The problem with the commercial real estate market by some institutions like Wells Fargo and Morgan Stanley is seen as a systemic threat although it is not yet clear whether it is really escalating to such a scale. According to Green Street data, the value of commercial real estate in the U.S. has already fallen by 25% year-on-year, and vacancy rates are also rising:

- Brookfield (BN.US) and Blackstone (BX.US) funds have significant exposure to the commercial real estate situation. Blackstone will report results tomorrow, before the market open;

- Brookfield has already defaulted on nearly $161 million in obligations for office buildings in Washington (DC), due to vacancy but is still pursuing a deal;

- Previously valued at about $784 million, the fund's problems involved properties in Los Angeles (777 Tower, Gas Company Tower), but now it is also affecting a dozen other office buildings;

- According to Bloomberg, Columbia Property Trust, Pacific Investment Management, as well as WeWork and Rhone Group are also having trouble paying off debt and meeting obligations.

Brookfield points out that 95% of its real estate portfolio is high quality properties and demand persists. At the same time, in the Washington metropolitan area, commercial real estate prices are down 36% y/y, and compared to the pre-pandemic period, only 43% of the region's workers need to go to the office at least once a week according to Kastle Systems. Remote work is also popular in other US states. Among the 12 largest office properties in the Brookfield portfolio, occupancy real estate rate in 2022 was 52% compared to 79% in 2018. At the same time, its monthly variable mortgage interest rate rose to about $880,000 in April from just over $300,000 in 2021.

Will CRE affect banks?

- OakTree estimates that banks in the U.S. hold about $1.8 trillion of the $4.5 trillion in outstanding mortgages (about 40 percent), and commercial real estate (CRE) loans account for about 8 to 9 percent of the average bank's assets (not counting any share of commercial mortgage-backed securities);

- Given the leverage of the banking industry, its approximate equity is about $2.2 trillion so a 9% share of assets would mean up to 100% equity which could herald the 'undercapitalization' of many banks;

- According to the BofA report, the average large bank has almost 50% of risky capital in CRE loans, a much larger exposure to smaller banks - up to 167%. According to OakTree, the average CRE exposure is 4.5% of assets for banks over $250 billion and over 11% for banks under $250 billion;

It is still unclear to what extent the problem may affect the financial system - under each mortgage there may have been sufficiently high borrower collateral (LTV) to absorb the losses - it would be crucial to know the terms on which the loans were made. Additionally, defaulted loans could be negotiated and restructured.

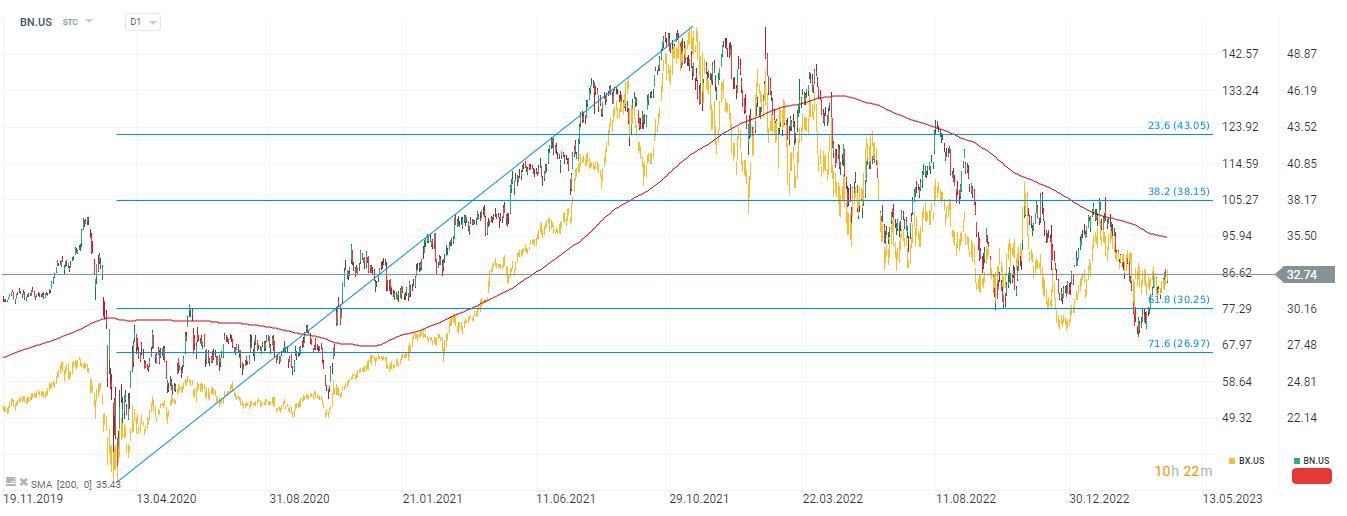

Shares of Brookfield Corp (BN.US) and Blackstone (BX.US), yellow chart. The shares of both companies are moving in a very simmiliar price pattern. Source: xStation5

Shares of Brookfield Corp (BN.US) and Blackstone (BX.US), yellow chart. The shares of both companies are moving in a very simmiliar price pattern. Source: xStation5

Daily summary: Alphabet shares support sentiments on Wall Street 🗽Oil, precious metals and crypto slide

Critical Metals at the center of speculation around Greenland 🔎

US Open: Nasdaq continue to climb📈Intel and Eli Lilly stocks surge

German industrial conglomerate to sell off troubled unit in India ❓Shares gain 5% 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.