Oil, as well as other energy commodities, are pulling back today. Brent and WTI trade almost 4% lower while gasoline and US natural gas prices drop over 4%. Move looks to be driven by overall concerns over the condition of the global economy, with re-emergence of US banking problems being one of prime fear drivers. Apart from that, OPEC+ currently seems unwilling to intervene to support prices, what also adds to pressure.

- US banking sector issues have been reignited with collapse of First Republic Bank, boosting recession risk for the United States

- Back in March when US banking issues first arose, oil took a significant hit

- Chinese post-Covid demand recovery continues at a slower than expected pace

- Russia's Novak said that OPEC+ monitors oil price drop but it may turn out to be temporary

- No changes have been made to meeting schedule - oil producers are still set to meet no sooner than June

- WTI drops below $69 and trades at the lowest level since March 24, 2023

- Brent tests mid-March lows in $72.50 area

- US natural gas prices drop below $2.20 to the lowest level since mid-April

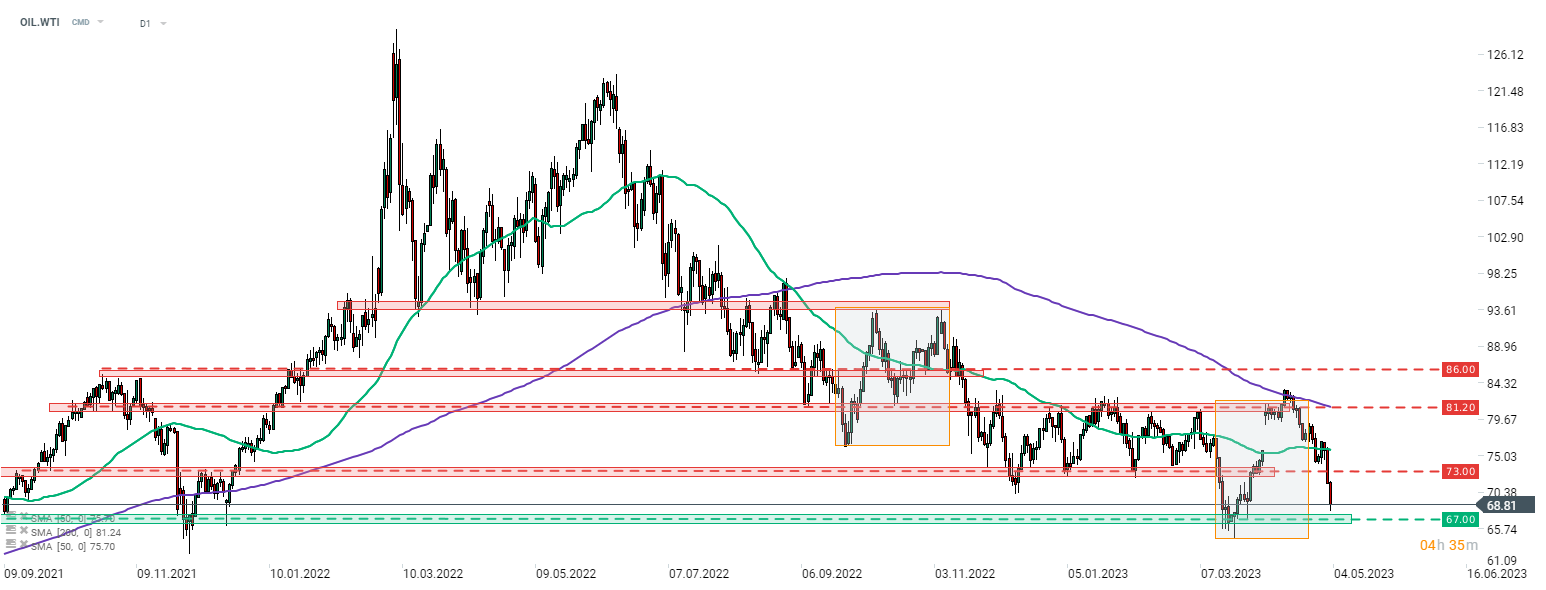

WTI (OIL.WTI) continues pullback after failed attempt to break above the upper limit of the Overbalance structure and 200-session moving average (purple line). WTI plunged below $73 price zone yesterday and continues to drop hard today. A test of $67 support zone looks probable, especially if Fed warns of rising recession risk today. Source: xStation5

WTI (OIL.WTI) continues pullback after failed attempt to break above the upper limit of the Overbalance structure and 200-session moving average (purple line). WTI plunged below $73 price zone yesterday and continues to drop hard today. A test of $67 support zone looks probable, especially if Fed warns of rising recession risk today. Source: xStation5

Significant declines can be spotted all across the energy commodity market today. Source: xStation5

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.