The USDJPY pair dropped today to the lowest level since Dec. 28 2023, as BoJ participants expressed that further rate hikes are the basic scenario as Japanese economy upward momentum persists. However, Junko Nakagawa commented that it's hard to predict the term of the next BoJ rate hike. Further strengthening of Japanese Yen, with falling US dollar pressure 'carry trade', with multiple hedge funds such as Telemetry seeing rising risk of changing financial market conditions. Nakagawa expects, that still too high inflation overseas will put inflationary pressure on Japanese import prices (while stronger yen pressures Japanese exporters), while inflation is on track to rise, with stronger domestic demand across the consumers.

- Rising import prices could affect consumer inflation with a lag

- Wage growth likely to accelerate as a trend, reflecting rising prices and stronger domestic demand

- Consumption likely to increase moderately, reflecting wages momentum,

- Expect inflation to gradually accelerate as a trend. Achievement of wage-inflation cycle is still in sight

- Upside risk to inflation persists, while downside risks may come from slowdown in global economies

- Even after July rate hike, real interest rates remain deeply negative, monetary conditions are accomodative

- Prices move in line with the BoJ projection, signalling reasonable adjustment in the monetary policy easing

- Japan fundamentals are still strong and record profits at Japan firms are not in risk

- Further real-estate market prices increases may support BoJ rate hike faster, even this year

Consumer inflation in Japan came in 2.7% in July (at or above 2% BoJ target for 28 consecutive months). The real interest rates are still very low, while traders expect that August USDJPY slump will probably not stop Bank of Japan, out of the 'sea change' in interest rates. Nakagawa remarks support this thesis, while final BoJ policy outcome is still uncertain, with recession risk in US, Europe and slowing demand China, which can may pressure Japanese companies and economic conditions.

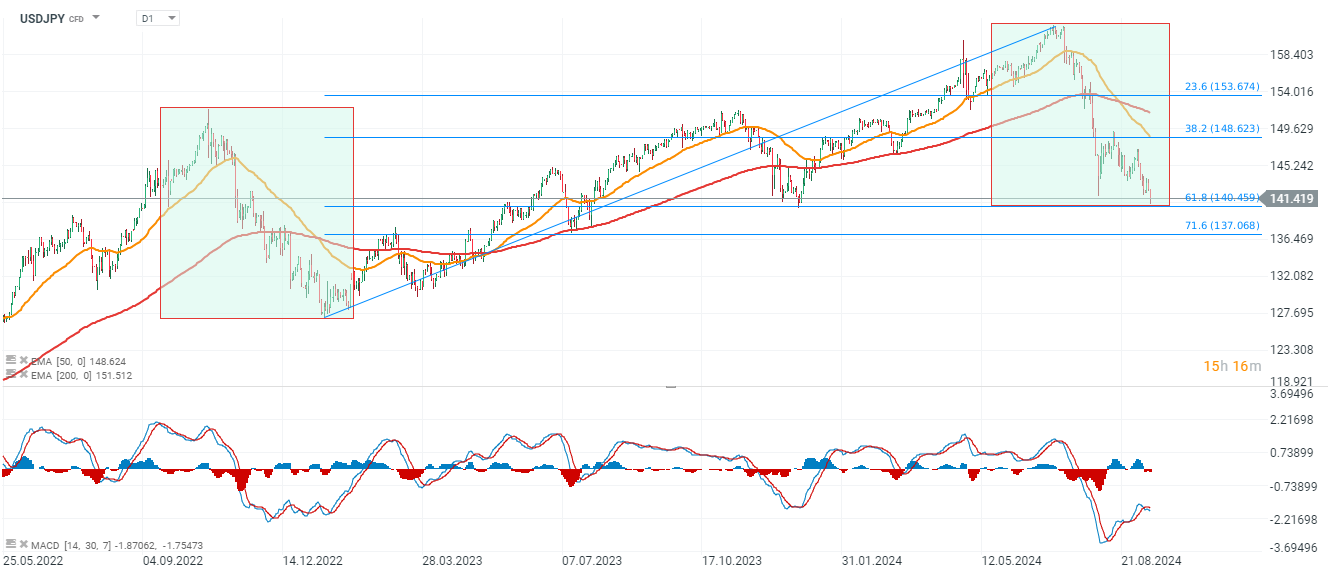

USDJPY (D1 interval)

USDJPY erased some declines, dropping 0.7% today, after reaching 140.6 level earlier today. The volatility may increase during the US CPI reading at 1:30 PM BST. Declines stopped in the 140.5 zone, at 61.8 Fibonacci retracement of the upward wave, since 2022. The scale of current declines may signal 1:1 correction (green zones on the chart) in the long term, upward trend if the pair will rebound from current levels. Eventually higher than expected US CPI report may support at least short term rebound, while downside 'trend-changing' risk persists.

Source: xStation5

Source: xStation5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Daily summary: Red dominates on both sides of Atlantic

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.