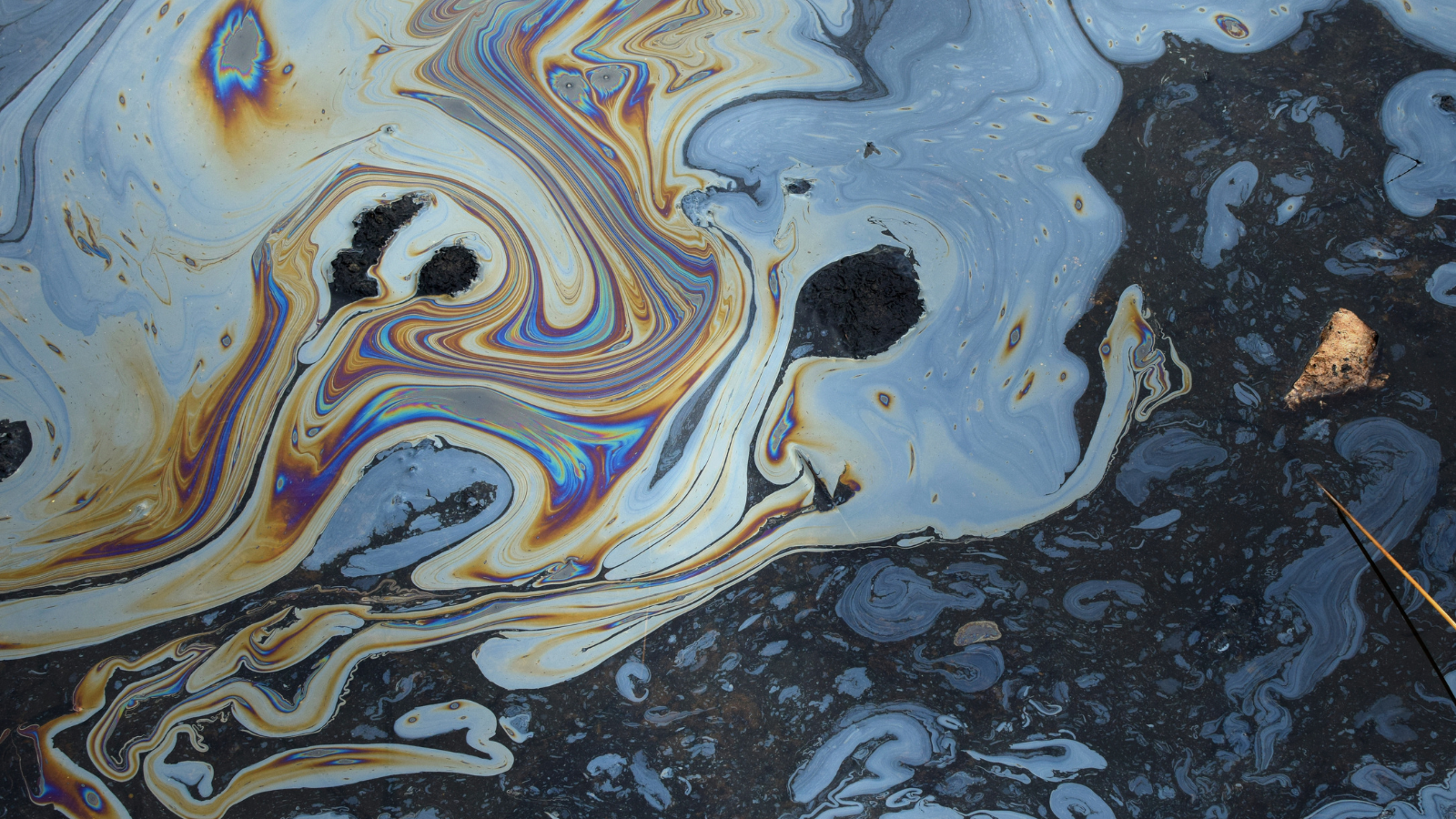

In the world of commodities, there's one slick superstar that's been quietly dominating the stage for decades. It's not a celebrity you'd recognise on the red carpet, nor does it have a fan club on Instagram. Yet, it's the lifeblood of the modern world, powering our vehicles, heating our homes, and even influencing the price of that delightful avocado toast you had for brunch. Meet Brent Crude Oil - the unsung hero of slippery slopes and the diva of drilling. Brent Crude has a fascinating story that's as wild as an oil-soaked roller coaster. Before we dive into everything there is to know about Brent Crude oil it is important to note that oil prices have gone up by roughly 2% amid Middle East Tension and will continue to fluctuate in the coming weeks.

In the world of commodities, there's one slick superstar that's been quietly dominating the stage for decades. It's not a celebrity you'd recognise on the red carpet, nor does it have a fan club on Instagram. Yet, it's the lifeblood of the modern world, powering our vehicles, heating our homes, and even influencing the price of that delightful avocado toast you had for brunch. Meet Brent Crude Oil - the unsung hero of slippery slopes and the diva of drilling. Brent Crude has a fascinating story that's as wild as an oil-soaked roller coaster. Before we dive into everything there is to know about Brent Crude oil it is important to note that oil prices have gone up by roughly 2% amid Middle East Tension and will continue to fluctuate in the coming weeks.

What is Brent Crude Oil?

Brent Crude Oil is a type of crude oil that is extracted from the North Sea. It is a light, sweet crude oil, which means that it is relatively low in density and sulphur content. This makes it easy to refine into gasoline, diesel fuel, and other petroleum products. Brent Crude Oil is the most widely traded crude oil benchmark in the world, and its price is used to set the price of two-thirds of the world's internationally traded crude oil supplies.

Brent Crude Oil is produced from a number of different oil fields in the North Sea, including the Brent, Forties, Oseberg, and Ekofisk fields. These fields are located off the coast of the United Kingdom, Norway, and Denmark. Brent Crude Oil is transported to refineries around the world via pipelines and tankers.

Brent Crude Oil is a valuable commodity because it is a high-quality crude oil that is easy to refine. It is also a relatively stable crude oil, meaning that its price is less volatile than other types of crude oil. This makes it a popular choice for oil companies and other businesses that need a reliable supply of crude oil.

Here are some of the key characteristics of Brent Crude Oil:

- Light and sweet: Brent Crude Oil is a light, sweet crude oil. This means that it is relatively low in density and sulphur content. This makes it easy to refine into gasoline, diesel fuel, and other petroleum products.

- High quality: Brent Crude Oil is a high-quality crude oil. It has a low sulphur content and is relatively free of impurities. This makes it a valuable commodity for oil companies and other businesses.

- Stable price: Brent Crude Oil has a relatively stable price. This is because it is a benchmark crude oil and is widely traded around the world.

What is Brent Crude Oil used for?

Brent Crude Oil is used to produce a variety of petroleum products, including:

Gasoline

Brent Crude Oil is the primary feedstock for the production of gasoline.

Diesel fuel

Brent Crude Oil is also used to produce diesel fuel, which is a key fuel for trucks, buses, and other heavy-duty vehicles.

Jet fuel

Brent Crude Oil is used to produce jet fuel, which is the fuel used by aeroplanes.

Other petroleum products

Brent Crude Oil is also used to produce a variety of other petroleum products, such as heating oil, asphalt, and petrochemicals.

Brent Crude Oil is a vital commodity for the global economy. It is used to produce a variety of petroleum products that are essential for modern life. Brent Crude Oil prices can have a significant impact on the global economy, as they can affect the cost of transportation, manufacturing, and other sectors.

How is Brent Crude oil different from other types of crude oil?

Brent Crude oil distinguishes itself from other types of crude oil in several key ways, primarily based on its geographic origin, chemical composition, market influence, and trading mechanisms.

Firstly, the geographic origin of Brent Crude sets it apart. As we mentioned above, it is extracted from the North Sea, specifically from four major oil fields: Brent, Forties, Oseberg, and Ekofisk. This North Sea origin differentiates it from other crudes, which come from diverse regions around the world. Each geographic source brings its unique qualities and challenges to the production and transportation of crude oil.

Secondly, Brent Crude is classified as a "sweet" crude oil due to its relatively low sulphur content. This low sulphur content, compared to "sour" crudes with higher sulphur levels, makes Brent easier and more cost-effective to refine into various petroleum products, such as gasoline, diesel, and jet fuel. The lower sulphur content is an advantage in terms of environmental impact and compliance with emission standards.

Brent Crude also stands out in terms of its API gravity, which measures its density. Typically, Brent Crude has a higher API gravity than some other crudes. This means it is a lighter crude, which is easier to refine and yields a higher percentage of valuable, light-end products like gasoline. In contrast, heavy crudes require more complex and costly refining processes.

Furthermore, Brent Crude holds significant influence in global oil markets. It serves as a key benchmark for oil pricing, impacting the pricing of a substantial portion of the world's crude oil. Other types of crude oils, such as West Texas Intermediate (WTI) and Dubai Crude, may serve as benchmarks but may not wield the same level of global influence.

The supply chain and infrastructure for Brent Crude are tailored to the North Sea region, which includes offshore drilling platforms, pipelines, and transportation networks. Other crudes have their own unique supply chains and transportation logistics. The geographical distribution of these supply chains can affect their availability, delivery costs, and market dynamics.

Lastly, Brent Crude is typically traded on the Intercontinental Exchange (ICE) in London and priced in U.S. dollars. This trading mechanism differs from that of other crudes, such as WTI, which is traded on the New York Mercantile Exchange (NYMEX) in the United States. These differences in pricing and trading mechanisms can lead to variations in crude oil prices and market behaviour.

In summary, Brent Crude's unique geographic origin, sweet composition, global market influence, and trading mechanisms all contribute to its distinct characteristics compared to other types of crude oil. These differences play a significant role in shaping global oil markets and influencing the economic dynamics of both oil-producing and oil-consuming nations.

How can I invest in Brent Crude oil?

Investing in Brent Crude oil can be approached in several ways, depending on your investment goals, risk tolerance, and expertise. Here are some common methods to consider:

- Futures Contracts: One of the most direct ways to invest in Brent Crude is through futures contracts. These contracts allow you to speculate on the future price of Brent Crude. However, futures trading can be complex and risky, as it involves leverage and requires a good understanding of the oil market. It's not recommended for novice investors.

- Exchange-Traded Funds (ETFs): ETFs that track the price of Brent Crude oil provide a more accessible way to invest. These ETFs aim to replicate the price movements of Brent Crude by holding futures contracts or other derivatives. Popular Brent Crude ETFs are traded on stock exchanges, making them easy to buy and sell.

- Oil Company Stocks: Investing in oil companies, such as major oil producers and explorers, can indirectly expose you to the Brent Crude market. These stocks can be bought through traditional brokerage accounts and are influenced by the oil price.

- Master Limited Partnerships (MLPs): MLPs are publicly traded partnerships that often operate in the energy sector, including oil and gas transportation and storage. By investing in MLPs, you can gain exposure to the energy industry and, indirectly, Brent Crude.

- Commodity Mutual Funds: Some mutual funds specialise in commodities, including crude oil. These funds may invest in a variety of commodities, including Brent Crude, and can be a more diversified way to gain exposure to the oil market.

- Oil-Related Options: Options contracts provide the right, but not the obligation, to buy or sell Brent Crude oil at a predetermined price. Options can be used for hedging or speculating on price movements, but they require a good understanding of options trading.

- Direct Investment in Oil Companies: If you have a substantial amount of capital and expertise, you can invest directly in oil companies engaged in Brent Crude extraction, production, or exploration. However, this requires substantial resources and industry knowledge.

It's essential to consider your risk tolerance, investment horizon, and level of expertise before choosing an investment method. The Brent Crude market, like any commodity market, can be volatile, and it's possible to incur significant losses. Additionally, ensure that you have a clear understanding of the specific investment vehicle you choose. Keep in mind that the oil market is influenced by various factors so it can be subject to significant fluctuations.

What is the current price of Brent Crude oil?

The current price of Brent Crude oil is $90.16 per barrel. This is as of 24 October 2023, according to OilPrice.com.

Brent Crude is a global benchmark for crude oil prices. It is a blend of oils from several fields in the North Sea, and is used as a pricing reference for many other types of crude oil around the world.

Oil prices have been volatile in recent months, due to a number of factors including the war in Ukraine, the tension between Israel and Hamas, rising inflation, and concerns about a global economic slowdown. However, Brent Crude prices have remained relatively stable in recent weeks, trading in a range between $90 and $95 per barrel.

It is important to note that oil prices can fluctuate throughout the day, so it is always best to check the latest prices before making any trading decisions.

Factors that can affect the price of Brent Crude Oil

Supply and demand

The price of Brent Crude Oil is affected by the supply of and demand for crude oil. When supply is high and demand is low, the price of Brent Crude Oil will fall. Conversely, when supply is low and demand is high, the price of Brent Crude Oil will rise.

Economic growth

Economic growth can also affect the price of Brent Crude Oil. When the economy is growing, demand for crude oil tends to increase, which can push up prices.

Geopolitical events

Geopolitical events, such as wars and revolutions, can also affect the price of Brent Crude Oil. If geopolitical events disrupt the supply of crude oil or increase uncertainty in the market, it can lead to higher prices.

Brent Crude Oil is a complex commodity and its price is affected by a variety of factors. However, it is an important commodity for the global economy and its price can have a significant impact on the cost of transportation, manufacturing, and other sectors.

How does Brent Crude oil impact the global economy?

Brent Crude oil's impact on the global economy is profound and multifaceted, as it influences various economic aspects, trade balances, and fiscal policies in both oil-importing and oil-exporting countries.

First and foremost, the price of Brent Crude has a direct effect on fuel prices, particularly gasoline and diesel. When Brent Crude prices rise, it generally leads to higher gasoline and diesel prices for consumers. This increase in energy costs can lead to increased transportation and production expenses, impacting both individual households and businesses. Consequently, higher oil prices can result in inflationary pressures on economies as the increased cost of energy ripples through various sectors.

Oil-exporting countries benefit from the sale of Brent Crude, as it contributes substantially to their government revenues. The revenue generated from oil exports allows these countries to invest in infrastructure, public services, and development projects. It also gives them greater fiscal flexibility and, in some cases, political influence on the global stage.

Conversely, oil-importing countries can face economic challenges when Brent Crude prices surge. Higher oil prices strain trade balances, as more money is spent on oil imports. This can lead to current account deficits, where a country is importing more than it is exporting, potentially impacting its currency value. Oil-importing nations often resort to energy subsidies and hedging strategies to mitigate the impact of rising oil prices.

The global economy is intricately connected to energy markets, and Brent Crude's pricing can influence investor sentiment and market volatility. Rising oil prices can create uncertainty, causing stock markets to fluctuate and affecting consumer and business confidence. This, in turn, can impact investment and economic growth.

Additionally, geopolitical tensions in oil-producing regions can lead to supply disruptions and price spikes in the Brent Crude market. Such events can affect the global economy by creating uncertainty, higher energy costs, and potential conflicts. The ability of oil-producing countries to influence supply and prices further underscores the geopolitical dimension of Brent Crude's impact on the global economy.

In summary, Brent Crude oil's influence on the global economy is pervasive. It affects inflation, trade balances, fiscal policies, investor sentiment, and geopolitical stability. Its pricing dynamics have far-reaching consequences that ripple through both oil-exporting and oil-importing nations, making it a critical factor in the world's economic landscape.

FAQ

Brent crude oil is a type of light, sweet crude oil that is produced in the North Sea. It is one of the two most widely traded crude oil grades in the world, along with West Texas Intermediate (WTI). Brent crude oil is used as a benchmark for pricing other crude oil grades around the world.

Brent crude oil is priced using a spot market system. In a spot market, buyers and sellers agree on a price for a commodity to be delivered immediately. The price of Brent crude oil is determined by the supply and demand of the oil in the spot market.

- Global economic growth: When the global economy is growing, demand for oil tends to increase, which can drive up prices.

- Supply disruptions: If there is a disruption to the supply of oil, such as a natural disaster or political instability, prices can also rise.

- Speculation: Oil prices can also be affected by speculation from financial traders.

Brent crude oil and WTI are both light, sweet crude oil grades. However, there are some key differences between the two. Brent crude oil is produced in the North Sea, while WTI is produced in the United States. Brent crude oil is also generally considered to be a higher quality oil than WTI, as it has a lower sulphur content.

Brent crude oil is important because it is used as a benchmark for pricing other crude oil grades around the world. This means that changes in Brent crude oil prices can have a significant impact on the price of oil that consumers pay. Brent crude oil is also important because it is a major source of revenue for many oil-producing countries.

What Is the FTSE 100?

Hawkish Vs Dovish: Differences Between Monetary Policies Explained

How to Invest in Gold - How to buy digital gold with XTB

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.