- Alphabet, Microsoft and Intel to report earnings today

- Reports will be released after close of Wall Street session

- Cloud, AI and ad revenue in focus in Alphabet earnings

- Microsoft cloud revenue expected to slow

- Attention on Foundry business in Intel earnings

Traders will be offered Q1 2024 earnings reports from 3 well-known US tech companies today after close of the Wall Street session. Alphabet (GOOGL.US), Microsoft (MSFT.US) and Intel (INTC.US). Reports from the three could help shape sentiment towards US tech sector. However, traders should keep in mind that markets are unpredictable and an earnings beat does not necessitate a post-earnings share price surge - disappointing earnings from Tesla sent EV manufacturer shares flying, while Meta Platforms is slumping in premarket in spite of reporting better-than-expected results. Let's take a quick look at what market expects from Alphabet, Microsoft and Intel, and what to focus on.

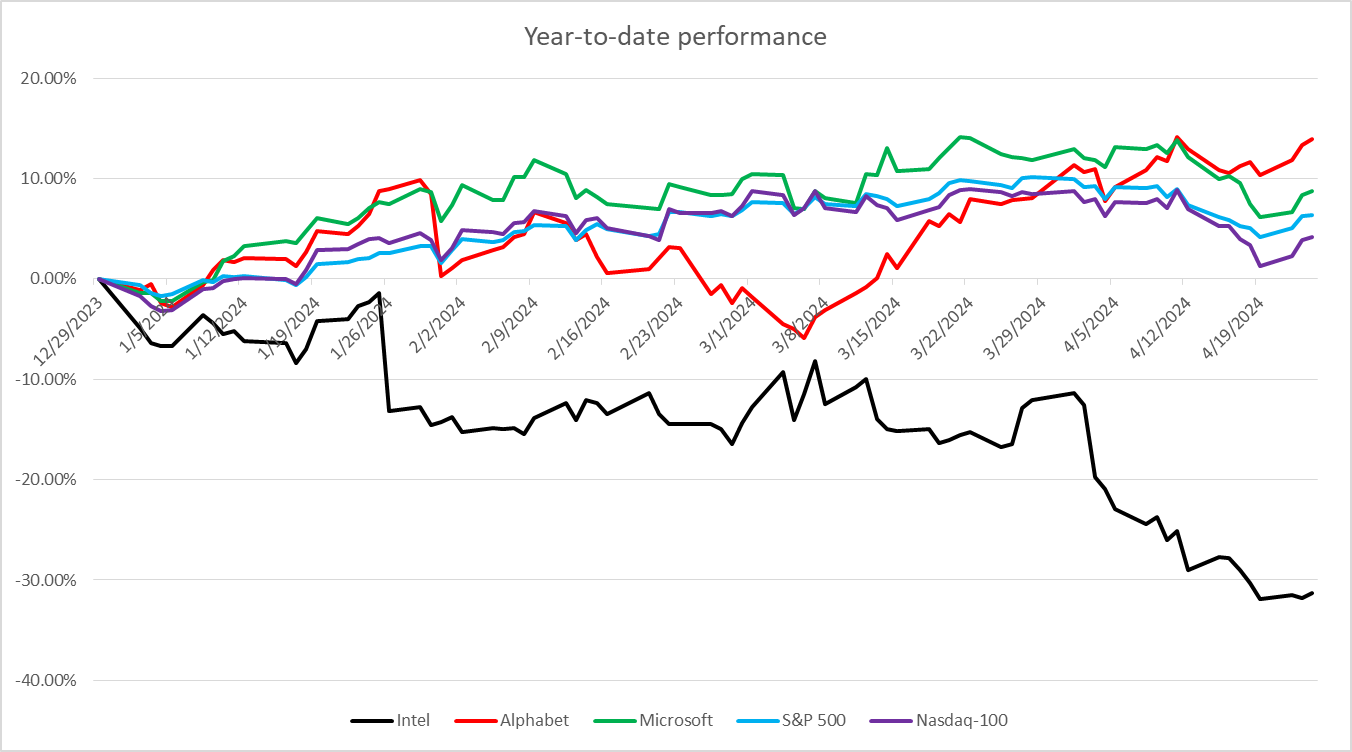

While Alphabet and Microsoft outperformed the broad market so far this year, Intel has been underperforming significantly. Source: Bloomberg Finance LP, XTB Research

While Alphabet and Microsoft outperformed the broad market so far this year, Intel has been underperforming significantly. Source: Bloomberg Finance LP, XTB Research

Out of three large US tech companies reporting earnings today, Microsoft looks the most expensive in terms of forward P/E ratio. Source: Bloomberg Finance LP, XTB

Alphabet

Alphabet (GOOGL.US) has been outperforming S&P 500 and Nasdaq-100 so far this year, gaining almost 14% year-to-date. Attention in Alphabet's report will be mostly on three things - AI, Cloud and advertising. Option markets are implying a 5.7% post-earnings share price move.

Alphabet is expected to report an over-13% YoY growth in total Q1 2024 revenue. Cloud growth is expected to remain strong. While this segment has seen its growth decelerated as it grew in size, analysts' expected year-over-year cloud revenue growth to remain more or less on the same level as in Q4 2023, which was higher than growth recorded in Q3 2024.

Cloud will be watched closely as it is Alphabet's fastest growing segment, but investors will also pay attention to advertising - company's biggest source of revenue. Company is expected to report an over-10% growth in ad revenue, an acceleration from 9.5% reported in Q4 2023. If confirmed, this would mark the fifth consecutive quarter of accelerating ad revenue growth.

Last but not least, any comments on AI will also be watched closely. A dive into AI is helping fuel Google Cloud growth therefore the two will likely be analysed in tandem.

Q1 2024 expectations

- Revenue: $79.04 billion (+13.3% YoY)

- Google Services: $69.06 billion (+11.5% YoY)

- Google Advertising: $60.18 billion (+10.3% YoY)

- Google Cloud: $9.37 billion (+25.8% YoY)

- Other Bets: $372 million (+29.3% YoY)

- Hedging: $96 million (+14.4% YoY)

- Google Services: $69.06 billion (+11.5% YoY)

- Revenue excluding Traffic Acquisition Costs: $66.07 billion (+13.8% YoY)

- Gross profit: $44.72 billion (+14.1% YoY)

- Gross margin: 56.9% vs 56.1% a year ago

- Operating Income: $22.39 billion (+28.6% YoY)

- Google Services: $24.3 billion (+11.8% YoY)

- Google Cloud: $672 million (+252% YoY)

- Other Bets: -$1.12 billion

- Hedging: -$1.65 billion

- Operating Margin: 28.6% vs 25% a year ago

- Net Income: $19.6 billion (+30.2% YoY)

- Net margin: 22.4% vs 21.6% a year ago

- Adjusted EPS: $1.53 vs $1.17 a year ago

- Capital Expenditures: $10.24 billion (+62.8% YoY)

Alphabet (GOOGL.US) remains close to an all-time high. Stock pulled back in the first half of April 2024, but has since managed to recover almost all the losses. Stock is trading a touch below $160 resistance zone, and a strong Q1 earnings report may push the price to new record levels. Source: xStation5

Alphabet (GOOGL.US) remains close to an all-time high. Stock pulled back in the first half of April 2024, but has since managed to recover almost all the losses. Stock is trading a touch below $160 resistance zone, and a strong Q1 earnings report may push the price to new record levels. Source: xStation5

Microsoft

Microsoft (MSFT.US) has been outperforming S&P 500 and Nasdaq-100 so far this year, gaining over 8% year-to-date, following a 90% rally in 2023. When it comes to upcoming earnings report, investors will focus primarily on cloud business, which has been a key growth driver recently. Options markets imply a 4.8% post-earnings share price move.

Microsoft is expected to report an over-15% year-over-year growth in total revenue in fiscal-Q3 2024 (calendar Q1 2024). Cloud is expected to remain the biggest segment in terms of sales and a key driver of growth. Revenue growth in Intelligent Cloud segment is expected to slow to around 19% YoY, from 20.3% YoY in fiscal-Q2 2024 (calendar Q4 2023). However, it is expected to be faster than 15.9% YoY growth recorded in a year ago period. However, a broader cloud revenue category - Commercial Cloud Revenue - is expected to see growth slow below 20% YoY for the first time in history.

AI will be an important theme in the earnings release. More precisely, how it impacts growth in Azure cloud. AI contributed 300 basis points to Azure growth in fiscal-Q1 2024 (calendar Q3 2023) and this contribution increased to 600 basis points in fiscal-Q2 2024 (calendar Q4 2023).

Fiscal-Q3 2024 was also the first full quarter following a consolidation of Activision into Microsoft after an acquisition. It is expected to acquisition help accelerate revenue growth, but at the same time was dilutive to profits.

Fiscal-Q3 2024 expectations

- Revenue: $60.88 billion (+15.2% YoY)

- Productivity & Business Processes: $19.54 billion (+11.6% YoY)

- Intelligent Cloud: $26.25 billion (+18.9% YoY)

- More Personal Computing: $15.07 billion (+13.6% YoY)

- Commercial Cloud Revenue: $33.93 billion (+19% YoY)

- Gross profit: $42.31 billion (+15.2% YoY)

- Gross margin: 69.1% vs 69.5% a year ago

- Operating income: $25.64 billion (+14.7% YoY)

- Productivity & Business Processes: $9.93 billion (+15% YoY)

- Intelligent Cloud: $11.71 billion (+23.6% YoY)

- More Personal Computing: $4.51 billion (+6.6% YoY)

- Operating margin: 43.0% vs 42.3% a year ago

- Net income: $21.06 billion (+15.1% YoY)

- Net margin: 34.0% vs 34.6% a year ago

- Adjusted EPS: $2.83 vs $2.45 a year ago

Microsoft (MSFT.US) reached fresh all-time highs above $430 per share in the second half of March 2024. However, stock has begun to struggle later on and dropped around 8% off the record highs. Declines was halted at the support zone ranging below $400 mark and stock started to recover. Will fiscal-Q3 earnings release provide fuel for a rally to fresh all-time highs? Source: xStation5

Microsoft (MSFT.US) reached fresh all-time highs above $430 per share in the second half of March 2024. However, stock has begun to struggle later on and dropped around 8% off the record highs. Declines was halted at the support zone ranging below $400 mark and stock started to recover. Will fiscal-Q3 earnings release provide fuel for a rally to fresh all-time highs? Source: xStation5

Intel

While Intel (INTC.US) is a smaller company and may not draw as big attention as Alphabet or Microsoft, its report will also be watched closely. After all, it is one of top US semiconductor stocks. Intel has been lagging S&P 500 and Nasdaq-100 significantly so far this year, dropping over 30% year-to-date. Option markets are implying a 7.4% post-earnings share price move.

Intel is expected to report an 8.5% YoY growth in total Q1 revenue, with the largest Client Computing segment expected to see an almost-30% growth and Datacenter & AI segment expected to see an almost 20% revenue drop. However, a lot of attention will be paid to Intel Foundry business. Intel is trying to reshape itself as a global chip foundry company. Foundry business is manufacturing of chips for third parties, just like TSMC does. Intel has received a lot of funds from CHIPS act to expand manufacturing capacity, but there are some hurdles to growth. One of the biggest ones, that differentiates it from TSMC, is the fact that Intel also designs its own chips, and it limits growth potential for its Foundry business. Why? Some companies, like for example AMD, may be unwilling to use Intel's Foundry services as it would require handing Intel, its direct competitor, blueprints to its new designs. However, Intel may attract customers among companies that do not design chips of similar class and use as Intel. Those include, for example, Nvidia and Apple.

As Intel touts Foundry business as next growth driver the outlook for the segment will be watched closely. Nevertheless, one should keep in mind that the segment accounts for less than 2% of Intel's total revenue and its growth has been slowing in the second half of 2023, therefore it will take time before it becomes really meaningful for company.

Q1 2024 expectations

- Revenue: $12.71 billion (+8.5% YoY)

- Client Computing: $7.39 billion (+28.1% YoY)

- Datacenter & AI: $3.45 billion (-19.2% YoY)

- Network & Edge: $1.35 billion (-13.8% YOY)

- Intel Foundry: $170 million (+44% YoY)

- Mobileye: $372 million (-18.8% YoY)

- Gross Profit: $5.70 billion (+24.8% YoY)

- Gross margin: 44.5% vs 38.4%

- Operating income: $562 million (-$294 million a year ago)

- Operating margin: 4.8% vs -2.5% a year ago

- Net income: $580 million (-$169 million a year ago)

- Net margin: 4.5% vs -1.5% a year ago

Intel (INTC.US) has been underperforming significantly this year. Stock kept moving lower, breaking through a number of support zone and has reached the lowest level in half a year. However, sell-off was halted in the second half of April and a positive surprise in Q1 earnings report may help launch an upward correction. Source: xStation5

Intel (INTC.US) has been underperforming significantly this year. Stock kept moving lower, breaking through a number of support zone and has reached the lowest level in half a year. However, sell-off was halted in the second half of April and a positive surprise in Q1 earnings report may help launch an upward correction. Source: xStation5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.