Maritime container freight company ZIM Integrated Shipping (ZIM.US) showed optimistic results for the full year 2022, and since then the price of its stock has been trying to reverse a downward trend. With rising inflation and economic uncertainty and geopolitical tensions, shipping freight saw a significant slowdown in 2022. This resulted in a decline in rates for freight companies, which enjoyed an economic boom, primarily in 2021.

- ZIM results showed that the company survived the period by strengthening its business and surprised the market with a net result and high freight volume (TEUs) that turned out to be almost equal to the previous record despire recession fears;

- The company's revenue in 2022 was $12.56 billion (17% year-on-year growth), net income $4.63 billion versus $4.65 billion in 2021, with a current market capitalization of $2.8 billion;

- Adjusted EBITDA was $7.54 billion (14% y/y growth), the company recorded EBIT (operating income) of $6.15 billion (5% y/y growth). The company expects EBITDA to contract in 2023 to $1.8-2.2 billion and lower EBIT in the $100-500 million range;

- The dividend for Q4 2022 will be about $770 million or $6.40 per share. Along with previous 2022 distributions, the company will share 44% of 2022 net profit with shareholders;

- Q4 net income was $417 million vs. $1.71 billion in Q4 2021, yielding $3.44 per diluted share vs. $14.17 in Q4 2021. EBIT (operating income) in Q4 2022 was $585 million giving a 72% year-on-year decrease. Revenues also declined in Q4 2022, to $2.19 billion (37% decrease y/y);

- The average freight rate per TEU in Q4 was $2,122 (down 42% y/y), and in 2022 it was $3,240 (up 16% y/y). Freight volume in Q4 was 823,000 TEUs (down 4% y/y), and in 2022, 3.38 million. TEU (3% year-on-year decrease). TEU is the standard measure of one 20 ft container size.

![]()

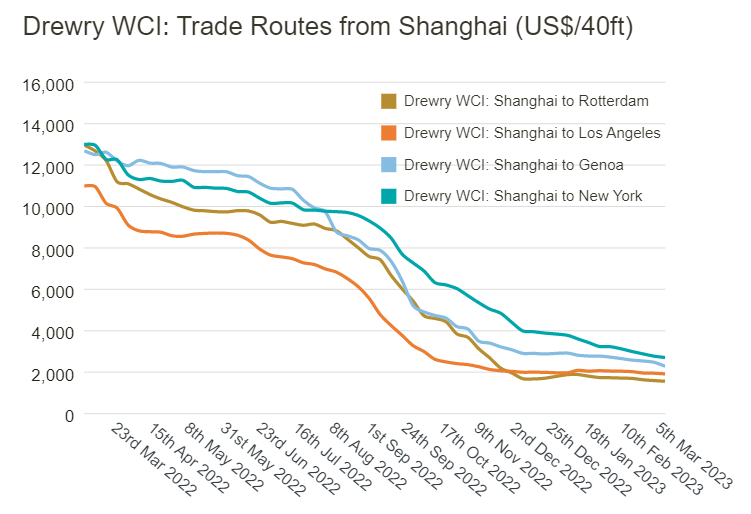

Freight rates fell powerfully in 2022, on all the most popular trade routes. Source: Drewry

CEO Eli Glickman conveyed that he is confident that the company will be able to generate positive operating income this year, and stressed that the company will reduce costs through ships powered by cheaper LNG fuel. Macro data from China released last night confirmed that economic recovery is indeed taking place, which could be a positive catalyst for freight rates. This could herald a positive surprise effect for ZIM as analysts expect a slowdown especially between Q2 and Q4 of this year. The biggest risks at present remain economic recession and deglobalization and tensions between Washington and Beijing.

ZIM Integrated Shipping (ZIM.US) stock, H4 interval. The price is trying to rise above $24 and has bounced upward from the average SMA 100 (red line). The main resistance level is in the $25 range, which bulls can break through by erasing the November 2022 downtrend gap. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.