OPEC+ left its oil production policy and quotas unchanged at a meeting today. Such a decision was in-line with market expectations. Group of oil producers seems cautious rather than optimistic when it comes to the reopening of the Chinese economy and its impact on oil demand. Given that price have held stable at relatively low levels recently, market hoped that OPEC+ may signal a production cut. No such decision was made and the next OPEC+ meeting will not be held until April. It looks highly likely that OPEC+ will keep policy unchanged throughout whole 2023 but a lot will depend on condition of global economy.

Oil is trading lower on the day with Brent and WTI dropping around 1.2% each. Oil has been trading lower since the beginning of the day and OPEC+ decision as well as higher-than-expected US oil inventories data added more fuel to the move.

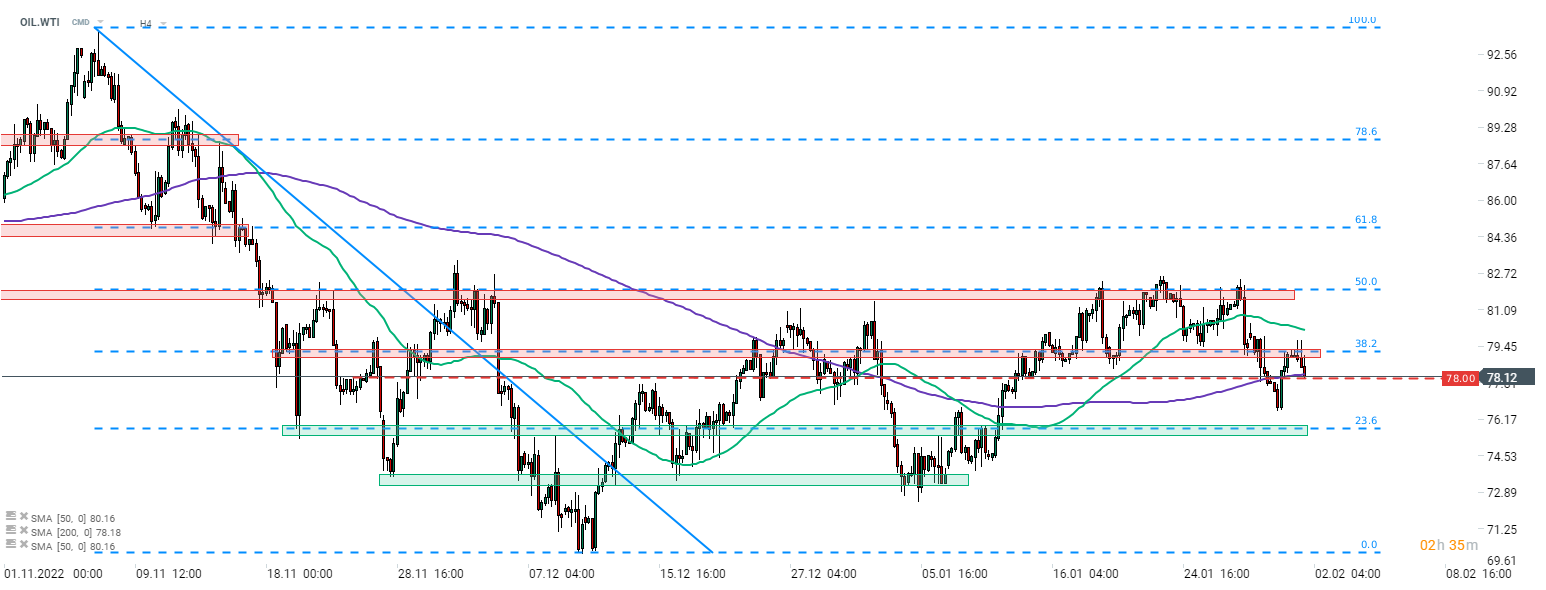

Taking a look at WTI chart (OIL.WTI) at the H4 interval, we can see that the price is testing $78 per barrel area, marked with a 200-period moving average (purple line). This comes after a failed attempt at breaking above resistance zone marked with 38.2% retracement of the downward move launched in early November 2022. If bears succeed at pushing price below $78 zone, the next support can be found at 23.6% retracement in the $76 area.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.