In this article you will learn:

In this article you will learn:

- Introduction

- Why trade stocks?

- Investing goals & styles

- Research – key criteria to look for

- Conclusion

Choosing the best stock to trade with may seem like a tough job. Too often many promising businesses are highly valued and investors think of them as bubbles, whereas stocks with low price to earnings ratios or high dividend yields can look attractive, but sometimes they fail as well. There’s no proven, always-working method for choosing the best CFD stock to invest in. However, for many years people have been trying to select potential winners and it is not likely to change anytime soon. Even despite the rise of low-cost index funds, it is said that active investing will survive as rising market share of ETFs and index funds is going to create opportunities in terms of active stock picking. In this article, we examine best practices for investors and key criteria in terms of researching the best companies to invest in.

Why trade stock CFDs?

Let us begin with the idea of investing – why should people make an effort to invest at all? While investing is always associated with risk, not owning stocks at all isn’t necessarily a risk-free option either. Just think about having your savings in a bank amid a low interest-rates environment - in many cases it is virtually impossible to earn an interest in a bank right now. Being familiar with at least one equation from the world of finance makes it easier to familiarise yourself with compound interest as well. It assumes reinvesting your earnings, which then earn interest as well. The idea might be seen as a secret formula of successful long-term investors.

Compound Interest=Initial Investment ×1+in

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Investing 1,200.00 USD (or your local currency) a year seems realistic for most people. Source: The Motley Fool (fool.com)

If you’re a beginner in the world of stock trading, we recommend reading our article “Investing in stocks – what is stock trading?” where we explain some of the more basic terms, including stocks, stock market, fundamental vs technical analysis, trading vs investing.

Investing goals & styles

Having explained the power of investing, it is worth pointing out that investors should know their goals and investment style before buying stocks. Clarifying your goals makes things much easier – is it a long-term price growth of your portfolio or do you intend to make money through dividends? Are you saving for retirement (30/40/50-year time horizon) or maybe your goal is to achieve a decent rate of return in a decade and buy a new car or home then? Some investors may have a time horizon of just 2 years, which is fine as well. The key thing is to recognise your objectives, apply an appropriate strategy and remain consistent. Unfortunately, many investors tend to overreact amid market crashes and forget about their goals. Therefore, it is absolutely essential to ask yourself what your investing goals are.

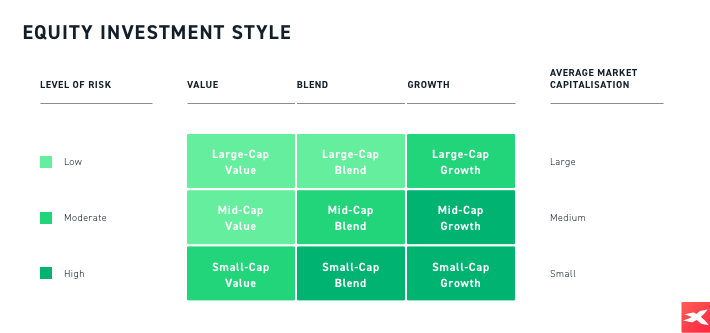

Secondly, it is recommended to know your investment style as well. This can be difficult for beginner investors, as an investment style will likely develop through experience. However, it would be a wise move to get to know different styles and try to figure out which one fits you best. Would you rather be a passive trend follower? Maybe you would prefer to apply an active management style? Do you intend to buy stocks only after companies have released solid earnings? There are plenty of questions that investors should constantly ask themselves. As far as investment styles are concerned, one may consider the following major approaches:

- Active vs Passive portfolio management

- Growth vs Value investing

- Small Cap vs Large Cap company

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

The risk of a portfolio is going to depend on the investor's investment style. Some strategies may be more risky, and can lead to greater losses, but in such cases the expected rate is potentially higher as well. Source: XTB Research, based on the Morningstar Style Box

Research – key criteria to look for

Let’s move on to the art of picking the best stocks to invest in. In this section, we will touch on the most important factors that investors should take into consideration while investing in stocks.

Sectors you understand

To begin with, it might be a good choice to invest in sectors that you understand and feel comfortable with. At the same time, it would be reasonable to avoid sectors that seem like a total mystery to you. Best companies to invest in can often be found in an industry that you represent. A quick example – an engineer could potentially research some good manufacturing stocks as he or she has an advantage here and knows the industry well. Many investors also tend to buy a stock if they love a product of a certain company. For instance, if you’re a tech fan and own a few products of a particular company (thereby understanding their business), maybe you should become interested in their shares as well? As you can see, researching top stocks is not limited to the computer screen – it is much more than that.

Growth and Value

It is no surprise that companies with strong fundamentals may be considered the best stocks to invest in. However, investors often find themselves at a crossroads amid the value vs growth stocks dilemma. Growth stocks represent companies that are expected to deliver high levels of profit growth in the future. Such companies have often demonstrated better-than-average gains in earnings. Meanwhile, value stocks usually represent well-established companies with strong fundamentals and predictable business models. One solution might be to actually diversify and have both types of companies in your portfolio. A broad exposure is still expected to provide a decent rate of return in the long-run, but the total risk is going to be reduced. We stressed the importance of diversification in our article “Portfolio Diversification – how to diversify trading portfolio”.

Valuation

Stock valuation is a very broad subject. It is crucial as institutional investors often base their decision on financial modelling. Every investor should be able to understand basic valuation metrics for stocks such as P/E ratio, P/S ratio, EV/EBITDA and others. The multiples approach may be particularly helpful as it is relatively easy to use. It is based on the idea that similar stocks are trading at similar prices. The method helps investors assess whether the company is undervalued or overvalued relative to its peers.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

Please be aware that the presented data refers to the past performance data and such is not a reliable indicator of future performance.

An example of comparable company valuation multiples. Source: Corporate Finance Institute (corporatefinanceinstitute.com)

Retail investors may even try to build basic DCF models based on their own assumptions about certain stocks. One might easily find some templates on the Internet, which should be enough to learn the craft. Even if you cannot devote your time to building models from scratch, you might still benefit from equity research reports of professional analysts from investment banks or brokerage firms. Such reports usually include a price target and an appropriate recommendation (e.g. sell or buy). However, investors should not focus solely on the price target, as it is based on an analyst’s assumptions. This, however, does not change the fact that analysts have a deep understanding of the industry they cover, which means that they are able to point out some critical factors (e.g. risk factors, opportunities or strengths of a certain company). Reading those reports and drawing your own conclusions may be a wise move.

Dividends

Investing in dividend stocks remains a popular strategy among investors around the world. Companies that aspire to be top dividend stocks are constantly trying to increase their dividend per share (DPS). Such firms can also be associated with regularity and reliable dividend policy – both features prove that a company respects its shareholders. The best dividend stocks are marked by relatively high dividend yield, which measures the dividend as a percent of the current stock price. However, one should keep in mind that a dividend yield results from dividing a company’s annual dividend by its current stock price. That is why an unusual yield could indicate that the firm is going through hard times and investors are selling off the stock. If you’re interested in this subject, we would highly recommend our article titled “Investing in dividend stocks”.

Qualitative factors

Qualitative factors play a huge role as far as choosing the best stocks is concerned. These are not necessarily reflected in financial projections, as they are hard to quantify. Nevertheless, they have a tremendous impact on the perspectives of a company. Pay attention to these most important qualitative factors while looking for the best shares to invest in:

- The quality of management

- Business model

- Competitive advantage

- Geographic exposure

- Political factors

- Brands and other intangibles

- Customer satisfaction with the company’s products

Conclusion

“Investing is simple but not easy,” Warren Buffet once said. The goal is to buy stocks that are undervalued and have significant upside potential – the idea is simple. However, psychological factors make things more difficult, as investors often behave irrationally due to emotions. Buying the best stocks is not enough – you should let logic, not emotions, prevail over your portfolio. Therefore, learning behavioural finance differentiates most successful investors from merely good ones. To conclude, it should be noted that some mistakes are inevitable, so being eager to learn from them is an essential trait for traders and investors.

Is it possible to invest in stocks with XTB?

At the moment, XTB offers stock CFD trading only. This includes over 1500 global stock CFDs, including Apple, Facebook, Amazon, and Barclays. CFD trading allows you to take a position on the price of an instrument without actually owning the underlying asset.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory.

The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments.

X-Trade Brokers Dom Maklerski S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication.

In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.

All You Need to Know About Shares & Stocks

What Is A Yield In Finance ? A Short Guide

How to Trade the Rising & Falling Wedge Patterns?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.