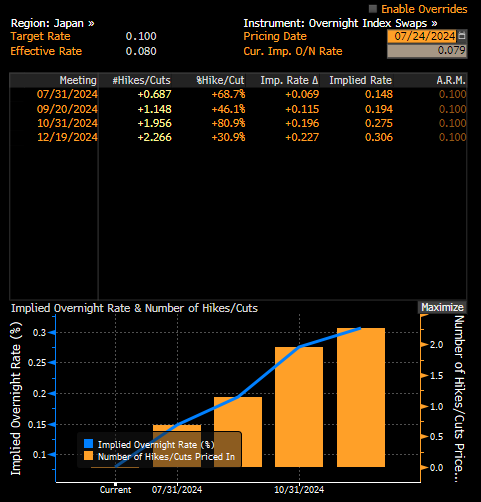

USDJPY pair is dropping below 155 today, with the yen gaining over 1% for the second consecutive day, driven by several factors. NBH television reported today that the Japanese government decided to raise the hourly minimum wage by 50 yen to 1054 yen for the current fiscal year. A higher minimum wage naturally hints at potential inflationary pressure, which could seal the deal for an interest rate hike in July or later in the year. Expectations indicate a 68% probability of a rate hike on July 31, and suggest over two full hikes of 10 basis points by the end of the year.

Interest rate expectations in Japan. Source: Bloomberg Finance LP, XTB

Another factor is investor positioning in anticipation of the end of favorable "carry trade" conditions in currency pairs involving the yen. BoJ rate hikes and rate cuts by other central banks, including the Fed, will reduce the interest rate differential. The return of capital to Japan additionally strengthens the yen. Therefore, we observe not only the dollar weakening against the yen but also the Mexican peso and Antipodean currencies. Interestingly, Donald Trump recently commented on the yen's excessive weakness, expressing his reluctance for other countries to have a significantly better position relative to the United States due to their currency.

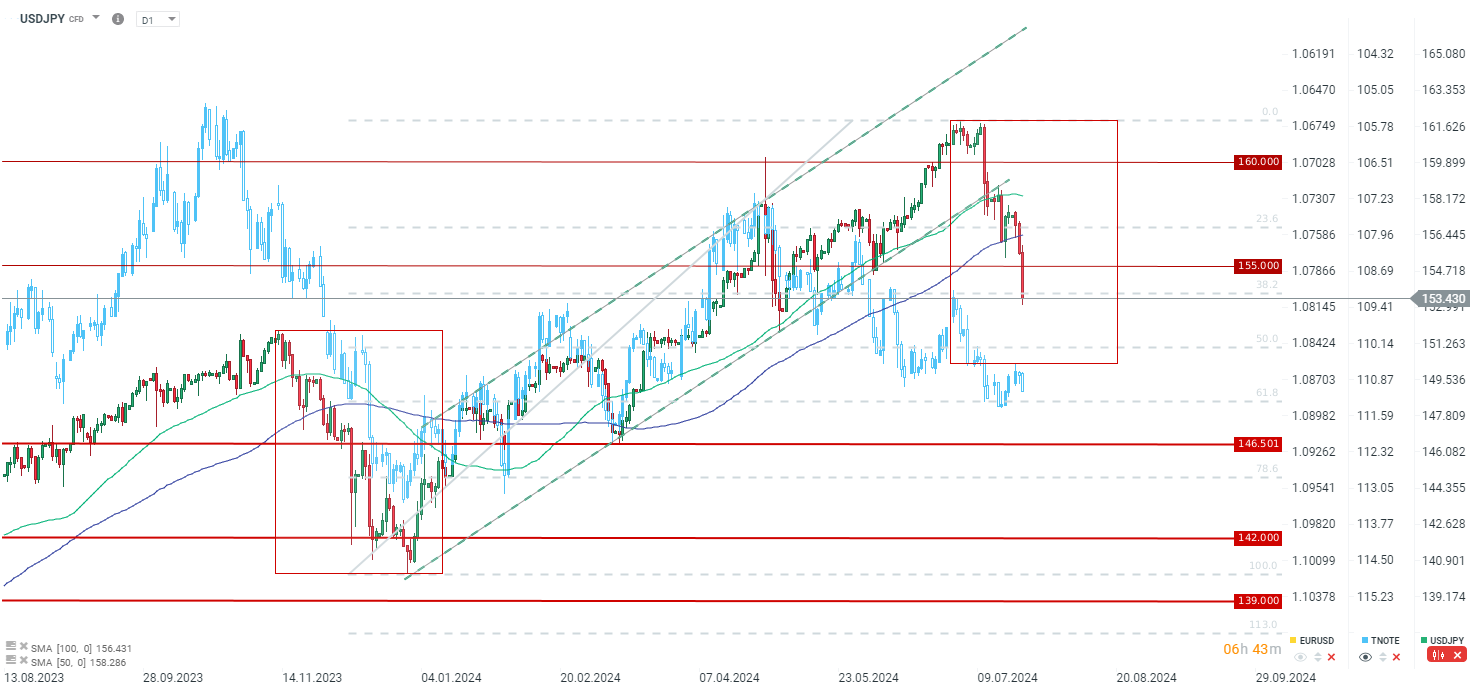

The USDJPY pair has reached its lowest level since mid-May today, falling not only below 155 but also below 154. During yesterday’s session, the pair crossed below the 100-day SMA. Previously, this average was breached in January and March, and the pair stayed below it for an extended period of time in November-December last year. If a similar situation occurs now, the pair could drop below 149 to the vicinity of the 61.8% retracement of the last upward wave, placing the pair at its lowest level since March. On the other hand, the pair has a long way to go, first needing to overcome the 38.2% retracement and then drop to the vicinity of the 50.0% retracement and the range of the previous significant correction, which occurred at the end of last year.

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.