Albemarle (ALB.US) is the largest global producer of lithium used in electric cars. The company also provides services in the chemical industry (including bromine, chemical catalysis, oil refining, food safety and other niche services). The latest commentary from Bank of America (BofA) analysts shows that the bank expects lithium prices, which have been falling for many months, to stabilize. This could indicate the better sentiment around the shares of the lithium producers. In recent days, Tesla (TSLA.US), one of the company's largest customers (EV battery packs) reported that it was building a massive lithium plant in Texas. However, it indicated that it does not intend to abandon Albemarle's services.

- On May 4, Albemarle reported Q1 results - lower-than-expected revenue ($2.58 billion vs. $2.74 billion forecast) but sharply higher-than-expected earnings per share of $10.93 vs. $6.94 estimates and $2.38 in Q1 2022 (nearly 400% increase).

- The sharply higher-than-expected net profit may indicate that the company has 'ample room' to raise prices for its customers and possibly cut costs. Net margin in Q1 was over 41%, and return on assets (ROE) was over 49% - all this despite massive declines in spot lithium prices.

The biggest threat appears to be a possible recession but, surrounded by a rebound in lithium prices in the markets, some analysts have recently raised recommendations:

- Bank of America raised its recommendation on Albemarle to 'neutral' with a target price of $200

- Scotiabank raised its recommendation on Albemarle to 'outperform' with a target price of $250

- KeyBanc raised its recommendation on Albemarle to 'outperform' with a target price of $270

The index of lithium producers and miners has had a great start to May. Source: Bloomberg

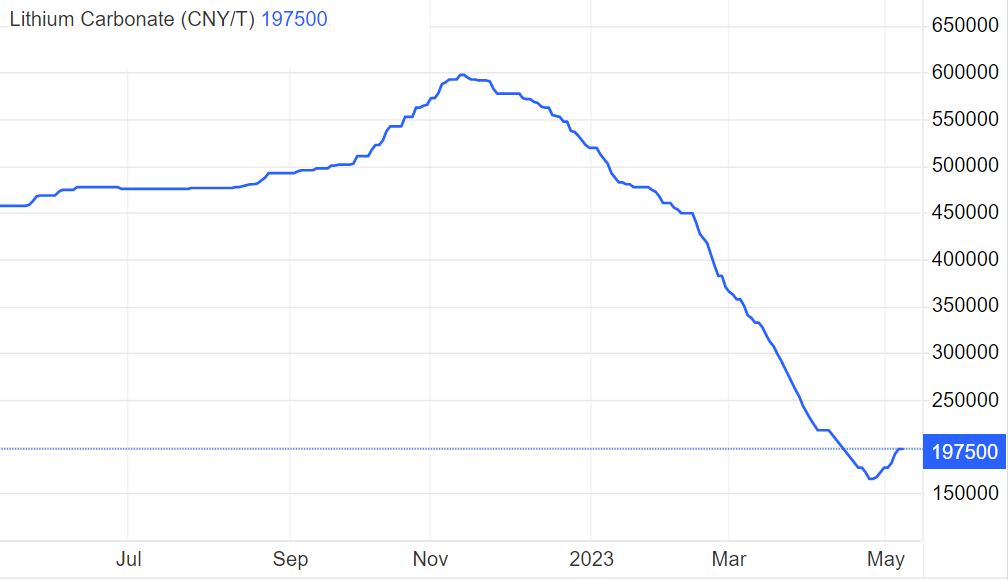

Prices for a ton of lithium, denominated in Chinese yuan (CNY), have risen nearly 20% since April 25. Source: TradingEconomics

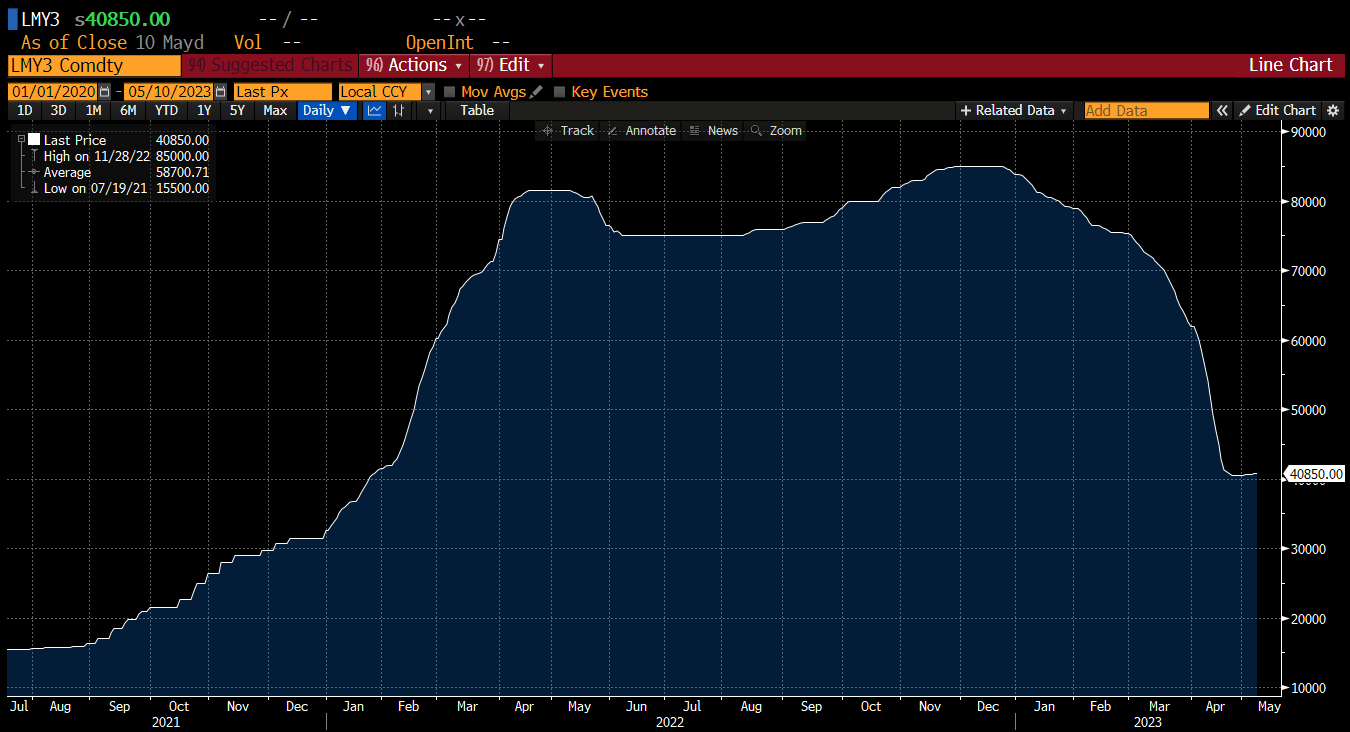

July lithium contracts are still showing the expected slight improvement. This shows that, if the rise continues, room for upside could become much more plentiful. On the other hand, the main threat to a further rebound is, of course, a recession and lower demand on EV market. Source: Bloomberg

Albemarle (ALB.US) shares, D1 interval. The sell-off stopped at the level set by significant previous price reactions, among others, local minima from the fall of 2022. If the positive momentum for lithium lasts longer, a possible would be rise towards $225 per share, where we see the 38.2 Fibonacci retracement of the March 2020 upward wave. On the other hand significant fall below SMA200 is worry for bulls. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.