Investing in an ETF gives you the opportunity to participate in a professionally managed mutual fund and allows you to focus on a selected market sector.

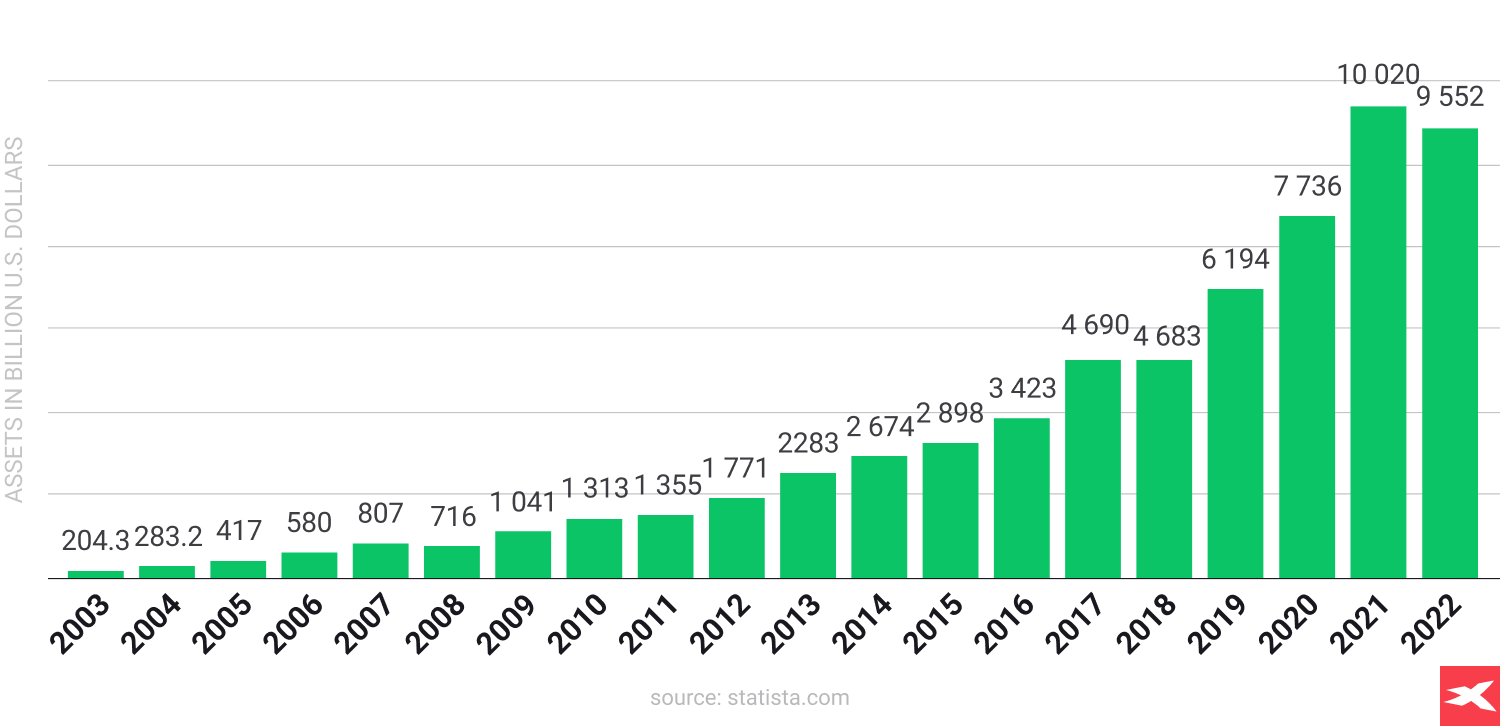

The popularity of investing in ETFs is currently booming and peaking among investors due to the desire to diversify investments, reduce risk, and interest in select industries or market sectors. The spike in the formation of more ETFs occurred after the pandemic, in 2020. Meanwhile, the pace of new fund creation accelerated in 2021 and the trend doesn't seem to be slowing, with the ETF market now worth more than $7 trillion USD.

Investing in an ETF gives you the opportunity to participate in a professionally managed mutual fund and allows you to focus on a selected market sector.

The popularity of investing in ETFs is currently booming and peaking among investors due to the desire to diversify investments, reduce risk, and interest in select industries or market sectors. The spike in the formation of more ETFs occurred after the pandemic, in 2020. Meanwhile, the pace of new fund creation accelerated in 2021 and the trend doesn't seem to be slowing, with the ETF market now worth more than $7 trillion USD.

Investing in ETFs is also an attractive investment because of the possibility of passive investing, the idea of which is to buy and hold while reducing risk. In this article we will present what ETFs are, touch on the most important issues related to investing in them, and how to buy them at XTB explain how to gain exposure to them.

Investing in ETFs is also an attractive investment because of the possibility of passive investing, the idea of which is to buy and hold while reducing risk. In this article we will present what ETFs are, touch on the most important issues related to investing in them, and how to buy them at XTB explain how to gain exposure to them.

What is an ETF fund?

An Exchange Traded Fund (ETF) is a type of security that tracks a sector, index, commodity or other asset. ETFs can be bought or sold on an exchange in the same way as regular stocks. The design of an ETF remains arbitrary and depends on the strategy of its creators. And in this way, an ETF can track anything from the price of a single commodity or a few stocks to a large and diverse collection of securities. ETFs can also be structured to provide exposure to precious metals such as gold and the commodities sector.

An ETF is an equity security, so it has an assigned price. ETFs are also called exchange-traded funds because they are traded continuously on stock exchanges just like corporate stocks. ETFs are sometimes confused with mutual funds, but there are differences between the two. Mutual funds are traded over-the-counter and their price is set only once a day, while ETFs are traded at the open of an exchange like stocks and their price fluctuates constantly.

ETFs are traded on exchanges, and they are subject to strict controls and regulations. In Europe they are regulated by the UCITS Directive, which unifies the regulation of European ETFs and introduces required standards of protection of fund participants. This is the highest possible standard of consumer protection in the financial services sector within the collective investment in Europe.

Passive or active investment?

Active investing involves buying and selling your positions frequently. Passive investing is limited to very infrequent buying and selling of positions in your portfolio.

The difference between active investing lies primarily in the investment horizon of short or long term. Each investor can choose which approach they feel is appropriate depending on the risks they wish to take. If an investor is looking for a temporary advantage in the market and expects the fastest possible returns, then active investing is a suitable option.

Passive investing can be done by investors who have a relaxed attitude towards investing and portfolio management. Such investors are not interested in daily tracking every price movement of the market, ETF or the company they are a shareholder of. Passive investing is also suitable for people who invest in what they consider to be modern market trends that may reach their peak within a few or several years.

Different Investors

Active investing is a likeable option by risk-taking investors. Investors who want to reduce risk as much as possible focus on passive investing.

Trading costs

Active investing involves higher transaction costs due to the frequency of trading and the number of positions opened. Passive investing results in low transaction costs due to the infrequency of trading.

Price Movements

The goal of active investing is to make money on short-term price movements. Long-term price movements and long market movements play an important role in investing.

Advantages and disadvantages of investing in ETFs

Investment in ETFs is perceived as safer due to their construction fundamentals, but like any investment on the financial market, it is subject to risk and has potential advantages and disadvantages.

Advantages

- ETFs provide lower costs because opening a position in every stock that an ETF holds in its portfolio could result in higher fees. By minimizing the number of transactions, position costs can be lower.

- Investing in ETFs provides access to a wide range of stocks from any industry of your choice, thus limiting your investment risk while maintaining focus on your chosen market sector.

- Risk management is known as one of the key factors in making money on the stock market. By diversifying or dividing the portfolio mathematically the probability of investment failure decreases (but it’s always possible) and the volatility of ETF prices is usually balanced.

- Some ETFs are backed by physical deliveries of a particular commodity or precious metal, which they purchase in the market on behalf of clients. For example this allows you to gain exposure to physical backed gold without buying physical gold.

Disadvantages

- Because ETFs hold a diverse mix of stocks, they don't have as much return potential as buying individual stocks because a gain on one company's stock can be offset by a loss on another company's stock. This is the cost of lower investment risk often referred to as Risk / Reward ratio.

- The portfolio of each ETF can be actually weak, with companies in bad condition or overvalued businesses. In face of this situation Your investment risk is huge and diversifying is only an illusion. It’s always very important to check which stocks or commodities are in each ETF portfolio.

- Some ETFs that are poorly or passively managed may lose value due to selecting the wrong companies. Thus, an ETF focused on a particular industry could potentially lose value or slow noticeably despite growth in the sector on which it is focused. Trying to avoid risk can be even riskier if the investor will not do due diligence before investing.

- Passive investing also can be risky because the market is still on the move and without adjusting ETFs portfolio short term losses can expand to long term problems that can be hard to reverse for many months or even years. History shows also that the number of companies which go bankrupt or fall down is very high and the S & P 500 in the 90s had different stocks ‘inside’ than now. It shows that some ETFs can actually be the trap but for now no one knows which of them are. The perfect example of ETF volatility are Ark Invest ETFs, managed by Cathie Wood which were on ‘Wall Street top’ in the time of covid pandemic and dovish Fed. But in 2022 they fell down and lost even 80% of the value during a harder period for riskier assets.

ETFs vs Stocks

Control

The main difference between these instruments is the control over your investment portfolio. When you buy stocks, you choose the companies and make up the composition of your investment portfolio.

When you buy ETFs you have an instrument created by creators, specialists who constructed it based on market research, potential of given stocks and matched stocks to fund's strategy. You cannot influence the composition of the portfolio of a given ETF, its composition may remain unchanged or change when the creators decide so.

Long term horizon

ETFs are focused on long-term trends rather than speculative uptrends, which often take place in one or more sessions in a stock and end with a sell-off due to, for example, the publication of important news. In addition, investing in a sector means that you are not susceptible to risks to just one company arising from, for example, a scandal, weaker financial performance or an unforeseen accident. It may happen that a particular company will be losing while the sector valuation will be rising.

CFD ETFs Access

- ETF CFDs similar to Stocks CFD can be purchased as leveraged derivatives, which increases the investment risk and potential return. Trading ETFs CFD is speculative and price action is the most important in this type of ETF investment.

- ETFs CFD is a financial contract that you trade to earn the price difference between your open and closed positions. It’s also a good option for investors, who like high risk ventures and dynamic trading.

- For example You can trade uranium ETFs CFD and use financial leverage. Thanks to leverage trading an ETF requires only a certain percentage of the whole position. For example using 1:5 leverage gives You the opportunity to open a 5000 USD contract by using only a 1000 USD margin. Thanks to CFD Trading day traders can earn money even when the price of ETFs fall down - by opening short positions.

- This kind of risky speculation can be especially dangerous and volatile because of the ETF’s market price action. Trading ETFs CFD trading gives traders an opportunity to maximize their profit faster even when price action is not very big, but loss can be also much bigger because of using leverage.

Risk vs Reward

Shares of individual companies have a higher investment risk, but also a higher rate of return in case of success of the company. ETFs are a tool, one of whose main tasks is to minimize risk. Investing in ETFs from a defined sector means that you are not susceptible to risks to just one company arising from, for example, a scandal, weaker financial performance or an unforeseen accident. It may happen that a particular company will be losing while the sector valuation will be rising.

Volatility

The price volatility of individual stocks is higher than that of ETFs, making them more volatile.

Statistic winners

Statistically, ETFs offer better average returns than individual stocks. Both ETFs and stocks can pay dividends.

Different Investors

Active investing is a likeable option by risk-taking investors. Investors who want to reduce risk as much as possible focus on passive investing.

Trading costs

Active investing involves higher transaction costs due to the frequency of trading and the number of positions opened. Passive investing results in low transaction costs due to the infrequency of trading.

Price Movements

The goal of active investing is to make money on short-term price movements. Long-term price movements and long market movements play an important role in investing.

ETF Physical or Synthetic?

ETFs are passively managed funds that are designed to replicate a selected group of instruments. Funds can accomplish this in two ways - by synthetic or physical replication of selected assets. Below we will briefly expand on this topic and describe these two models.

Physically replicated ETFs

As the name implies, this method involves buying the physical assets that go into a given ETF. This could be gold, silver, or buying S&P 500 stocks if the purpose of the ETF is to mimic a selected index. In this case, the number of shares bought by the fund corresponds to the 1:1 share structure of the 'tracked' S&P 500 index. In the case of liquid large-cap stocks from the U.S. market, the use of physical replication is not a problem. Regardless of the size of the fund's demand, the markets will provide the liquidity needed so the fund can replicate the performance of the index.

Limitations of physical replication

A problem arises if a fund's demand is greater than the liquidity available in the replicated instruments. Such a situation can arise in the case of funds with exposure to stocks in emerging markets or innovative new market sectors. In such a case, the stock exchange may not provide demand for the ETF fund.

Another problematic situation is when a fund intends to purchase a high percentage of all companies. Depending on the market, this can create additional obligations and fees for the large shareholder, in which case the portfolio of the ETF in question is reduced by the corresponding amounts, slowing its growth. For this reason, such ETFs avoid acquiring high percentages of a company's shares.

Solution of the problem

In this situation, an ETF can substitute assets that it is unable to purchase directly with others that are very similar. For example, a fund that invests in commodity companies might start buying shares of companies responsible for the infrastructure of mines.

Such a situation, however, contradicts somewhat the idea of ETFs, which are supposed to faithfully represent specific assets and not buy correlated instruments depending on the decision of analysts. In the case of bankruptcy of a physical backed ETF (for example gold or silver backed ETF like f.e. iShares IGLN.UK or ISLN.UK) in the physical replication model, the assets held should cover 100% of the fund's liabilities to investors.

Synthetic replicated ETFs

If the above methods prove insufficient ETFs use synthetic replication. This involves entering into a contract to exchange the rate of return on the assets held by the fund.

This is how an ETF fund can offer a rate of return on assets it does not physically own. However, such a fund has access to the rate of return generated by the assets through an individual swap agreement, such as with a large investment bank.

Risk model

Synthetic replication is seen as less safe. An additional risk factor is the involvement of a third party in this model, e.g. an investment bank that is a guarantor. In the case of synthetic replication, if the bank or other institution that guarantees the returns on the assets in the synthetic fund goes bankrupt, investors may have trouble recovering their ETF investment funds.

Proponents of synthetic ETFs point to the lower operating costs. Synthetic fund supporters also point out that in the case of physically replicated funds, there is an additional third party that holds and protects the assets collected and it may be also an additional risk factor.

ETF Distributing or Accumulating model?

The two basic types of ETFs share classes are 'distributing' and 'accumulating'. Distributing funds distribute the income earned from the assets they hold to the investor by paying dividends. Funds in the accumulating model reinvest that income to grow the fund's valuation and capital.

Distributing ETFs

Most financial instruments pooled in a portfolio of ETFs can produce income. In the case of bond ETFs, the income can be a fixed interest rate. In the case of shares bought by an ETF, the income may come from dividends. Keep in mind that different rules and taxes also apply to dividends from companies in different countries, so the amount of dividends an ETF collects can vary.

An ETF that owns bonds/shares continuously distributes income to its investors, which investors can then use for any purpose or pay out. Some ETFs have a portfolio model geared towards dividend companies so that the dividends paid from such funds can be predicted to be cyclical. When distributing funds hold dividend stocks, the income is used to make distributions to fund holders at specific intervals - often monthly, quarterly, semi-annually or annually.

In practice, this means that distributing ETFs have a more complicated model due to the time difference between when the fund receives dividends or interest and when dividends are paid to fund holders, but this difference can vary which can sometimes expose the fund to market movements. The ETF distributing fund will then reinvest the dividends and interest, but then sell the assets when the time comes to pay the dividends. This situation does not directly affect complications on the part of equity holders.

Accumulating ETFs

With accumulating ETFs, the income is reinvested by the fund into more stocks and bonds, thus contributing to the capital growth of the fund holders. When accumulating funds hold income stocks, the income is used to fund distributions to fund holders at specific intervals - usually monthly, quarterly, semi-annually or annually.

Accumulating ETFs are more tax-efficient for investors holding positions for long periods of time because there is no need for a tax return on dividends received.

Summary

The choice between these two ETF models depends on whether the investor wants to receive regular income from the investment or wants to accumulate capital in positions and not account for the dividends received on a tax basis.

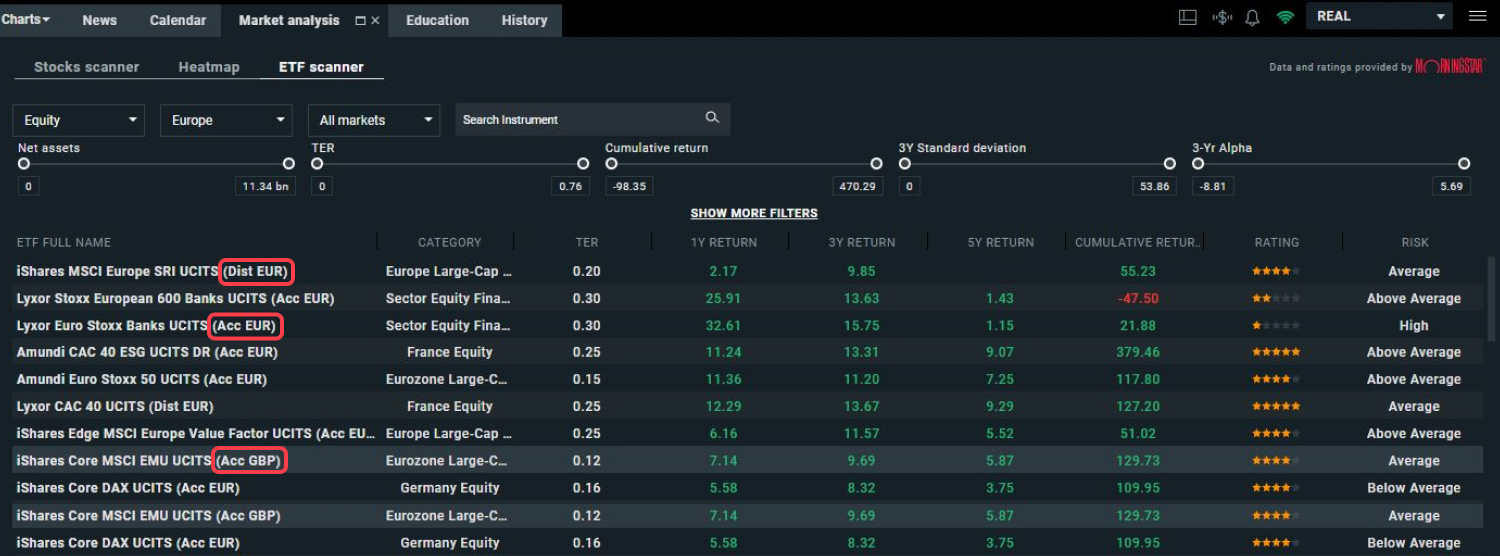

Our xStation platform has a built-in ETF scanner that allows filtering the ETF model so clients can easily find interesting dividend and accumulation ETFs (acronyms ‘Acc’ and ‘Dist’) and use advanced selection tools.

ETF xStation scanner

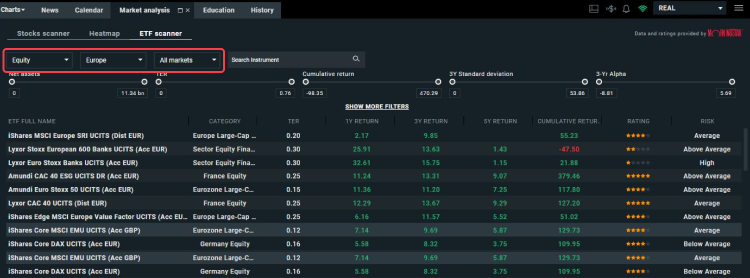

At XTB we understand how important it is for our clients to filter the market, find and analyze exactly those instruments which correspond to personalized requirements. Therefore we have created and made available in the xStation5 platform the ETF Scanner, which serves as a tool for selection and search of ETFs from specific sectors.

Primary filters

The ETF Scanner is a tool available in the xStation trading platform, under the 'Market Analysis' tab, and it allows you to efficiently search for ETFs using advanced filters.

The ETF Scanner allows you to filter ETFs based on:

- The region on which the ETF is listed.

- Class of the ETF, i.e. the portfolio it is built from (commodities, shares, mixed model).

- The type of the market on which it is listed. There are developed markets, mixed markets and emerging markets, which are of growing interest to investors.

Source: XTB. Past performance is not a reliable indicator of future results.

Additional filters

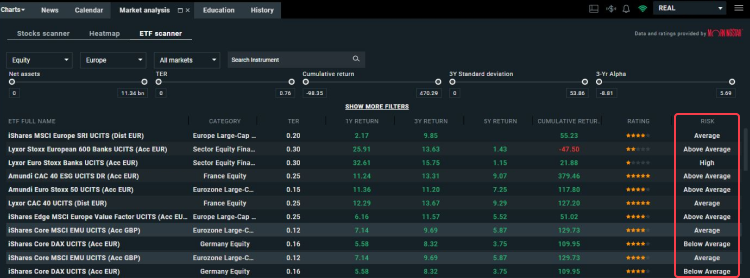

Risk ratings

We know that investors looking for ETFs calculate risk, which is one of the main features of an ETF investment. That's why we've also provided risk ratings by research

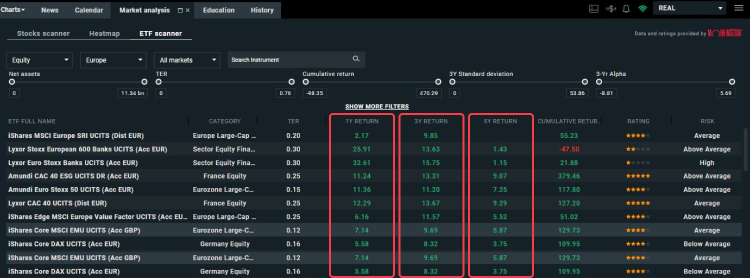

Return rates data

ETF xStation scanners have also advanced data available on a given ETF, such as information about its past return rates in Year to Year, 1 year, 3 years and even 5 years horizon. We also add Alpha and Beta ratios to the ETFs, which are used by many investors to calculate the profitability of their investments.

Source: XTB. Past performance is not a reliable indicator of future results.

ETFs operating costs

In xStation ETF Scanner we also added information about TER (Total Expanse Ratio) , which takes into account the total costs associated with managing and operating a given ETF. These costs include mainly management fees and other, additional costs (for example, legal fees or operating costs), by which the value of the ETF is reduced. From the investor's point of view, the lower the TER, the lower the operating costs the ETF has.

Source: XTB. Past performance is not a reliable indicator of future results.

Net assets and standard deviation

The ETF xStation scanner also gives the ETF's net asset value, i.e. the fund's financial value minus all its financial liabilities and information about the standard deviation, which can be used as a measure of the instrument's price volatility.

Dividend model

ETF distribution type - There are two main distribution types. A distribution ETF (often labeled "Dist") pays all dividends or interest earned, so investors receive annual payments. On the other hand, accumulation ETFs (often labeled "Acc") reinvest dividend or interest income, so investors profit on a compound interest basis.

Source: XTB. Past performance is not a reliable indicator of future results.

When to choose ETF investment?

ETFs are an attractive investment proposition for those who want to invest in a broad sector or are less interested in research and the situation of individual companies. It can be time consuming and knowledge intensive to determine such details.

ETFs allow you to invest in companies that tend to perform well. Sometimes sectors like banking do well and all bank stocks gain, but other sectors like new technology face different risks. Such sectors can be more attractive investments with potentially higher returns, but picking one particular company can require professional expertise, while ETFs allow you to profit from many companies.

ETFs offer ease of entry and are easy to sell because of their high liquidity and daily trading on most platforms. Some investors choose to build a mixed portfolio using stocks and ETFs. In choosing a strategy individually, it's important to understand the characteristics of ETFs and to follow the industries of your choice.

ETF Trading hours

What about available ETFs trading hours? This information is especially important for day traders. ETFs and ETFs CFD trading is available from Monday to Friday when stock exchanges are open. Open trading hours depend on exchange. During weekends exchanges are closed and prices of ETFs are static. At all other times the prices of ETFs are constantly fluctuating.

Of course the best time for ETFs trading is during periods of very high liquidity, when market volatility is higher. When there are high trading volumes in the market, ETFs volatility increases. It could be influenced by publishing important political or company news but also because of positive or negative sentiment in the defined market sector. But If you treat your ETF investment as a long term you don’t need to follow temporary market volatility.

REIT ETF & Stock - How to Invest in Property

Investing In ETFs - A Short Guide

How to Look for the Best CFD Broker

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.