sequence within a descending trend channel. Today's revival is occurring as we approach the lows from July. Bullish problems could arise around the 23.6% retracement, potentially leading to a continuation of the downward trend towards the vicinity of 4375 points. The scope of the entire major correction in the long-term trend suggests a possible descent even to around 4200 points.

Source: xStation5

The US100 index has long surpassed the downward trendline and is currently below the 15,000 point level. Only after rising above 15,080 points could we consider a larger revival attempt. Nevertheless, the US100 is defending the range of the largest correction in the trend, where there is also the 23.6% retracement of the entire upward trend that began in autumn 2022.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.