S&P 500 futures are up approximately 0.1% ahead of the financial results from Nvidia, a pivotal company for the entire US stock market. Although the move in the US500 is minor, the index is trading near record highs, with the potential for its highest-ever close. Currently, Nvidia's market capitalization is around $4.4 trillion, giving it an 8.1% weighting in the S&P 500 index. Market expectations are high, yet also moderate due to obstacles related to export restrictions to China. Nevertheless, the company's results will influence not only its own share price but also the performance of global indexes, as Nvidia is the largest and arguably the most significant company in the world right now. Options pricing suggests a potential 6% move in either direction for the stock during the next trading session. This volatility will also be reflected in US500 and US100 futures contracts immediately after the earnings release, following the close of the cash session on Wall Street.

According to market participants, the increase in Nvidia's valuation is the result of relentless demand for artificial intelligence hardware. The company's sales are projected to grow by over 50% year-on-year. The market is positioned for solid results, and the accompanying rise in futures contracts reflects expectations for continued dynamic growth from the chip industry leader. Additionally, investors will be closely watching CEO Jensen Huang's comments regarding China, as a series of export limitations could impact future demand prospects in that region.

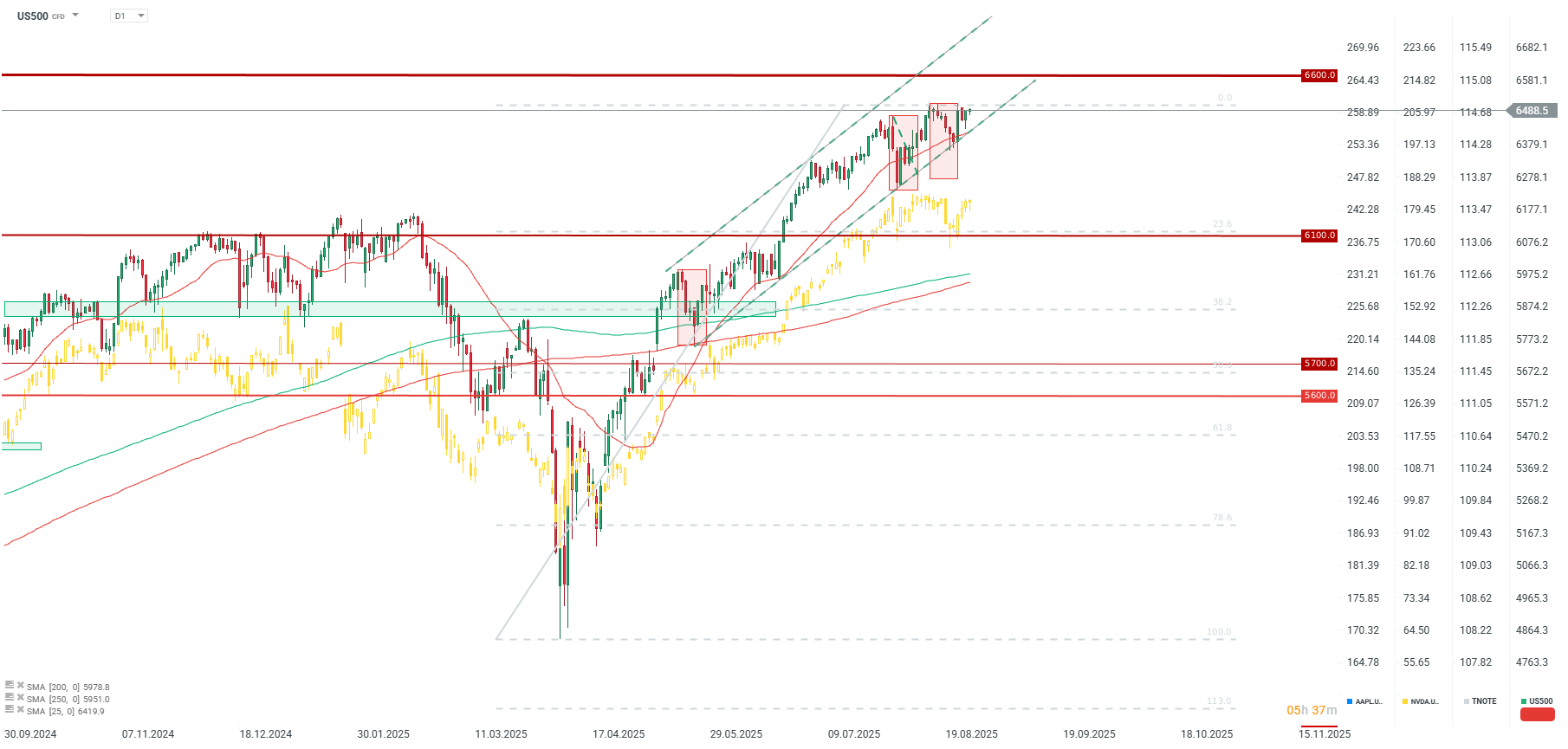

Nvidia is up just under 0.2% today and, similar to the US500, is trading near all-time highs. The US500 is trading slightly below the 6,500-point level. The nearest support is around the lower boundary of the upward trend channel along with the 25 SMA line. Many financial institutions forecast the US500 will reach 6,600 points this year, which would imply a move of just 1.6% from the current level.

Arista Networks closes 2025 with record results!

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.