Do you agree that green energy is a better future for the Earth? Learn how to start green investment. Green investment is a growing global trend. More and more countries and investment, sustainable funds are choosing to join it. Green energy investments can be of interest to environmentally conscious individuals who want to support the trend while earning from it. In this beginner's guide, we will explore what green investments mean, what types of green investments are available at XTB and how to choose the right investment option. We will also look at the impact of these investments. If you're interested in investing in green energy companies, ETFs or just trading CFDs just keep reading!

Do you agree that green energy is a better future for the Earth? Learn how to start green investment. Green investment is a growing global trend. More and more countries and investment, sustainable funds are choosing to join it. Green energy investments can be of interest to environmentally conscious individuals who want to support the trend while earning from it. In this beginner's guide, we will explore what green investments mean, what types of green investments are available at XTB and how to choose the right investment option. We will also look at the impact of these investments. If you're interested in investing in green energy companies, ETFs or just trading CFDs just keep reading!

What are Green Investments?

Green investments refer to financial instruments that support environmentally friendly projects. Mainly under the term are shares of companies like Tesla or FirstSolar and ETFs that support the energy transition in some way. Their activities may include, for example:

- Clean and renewable energy sources (solar, wind, hydrogen or uranium)

- Sustainable agriculture

- Green transportation (electric cars)

So investors can start green investments through shares of companies that are involved in this trend. They can also choose the stocks of companies that pay attention to ESG and treat eco-questions as very important in their business. Many banks and investment funds, among others, the world's largest investment fund, BlackRock, are now paying attention to companies' policies in this regard. Some companies cannot count on foreign involvement of investor capital if they do not have a proper environmental policy. Companies thus become analysed in terms of so-called environmental social governance (ESG).

This ESG investment trend may be attractive to investors who see additional ethical value in it. Green investments have grown rapidly over the past decade. This trend is likely to continue as people are increasingly concerned about the effects of climate change on the Earth. However, it is important to remember that, as with any other investment opportunity, green investments come with risks. We will discuss later in the article.

Defining “Green investing”

So we already know that so-called green investments refer to responsible investment that prioritise environmental sustainability and social responsibility:

- They can include companies that produce clean energy, environmentally friendly products or sustainable practices.

- Green investments prioritise environmental sustainability and social responsibility, considering the long-term impact on society and offering good financial returns.

- Compared to traditional institutions, green investments take into account long-term environmental and social impacts as well as financial returns.

- The emphasis is on investing in companies with good ESG ratings, rather than focusing solely on short-term returns.

Many financial institutions have started to offer various investment products, e.g. ETFs, based on ESG and green investments. All this to meet the growing demand of investors who want to invest ethically and make profits by participating in the ESG trend or more broadly in electric cars and renewable energy. XTB has a wide range of company stocks and ETFs to satisfy even the biggest fans of green investments.

Green investing in XTB

Investments in green energy, in principle, can be divided into two categories: investments in companies and investments in ETFs. XTB allows investment in both types of assets. It provides investors with commission-free trading in stocks and ETFs, with up to EUR 100,000 of trading per month (then comm. 0.2%, min. 10 EUR).

Investments in green energy, in principle, can be divided into two categories: investments in companies and investments in ETFs. XTB allows investment in both types of assets. It provides investors with commission-free trading in stocks and ETFs, with up to EUR 100,000 of trading per month (then comm. 0.2%, min. 10 EUR).

And the opportunity to buy shares in hundreds of 'green' listed companies. Investors can choose stocks from a wide range of sectors from wind energy to nuclear power to investments in solar, water or hydrogen. In addition to listed companies, XTB's platform also includes key ETFs and shares of green, sustainable funds, known for ESG investing.

- Wind: Vestas (VWK.DK), Enphase (ENPH.US), EDP Renovaveis (EDPR.PT), Brookfield Renewable (BEPC.US), Clearway Energy (CWEY.US)

- Solar energy: First Solar (FSLR.US), Canadian Solar (CSIQ.US), Orsted (ORSTED.DK), Nordex (NDX1.DE),

- Nuclear: Cameco (CCJ.US), Uranium Energy Corp (UEC.US), Energy Fuels (UUUU.US), NexGen Energy (NGX.US), Kazatomprom (KAP.UK)

- Electric vehicles: Tesla (TSLA.US), Rivian (RVN.US), Toyota (TM.US), Lucid (LUCD.US), Nikola (NKLA.US), Fisker (FSR.US), Arrival (ARvL.US)

- Hydro: Norsk Hydro (NHY.NO), Nel (NEL.NO), PlugPower (PLG.US), L&G Hydrogen Economy UCITS (HTWO.UK), Bloom Energy (BE.US)

- Water: American Water Works (AWK.US), Evoqua Water (AQUA.US), United Utilities (UU.UK), Pennon Group (PNN.UK), Veolia (VIE.FR)

- Electric utility: Constellation Energy Corp (CEG.US), Electricite de France (EDF.FR), NextEra Energy (NEE.US), Greenvolt Energias (GVOLT.US), Eversource Energy (ES.US), Linde (LDE.DE)

- ESG Investment funds: Brookfield Asset Management (BAM1.US), Liontrust Asset Management (LIO.UK)

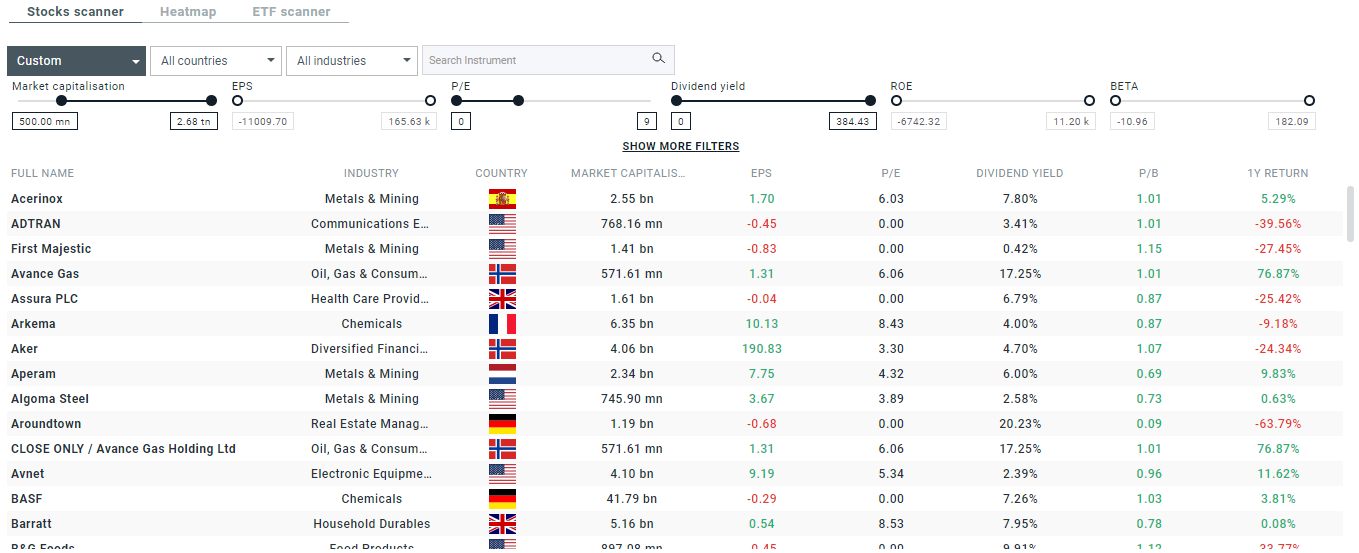

The XTB platform's built-in 'Stocks scanner' can facilitate fundamental analysis of the stocks of thousands of companies.

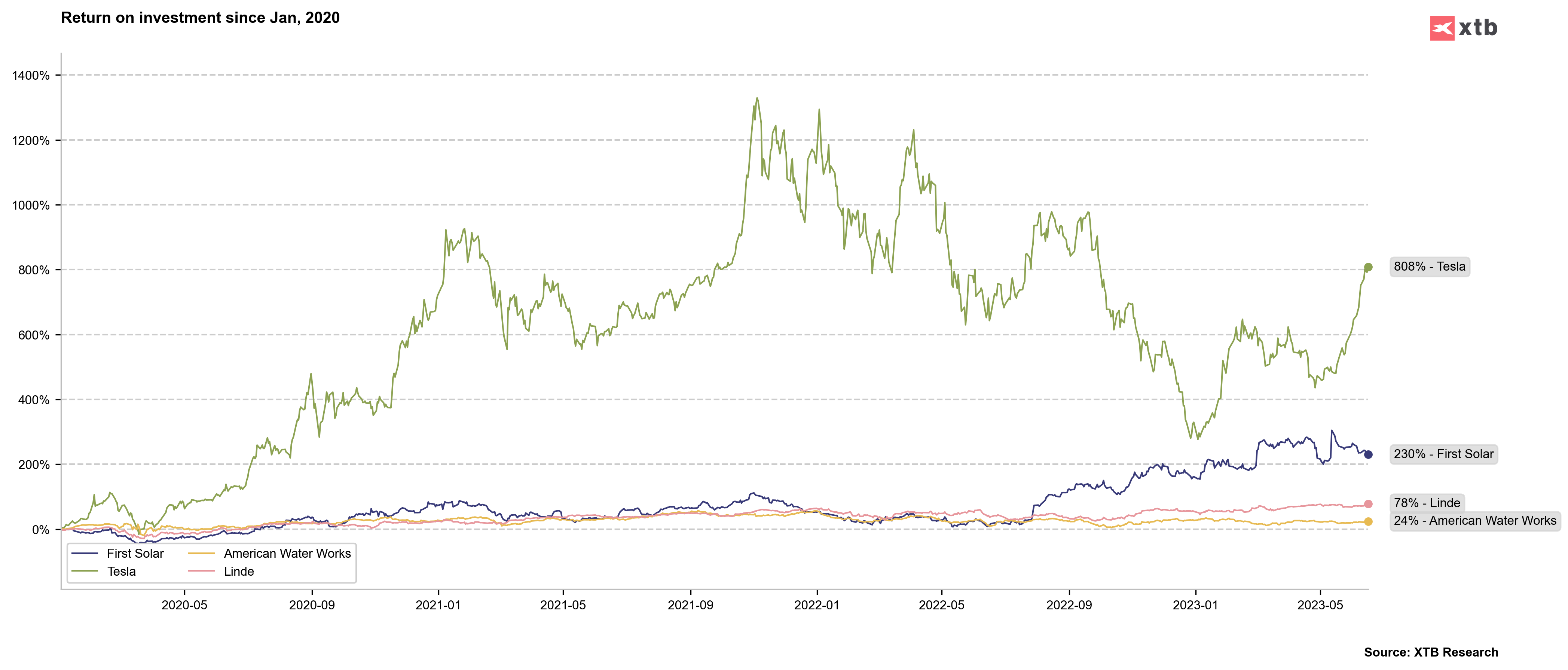

There are some fast growing green companies like Tesla (TSLA.US) or First Solar (FLSR.US) but there are also companies where volatility is usually much lower like Linde or American Water Works. Source: XTB Research

There are some fast growing green companies like Tesla (TSLA.US) or First Solar (FLSR.US) but there are also companies where volatility is usually much lower like Linde or American Water Works. Source: XTB Research

Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

ETFs (Exchange-Traded Funds) can hold a few, dozens or hundreds of companies from a selected sector in their portfolio. Their price is the result of a weighted average of all the stocks of the companies they track. ETFs help build a diversified portfolio and can potentially reduce investment risk. They are also a common investment choice for passive investors. The exact portfolio of each ETF can be verified on its website. They can also track the price of commodities or other underlying assets. Each ETF can give You investing exposure to another, specific market sector.

ETFs: Amundi CAC40 ESG UCITS (C40.FR), iShares MSCI EMU ESG Screened (SASU.UK), Invesco Solar Energy (RAYS.UK), iShares Global Clean Energy UCITS (INRG.UK), iShares Global Waters

UCITS (IQQQ.US), L&G Clean Water (GGG.UK), iShares MSCI EMU ESG Enhanced (EDM4.DE), iShares MSCI USA ESG Screened (SASU.UK)

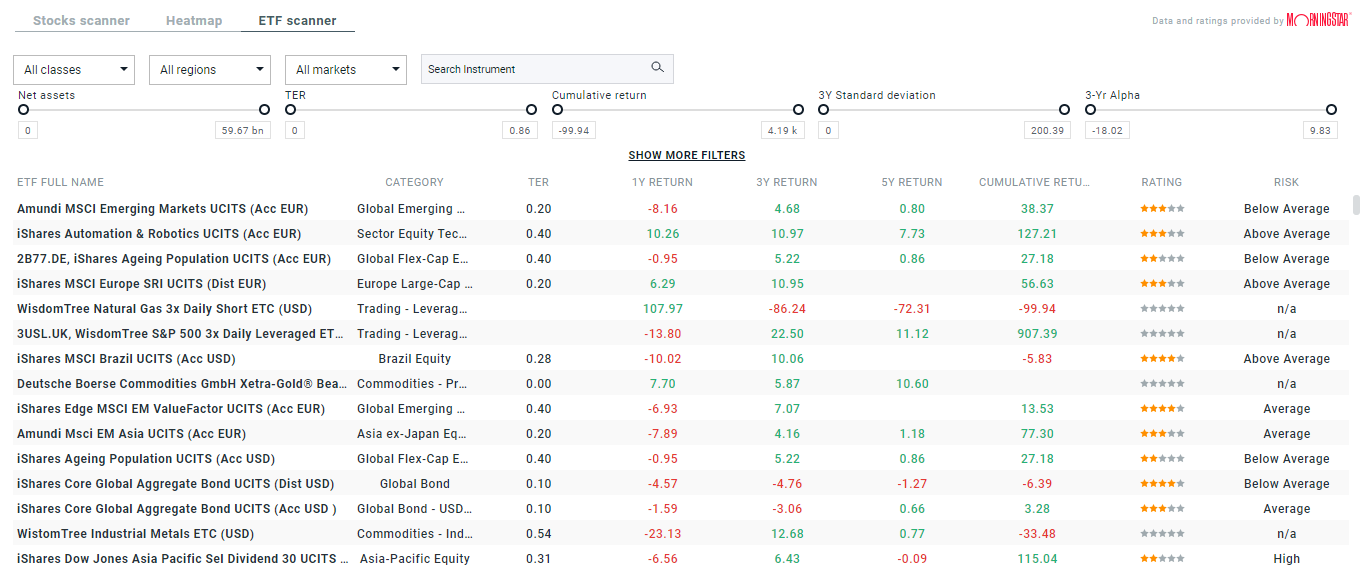

XTB's platform also provides an "ETF scanner", which allows their accurate selection and a sub-log of the rating issued by Morningstar. Here you can search your favourite ETF green investment funds.

Source: xStation5

Green investment trading

Investing in stocks or ETFs is popular primarily among long-term investors. For active short-term trading (trading), however, many use leveraged CFD instruments. They also allow you to make money on declines in the price of stocks or ETFs through so-called short selling. Before you start trading, familiarise yourself with how leveraged contracts work:

- CFDs are riskier and feature built-in leverage. Leverage can both multiply profits and exacerbate losses on positions;

- At XTB every trader can find dozens of CFDs on oil, copper, bitcoin or US indices, but also CFDs on shares of listed companies or ETFs;

- CFD contracts on stocks and ETFs track real stock prices, in real time

- They are used for price speculation only - an investor trading them does not purchase shares in a company. They are available on the XTB platform, under the 'Stocks CFD' and 'ETFs CFD' tabs.

For example, if you want to invest €1,000 in shares of a company whose shares cost €100 - you will buy 10 such shares. But if you trade CFD stocks, and the leverage assigned to these stocks is 1:2 - you will buy a CFD contract for 20 stocks investing only EUR 1000.

So, adequately, if the price of a share rises by EUR 60, you will earn more because of twice as many contracts as shares you could buy with your funds. But if the price falls by EUR 60, you will also lose more. If you want to learn more about CFD instruments, visit our educational platform.

An example of CFD stock trading

At XTB, ETFs are also available as CFDs. This makes it so you don't have to look for completely separate instruments from stocks to start trading. You can trade shares of 'green' companies and ETFs. Let's demonstrate this with an example.

An investor has €2500 and buys 10 shares of Tesla (TSLA.US), at a price of €240.

If their price rises by 10%, he will earn €24 on each of them, giving him a total profit of approximately €240. If the price falls by 10% since the purchase, the investor will record a loss of €240.

The investor has €2500 and buys CFDs on Tesla shares (TSLA.US), at a price of €240. The leverage is 1:5. The investor will therefore purchase 50 CFDs on Tesla shares.

If their price rises by 10%, the investor will earn EUR 24 on each of the 50 contracts, giving him a profit of EUR 1240. If the price falls by 10%, the investor will suffer a loss of €1240.

If the investor had no spare funds in the account other than those invested in Tesla shares, this situation may involve an automatic stop out mechanism. Margin Level will come dangerously close to 50% below which liquidation occurs (of the €2,500 held, the investor lost almost half - €1,240). Below is the formula for calculating the Margin Level - to prevent the Stop Out mechanism, the level cannot fall below 50%.

Why invest in eco?

Renewable energy companies (wind, hydroelectric, solar) are great examples of green investments. They contribute to a sustainable, green environment. They can also offer potential returns to investors who prioritise ESG (environmental, social and corporate governance) issues. Why invest in green energy?

Investing in green energy can bring growth while maintaining the ethical aspect of investing

- Invest in green energy by buying shares in 'eco' companies or funds allows them to scale their business and continue the global trend

- Some of these companies create innovative technological solutions. Some companies are key to the energy or utility market. They may have easier access to capital - many can count on government support and positive institutional ratings

Clean technology innovation is also an area where investors can find entirely new opportunities. Start-ups in the EV market like Fisker and Arrival can serve as examples of innovations that address pressing environmental issues while offering growth potential. Of course, even with ESG investments, it's always worth remembering that not every innovation brings profit and business success.

Banks and other financial institutions have recognised the importance of this type of investment and have created products that cater to the needs and imagination of investors. Among them are iShares ETFs from BlackRock or shares in mutual funds. Remember that investing always involves risk. Legendary investor Howard Marks says: 'It's not what You buy. It's what You pay.' This means that an investor should carefully evaluate how the current stock price relates to the company's fundamentals and prospects.

Benefits of green energy investment

-

By investing in shares of 'green' companies or ESG-focused funds, investors are helping to create a better future for themselves and society as a whole

- Potential for long-term growth and profitability - companies with strong environmental, social and governance (ESG) practices can perform better in the long term due to the global trend toward green solutions.

- Investing in green companies can align with personal values and commitment to sustainability. And have a positive impact on environmental issues because each investor supports the company whose shares he or she purchases.

- Green investments offer the opportunity to support companies that prioritise social responsibility while generating financial returns.

Researching Green Investment Opportunities

Understanding the different types of green investments, identifying companies and industries with a strong focus on sustainability, and evaluating the potential risks and returns of green investments are crucial steps in researching green investment opportunities. Here are some tips to keep in mind:

- Look for ESG ratings (Environmental, Social & Governance)

- Research company sustainability reports

Evaluating Risks and Returns:

- Analyse market trends

- Consider government policies affecting green investments

By understanding these key elements of green investing research, you'll be better equipped to make informed decisions about your portfolio. Remember that every investment carries inherent risk; however, choosing wisely can lead to both financial gains and in the end - to positive environmental impact. Each company has another business model and risk, which can hit the value of shares.

Risks and Challenges of Green Investments

Investing in green assets can be a risky venture due to the lack of standardisation in measuring 'greenness' and inconsistency in government regulations that affect returns on investments. This makes it difficult for investors to determine which companies are truly environmentally responsible. Lack of capital or high level of company debt may lead to potential losses. Additionally, investing in green commodities like zero-emission energy sources presents volatility risks since they rely heavily on fluctuating commodity prices.

To mitigate these risks and challenges of green investments, it's essential to do your research on environmental, social, and governance (ESG) factors before investing. In the XTB platform, the Research department is covering market news every day - You can be inspired and always know the current market risk.

Impact investing

With green investments, Your money invested may have a significant positive impact on the environment. By investing in companies that prioritise sustainable investment and environmental protection, investors can help drive innovation towards more eco-friendly technologies and practices. This, in turn, can lead to reduced carbon emissions, cleaner air and water, and a healthier planet for future generations.

Investing in green initiatives also has financial benefits. Companies that prioritise sustainability tend to be more resilient to market disruptions caused by climate change regulations or public pressure for environmental action. Additionally, they are often able to attract socially conscious consumers who prefer products made by environmentally responsible companies.

As such demand continues to rise for sustainable products and services globally; it's expected that returns on green investments will remain strong over time while contributing positively towards our society's well-being as well as mitigating the impacts of climate change.

Environmental Impact

Reducing our carbon footprint is essential to protecting the planet. By investing in green energy and reducing waste, we can contribute to a healthier environment for all. Promoting sustainable practices such as recycling and using renewable sources of energy are also key steps towards a greener future.

Protecting biodiversity is crucial for maintaining a healthy ecosystem. Investing in companies that prioritise conservation efforts can have a significant impact on preserving endangered species and their habitats. As investors, we have the power to support businesses that prioritise responsibility towards the environment.

By making green investments, we can make a positive impact on both the environment and our portfolios. It's important to research companies that align with your values and invest in those making real strides towards environmental sustainability.

Social Impact

Improving community health is a significant social impact of green investments. Investments in renewable energy and sustainable practices can lead to cleaner air, water, and soil while reducing the prevalence of diseases caused by pollution. All of it may be called ethical investing or socially responsible investing.

Additionally, supporting ethical business practices through environmentally-friendly investments can improve working conditions for employees, contributing to overall community health.

Providing access to clean energy is another vital aspect of social impact that green investments offer. Investing in renewable sources such as solar or wind power not only reduces carbon emissions but also provides communities with a reliable source of electricity.

This access enables individuals to fulfil their basic needs like lighting and cooking while driving economic development through job creation. Ultimately, green investments have an immense potential for creating positive social change on both local and global levels.

Summary

Diversifying your investment portfolio with green investments not only benefits the environment but also may have a positive financial impact. By investing in eco-friendly funds and companies, you can potentially earn long-term profits while contributing to sustainable solutions for our planet.

Additionally, including green investments in your portfolio may attract ESG-focused (Environmental, Social and Governance) investors who prioritise sustainability when making their own investment decisions. Investing in green or renewable energy stocks can provide higher returns than traditional investments. Green investments offer stability against market fluctuations due to rising demand for environmentally conscious products and services. Including eco-friendly assets in your portfolio diversifies risk by spreading it across different industries and sectors.

FAQ

Green investments refer to a group of company stocks or green funds ETFs that engage in ESG trends, natural resources conservation and sustainable production. First and foremost, however, it means acquiring shares of companies that use or provide zero-emission energy sources or other environmental sustainability services.

A good example of this would be the stocks of electric car companies (and other green technologies). Equity market-related sustainable investment opportunities are designed not only to offer competitive rates of return. But also to promote a positive impact on the environment and the planet.

Investing in green initiatives allows you to support efforts to combat climate change and promote sustainable development. It may be a good solution for 'ethical investing'. At the same time, sustainable investments can provide financial returns.

Green investment opportunities are varied. However, they usually mean investments in companies and funds engaged in clean energy production, waste reduction, sustainable agriculture and green real estate development. All of these sustainable investing opportunities investors can find on the XTB platform.

Like any other type of investment, green investments are not without risk. They can include changes in regulations, dependence on subsidies, technological advances and fluctuations in market demand. What's more, some companies are not profitable so their debt is a threat. Conducting comprehensive research and considering all risks is crucial before investing in stocks or ETFs.

Of course, green investments are also subject to regulation. Specific regulatory measures may vary depending on the region and the nature of the investment. In many regions, investments must meet strict criteria and standards to be considered green. Moreover, company stocks and ETFs are listed on regulated markets. This means they must meet high standards for reporting revenues and business situations.

The most popular is to start investing online. You can open a free investment account in XTB or a trial DEMO account. Always remember to thoroughly familiarise yourself with the financial situation of the companies you want to invest in and expand your knowledge. Also, don't forget about investment risks and manage your own capital wisely.

Join the hundreds of thousands of investors. Create an investment account and use the XTB platform to start green investing.

REIT ETF & Stock - How to Invest in Property

Climate change investments: Maximising impact

ETF Trading - What are they and how to invest in Exchange Traded Funds?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.