Long-term investing is key to wealth, leveraging cost-effective strategies and profits from business cycles. Now, with easy access through trading apps, it's more popular. Yet, risks and disadvantages exist. Learn more about balancing benefits and potential pitfalls in investing for the long haul.

In the ever-evolving landscape of financial markets, adopting the right investment strategy is crucial. One such approach that often stands the test of time is long-term investing. In this article, we'll delve into the advantages and disadvantages of committing your funds for the long haul, exploring the intricacies of this investment strategy. In the intricate world of long-term investing, balancing the advantages and disadvantages is an art. Investing means a number of potential opportunity costs, and uncertainties. Ultimately, a thoughtful and disciplined long-term investment strategy can pave the way for financial success.

It means a strategic approach focused on patience and compounding returns, targeting wealth accumulation by weathering market volatility and reducing transaction costs over extended periods. Long term investments offer several advantages such as potential for higher yields due to compounding, lower impact of market volatility, and reduced cost from fewer transactions and lower capital gains taxes. However, long-term investing also presents risks. Almost any investment may be a failure, and a long term approach may be not enough to stop an investor from making a mistake. Read this article to know more about pros and cons of long term investments.

Long-term investing is key to wealth, leveraging cost-effective strategies and profits from business cycles. Now, with easy access through trading apps, it's more popular. Yet, risks and disadvantages exist. Learn more about balancing benefits and potential pitfalls in investing for the long haul.

In the ever-evolving landscape of financial markets, adopting the right investment strategy is crucial. One such approach that often stands the test of time is long-term investing. In this article, we'll delve into the advantages and disadvantages of committing your funds for the long haul, exploring the intricacies of this investment strategy. In the intricate world of long-term investing, balancing the advantages and disadvantages is an art. Investing means a number of potential opportunity costs, and uncertainties. Ultimately, a thoughtful and disciplined long-term investment strategy can pave the way for financial success.

It means a strategic approach focused on patience and compounding returns, targeting wealth accumulation by weathering market volatility and reducing transaction costs over extended periods. Long term investments offer several advantages such as potential for higher yields due to compounding, lower impact of market volatility, and reduced cost from fewer transactions and lower capital gains taxes. However, long-term investing also presents risks. Almost any investment may be a failure, and a long term approach may be not enough to stop an investor from making a mistake. Read this article to know more about pros and cons of long term investments.

Long term investing opportunities and risks

Long-term investing offers a myriad of opportunities for investors willing to take a patient approach. Of course as any strategy it also brings some risks. So, let's think and explain this investment philosophy. When it comes to long-term investments, one of the defining characteristics is the investment time horizon. This refers to the period an investor plans to hold an investment before selling it. Long-term horizons typically span ten years or more.

- Another key factor is risk tolerance, which is the investor’s ability to endure market volatility. It plays a crucial role in determining the asset allocation of a portfolio and influences whether an investor’s strategy is conservative, moderate, or aggressive.

- It’s important to note that risk tolerance is not a one-size-fits-all concept. It varies from investor to investor. Conservative investors may gravitate towards well-known investment vehicles or index funds, while aggressive investors may be willing to accept higher levels of risk for potentially greater returns, using for example the stock market.

- Regardless of the risk tolerance level, the primary objective of long-term investments often centres on wealth accumulation and diversifying investments.

Opportunities and risks

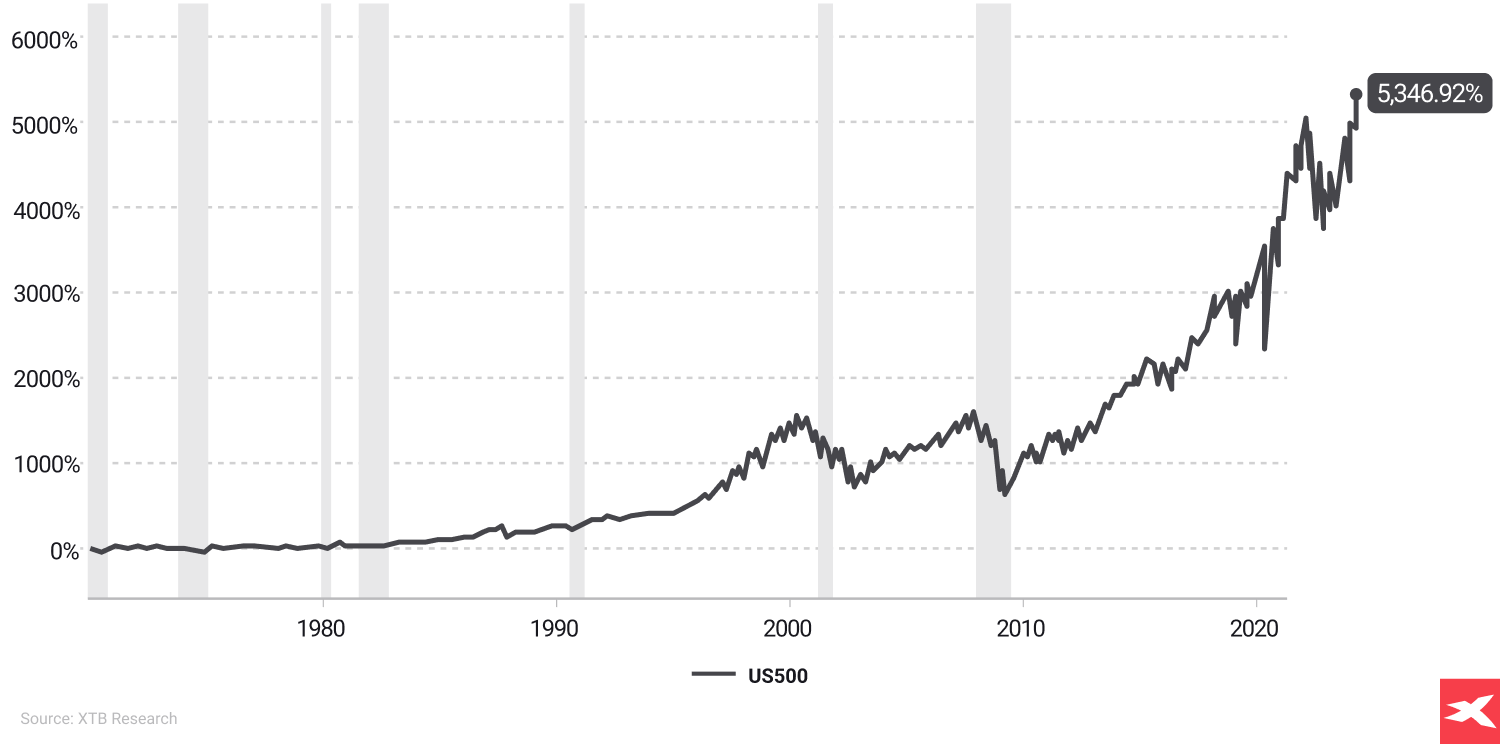

One of the primary opportunities is the potential for capital appreciation over an extended period. Historically, the stock market has shown a tendency to rise over time, providing investors with the opportunity to benefit from the growth of their investments.

History shows that recessions are headwinds for long term investors but until now stock market rebounded after every weaker period such as the 2001 dot-com crash, 2008 GFC, 2020 Covid-19 crash as well as Black Monday in 1987 and 1929 Wall Street preceding The Great Depression. The chart above shows nominal S&P 500 growth, reflected in the US dollar. The past performance does not guarantee future results. Source: XTB Research, Past performance is not a reliable indicator of future results.

Long-term investment vehicles

As we delve deeper into the world of long-term investing, it’s essential to familiarise ourselves with the various investment vehicles at our disposal. Equity investments, such as stocks and ETFs, are fundamental to diversified portfolios. Historically, they have provided higher returns over long-term periods, particularly through equity index funds, which offer exposure to a wide range of stocks. However, we can’t predict for sure that these conditions will repeat in the future.

- Fixed-income investments like bonds, mutual funds, and bond funds are also popular choices for their ability to provide regular income and stability. Exchange traded funds that track indices or asset classes offer both income and ease of trading on exchanges.

- Money market funds, government bonds, and real estate investments, either directly or through REITs, offer potential for capital appreciation and high dividend yields. Additionally, money market mutual funds can be considered as an alternative investment option, along with a well-chosen mutual fund.

- For those with a longer time horizon and high-risk tolerance, alternative investment vehicles such as private equity, venture capital, and growth stocks offer the possibility of substantial returns.

Advantages and disadvantages of long term investment

Long-term investing offers a myriad of opportunities for investors willing to take a patient approach. Of course as any strategy it has pros and cons. So let's think and explain advantages and disadvantages of this investment philosophy.

Advantages

- Possibility of capital gains without working directly

- Opportunity of participating in large market swings and business cycles

- Less time spending on markets analysis, strategic moves and portfolio management

- Possibly lower investing stress

- Lower costs due to lower investing activity

- Tax optimisation strategies

- Thanks to compounding interest of investments, over the long term average annual returns may be more than satisfactory

Long-term investing unveils the magic of compound interest. Albert Einstein once referred to compound interest as the eighth wonder of the world, and for a good reason. With time on your side, your initial investment can grow exponentially, generating interest not just on your principal amount, but also on the interest earned over time.

Weathering market volatility

One of the key merits of long-term investing is its ability to weather the storm of market volatility. Short-term fluctuations become mere blips on the radar when you have a patient, long-term approach. This resilience allows you to ride out market downturns without making hasty decisions that could jeopardise your financial goals.

Lower fees and tax optimisation

Long-term investors may enjoy favourable tax optimisation, depending on each country. Some economies offer special investment platforms, addressed for long term investors (for example IKE / IKZE in Poland, please check it accordingly - by country) the equivalent in the UK would be an ISA account. In general cases, as long as long term investors do not sell their assets, they don't have to pay any tax due to holding them

Disadvantages

- Missing out short-term investing opportunities and market trends

- No guarantee of future returns and beating market's average returns

- A possibility of creating “too defensive” strategies; underperforming yields from a broad type of assets

- Risks of cyclicality, uncertainty and investment biases

- Impulsive reactions due to investment losses and risk of feeling “FOMO” (Fear of missing out)

- Risk of unrealised gains during extended periods of attractive valuations

- Long term headwinds and time-costly rebuilding portfolio after market crashes and crises

Opportunity cost

Long-term investors may miss out on short-term opportunities. In a dynamic market, swift changes can create profitable short-term openings that long-term investors might overlook due to their commitment to a more extended timeframe. Striking a balance between seizing short-term gains and maintaining a long-term approach is crucial.

Market uncertainties

The unpredictability of markets is a challenge for long-term investors. Economic downturns, geopolitical events, and other unforeseen circumstances can impact long-term investments. Staying informed and adaptable is key to navigating the uncertainties that come with a prolonged investment horizon.

Psychological aspects of long-term investing

- Long-term investing demands patience and discipline. The market's ups and downs can be emotionally challenging, but maintaining a calm and disciplined approach is vital for success.

- Avoiding impulsive decisions during turbulent times is crucial for staying on course.

- Investors are human, and emotions can cloud judgment. Overcoming emotional biases, such as fear and greed, is critical for long-term success

- Creating a well-thought-out investment plan and sticking to it, regardless of emotional fluctuations, is key.

Advantages of Long-Term Investing

The benefits of long-term investing are manifold. One of the key advantages is the potential for higher returns over time. This is because long-term investments provide the opportunity for investments to grow and recover from downturns, thereby increasing their value. Another significant advantage is the reduced stress that comes with long-term investing. By removing the need for constant market monitoring and immediate response to market fluctuations, long-term investing contributes to emotional stability.

Long-term investors also benefit from the principle of “time in the market” versus trying to “time the market”, which is difficult to do consistently and successfully. This principle emphasises the idea that the longer you stay invested in the market, the higher your potential returns, regardless of market fluctuations.

Compounding Returns

One of the key advantages of long-term investing is the opportunity of compounding returns. This is the process by which an investment grows exponentially over time due to the reinvestment of returns. For instance, when dividends are reinvested, it increases the value of the initial investment.

Historically, investors in the S&P 500 index achieved 10% yearly return on average. However, past performance does not guarantee future returns and during bear markets even long term investors lost a ton of money.

Long-term investing enables deferral of capital gains taxes and reinvestment of the returned earnings. This means that an investor’s capital grows as the non-taxed money can generate additional earnings (but also loses).

Reduced Market Volatility Impact

Market volatility can be a source of stress for many investors. However, long-term investors are in a better position to weather this storm in the stock market. Investing in indexes like the FTSE 100 during any 10-year period between 1986 and 2021 had an 89% chance of making a positive return, showcasing the benefit of staying invested over the long term.

Moreover, investors who remain invested over extended periods are more likely to see their portfolios recover from market downturns, thus mitigating the effects of market volatility. This resilience is rooted in the ability of long-term investors to hold their nerve during periods of market volatility and avoid panic selling, thereby reaping the rewards of their patience as markets stabilise and recover.

Lower Transaction Costs

In the world of investing, transaction costs can significantly impact returns. One of the advantages of long-term investing is that it can result in lower trading fees. This is because frequent trading incurs higher costs, which can diminish overall returns.

Long-term investors are subject to transaction fees less frequently compared to short-term investors. Since long-term investments involve fewer buy and sell transactions, investors save on brokerage fees that can accumulate with more frequent trading. In addition, capital gains taxes on long-term investments are typically lower than the taxes on short-term profits, allowing investors to retain a larger portion of their returns.

By holding investments for the long term, investors can also defer capital gains taxes, allowing their returns to compound in their accounts without the immediate tax impact.

Disadvantages of Long-Term Investing

While long-term investing offers several benefits, it also presents certain challenges. One such challenge is the issue of opportunity costs. These refer to the potential benefits an investor misses out when choosing to invest in one option over another.

Furthermore, investors may face liquidity constraints with long-term investments, making it difficult to access funds for emergencies or other immediate needs. Additionally, investors need to maintain a dose of realism and recognise the signs of poorly performing investments to prevent compound losses over time.

Opportunity Cost

Opportunity cost in the context of long-term investing pertains to the foregone opportunities for gains from short-term investments. In other words, investing long-term can mean missing out on:

- higher yield opportunities that arise in the short term

- potential gains from market fluctuations

- the ability to quickly react to changing market conditions

This represents a significant opportunity cost.

Furthermore, while diversification is aimed at minimising risk, it may also result in lower overall returns. This is because diversification prevents significant concentration in any one investment or industry sector, which could be considered an opportunity cost.

Understanding and managing opportunity costs is crucial in making informed investment decisions.

Limited Liquidity

Investors may face challenges in accessing their money quickly from long-term investments due to limited liquidity. For instance, Certificates of Deposit (CDs) are a type of long-term investment that typically come with higher interest rates but have limited liquidity and assess a penalty for early withdrawal. In contrast, a money market account can offer a more liquid alternative for those seeking easier access to their funds, making it a suitable option for short term investment. Additionally, treasury bills can be considered as another short term investment option with relatively higher liquidity.

While a no-penalty certificate of deposit can allow for early withdrawal without a fee, this is an exception rather than the norm in long-term investments. For CDs, the penalty for early withdrawal is typically applied to the amount of principal withdrawn, which can diminish the investment’s returns. Understanding the liquidity constraints of different investment vehicles is key to effective portfolio management.

Changing Market Conditions

Another challenge in the realm of long-term investing is the constantly changing market conditions as markets are constantly driven by fear and greed. Speculative bubble bursts as well as the impact from rising interest rates or economic downturn may hit assets valuations.

Long-term investments in stocks are subject to risks not only from companies' business performance and cyclical global market fluctuations, economic movements, and policy changes. Also, currency change in FX rate (fx risk) may hit investment returns which are denominated in other currency than currency of the investment.

Strategies for Successful Long-Term Investing

While long-term investing presents certain challenges, they can be effectively managed with the right strategies. Among these strategies are diversification, regular portfolio review, and dollar-cost averaging. These strategies not only help manage risks but also maximise returns, bolstering the effectiveness of long-term investing.

Diversification

Diversification is a powerful strategy in the arsenal of a successful investor. It involves spreading investments across various:

- asset classes

- sectors

- industries

- companies

- borders

- time frames

This strategy minimises risks associated with individual investments and protects against market-wide events.

Investors can diversify their portfolio either through direct investment in a variety of assets such as stocks, bonds, and real estate or by investing in index funds that represent a broad range of assets. This approach offers an easier path to diversification.

The benefits of diversification include:

- Increased risk-adjusted returns

- Protection against significant losses

- Access to a broader range of investment opportunities

- A more enjoyable investment experience

Regular Portfolio Review

Regular portfolio review is another crucial strategy for successful long-term investing. It involves periodically assessing the performance of your investments and making adjustments as necessary. This ensures that diversification remains effective and that your portfolio aligns with your changing financial goals and market conditions.

Assessing your current risk tolerance during these reviews is crucial for ensuring that your portfolio reflects your comfort level and remains aligned with your financial objectives. Evaluating investment costs and tax efficiency as part of the review process is also important to optimise the overall after-tax return on investment.

Dollar-Cost Averaging

Dollar-cost averaging is a technique that involves regularly investing a fixed sum of money. It offers several benefits, including:

- Reducing the overall impact of price volatility

- Preventing poorly timed lump sum investments

- Being particularly beneficial during high market volatility periods.

By using dollar-cost averaging, investors can remove the emotional aspect of investing decisions, potentially leading to better long-term results. This technique is suitable for a range of investors, from beginners to those with more experience, and is commonly used in retirement plans like 401(k)s where regular contributions are made.

Investors can apply dollar-cost averaging to various investment vehicles, such as:

- Mutual funds

- Index funds

- ETFs

- Dividend reinvestment plans

This strategy, often used in tax-advantaged accounts like traditional IRAs, can also be applied to high yield savings accounts, including a regular savings account. It reinforces the habit of regular investing, which, along with compound interest, can be beneficial for building substantial wealth over time.

Case studies: long-term investing success stories

Long-term investing has created some of the world’s most successful investors, including Warren Buffett and Peter Lynch. Their success stories serve as a testament to the power of patience, discipline, and strategic investment choices.

Warren Buffett, known as the “Oracle of Omaha”, started his investment journey at 11 years old with shares in Cities Service. By age 32, he had already accumulated over $7 million in wealth through his partnerships. Buffet’s astute investment in Berkshire Hathaway laid the foundation for an empire that would include diverse holdings like Coca-Cola and American Express.

On the other hand, Peter Lynch, through a focus on “invest in what you know” and detailed research, guided the Magellan Fund to an average annual return of 29%, growing its assets from $20 million to over $14 billion. Despite their immense wealth, both Buffett and Lynch are known for their modest lifestyles and commitment to philanthropy, reflecting a balanced approach to wealth management.

Balancing Long-Term and Short-Term Investments

A successful investing journey requires striking a balance between long-term and short-term investments. This balance is crucial for creating a well-rounded portfolio that aligns with your financial goals and risk tolerance.

Assessing Your Risk Tolerance

Assessing risk tolerance is a critical step in balancing long-term and short-term investments. It involves considering objective measures such as:

- Age

- Time horizon for investments

- Income needs

- Family circumstances

Subjective measures of risk, including your personality and reaction to losses, must also be taken into account. Your risk tolerance can change over time, becoming more conservative as you age or experience life changes. Understanding your risk tolerance helps ensure that your investment portfolio reflects your comfort level and aligns with your financial objectives.

Allocating Assets

Once you’ve assessed your risk tolerance, you can proceed to allocate your assets. This involves distributing your investments among different asset classes based on your risk tolerance and financial goals. Investment companies often create model portfolios ranging from conservative to very aggressive to match investor risk tolerance.

Your portfolio allocation should be periodically reviewed and rebalanced to maintain the intended asset weighting and adapt to any changes in financial needs or life circumstances. Understanding how to allocate your assets can help you create a balanced portfolio that includes a mix of short-term and long-term investments.

FAQ

Investing can provide substantial returns not only because of higher stock prices but also income through dividends, and portfolio diversification. It may be a very good way for building wealth for risk aware investors. The biggest advantage of investing is the opportunity to have profits, because of capital deployment, without working directly.

However, it also carries risks such as investment failure, market volatility, tax implications, and the need for time and expertise. Investing may also hit an investor from the psychological side and make him greedy or fearful, which usually may lead to investment mistakes, as well as painful emotional reactions. The biggest disadvantage of investing is a risk of investment losses and dissatisfaction.

Long-term investing is more cost-effective than regular buying and selling, as it reduces the fees associated with regular trading. It may help to save money in the long run. Another benefit of long term investing is time efficiency.

Of course that any investment needs research and risk analysis, but long term investors don’t have to do it on a daily basis. Long term investors may also benefit from long term growth of company invested, as well as a stock market as a whole; especially thanks to index fund ETFs exposure.

It’s very hard to say, because past results don’t guarantee future investment profits. In general, the best long term investment may be stocks, exchange traded funds and real estates.

- For investors, who are more cautious and don’t tolerate volatility of the financial markets, real estate may be the best choice but in general the US and EU stock market outperformed yields from the real estate market in almost every measure.

- Some stocks of winning companies can provide much higher returns than index average, but this investment may be more risky.

- Index fund ETF investment can “guarantee” that investors will have as good (or as bad) returns, as average stock market performance (without any significant upside but also without any downside from average).

- More cautious investors, who are not professionals and are looking for stock market exposure, may choose ETFs such as iShares S&P 5000 or iShares Nasdaq 100 UCITS. For investors who don’t want to risk almost anything, bonds and general fixed income may be also very good choices.

All the mentioned options provide opportunities for long-term financial growth and stability.

The essence of long-term investing lies in patience, discipline, and strategic foresight, as it involves a commitment to staying the course despite market volatility and economic uncertainty, accumulating wealth over time.

It’s definitely not easy to invest for a long term and hold positions despite all market events and uncertainties. The essence and goal of long term investing is building wealth effectively, by holding assets for years or even decades.

For sure, stocks may be the best long term investment, but also may be the worst if investors choose shares of a company, which will perform weak and disappoint investors. Stock market volatility and high uncertainty not only about company business, but also valuation and sentiments make this investment very risky.

Investors who accept this risk have a chance to outperform almost every asset, but the price of it is a risk of failure and capital losses. Stock investment may also bring huge questions about timing, because one stock can outperform the market over months or years, but there is no guarantee that it will do that for decades.

Climate change investments: Maximising impact

Best ETFs to Look Out For

Building Balance: How to Diversify Your Portfolio with XTB

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.