A trend that is playing a key role in the stock rally that is happening at the moment is the continued optimism for artificial intelligence technologies driving up technology stocks.

AI infrastructure is currently booming, fueled by surging demand from data centres and enterprises. Polaris Market Research predicts the market will reach $197.39 billion by 2030, up from $23.54 billion in 2021 poised to grow at a significant CAGR of 27.6%.

Nvidia *(-2.5%, $905), a prominent semiconductor designer, along with well-known technology giants such as Microsoft *(+0.11, $415) and Amazon *(+0.92%, $177), has greatly profited from this technological revolution. Nevertheless, the recent quarterly earnings reports have shed light on winners within the AI server sector as well. One particular stock, which has surged over 1,100% in the past year, has sparked concerns regarding its current valuation.

*Please be aware that information and research based on historical data or performance does not guarantee future performance or results.

A trend that is playing a key role in the stock rally that is happening at the moment is the continued optimism for artificial intelligence technologies driving up technology stocks.

AI infrastructure is currently booming, fueled by surging demand from data centres and enterprises. Polaris Market Research predicts the market will reach $197.39 billion by 2030, up from $23.54 billion in 2021 poised to grow at a significant CAGR of 27.6%.

Nvidia *(-2.5%, $905), a prominent semiconductor designer, along with well-known technology giants such as Microsoft *(+0.11, $415) and Amazon *(+0.92%, $177), has greatly profited from this technological revolution. Nevertheless, the recent quarterly earnings reports have shed light on winners within the AI server sector as well. One particular stock, which has surged over 1,100% in the past year, has sparked concerns regarding its current valuation.

*Please be aware that information and research based on historical data or performance does not guarantee future performance or results.

Live Updates

17 February 2025: Can SMCI deliver?

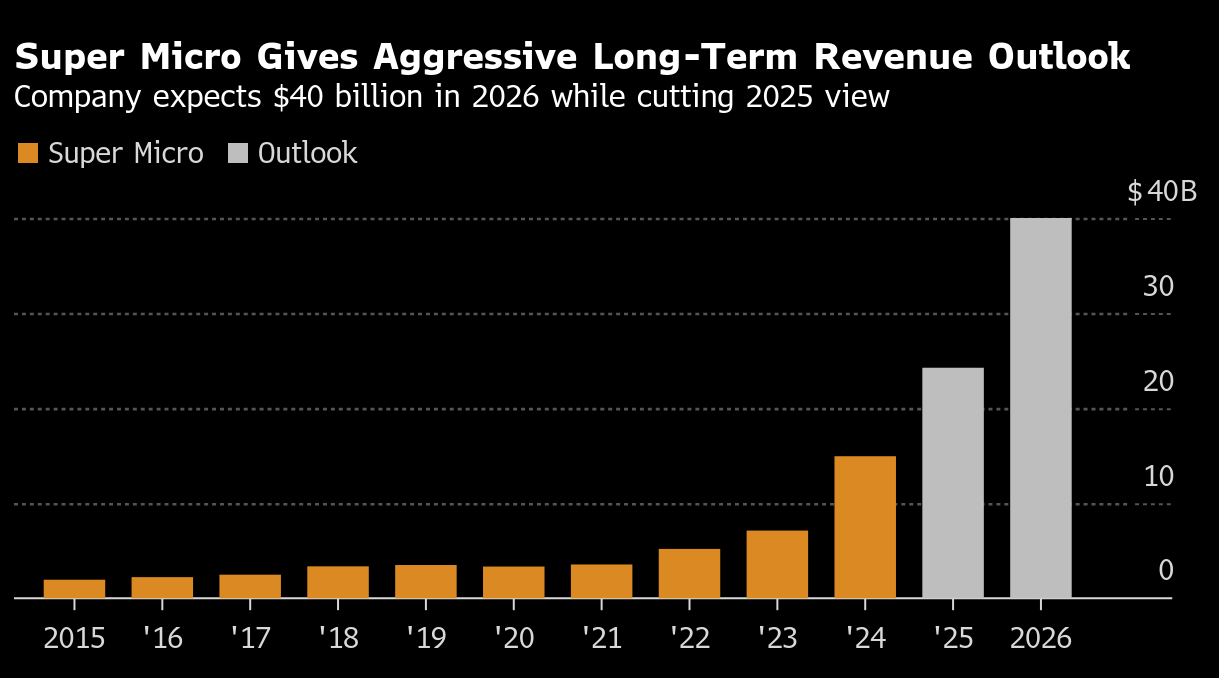

Super Micro Computer (SMCI.US) was up nearly 5% on 12th February after releasing preliminary financial data for Q2 of the fiscal year 2024/25 and presenting its outlook for the upcoming year. Despite weaker Q2 results, the company’s strong projections for 2026, significantly exceeding previous analyst estimates, and its assurance of meeting key financial reporting deadlines pushed the stock up by over 13% at its peak.

Since the beginning of February, SMCI stock has surged by over 50%, breaking out of the downward trend that had persisted since July. Source: xStation, Past performance is not a reliable indicator of future results.

The company estimates that in Q2 24/25, it achieved revenue of $5.6-5.7 billion, compared to the previous forecast range of $5.5-6.1 billion. Analysts had expected $5.81 billion. The estimated adjusted EPS for the quarter is $0.58-0.60 (versus the previous range of $0.56-0.65 and analyst consensus of $0.64).

Apart from weaker Q2 estimates, the company also lowered its expectations for Q3 24/25, forecasting revenue between $5-6 billion. As a result, it reduced its full-year fiscal 2025 revenue forecast to $23.5-25 billion (previously: $26-30 billion).

Despite these reductions, CEO Charles Liang has set an ambitious revenue goal of $40 billion for fiscal year 2026, representing a 60% growth, forecasting $40 billion, nearly $10 billion higher than analyst consensus estimates. This growth is expected to be driven by the integration of DLC technology, which is projected to be adopted by around 30% of new data centers within the next 12 months. The company believes this target is “conservative,” with key growth drivers including the transition to Nvidia’s Blackwell GPU platforms and the expansion of liquid-cooled data center solutions. Gross margins, however, remain a significant concern. For Q2 2025, Super Micro forecasts margins between 11.8% and 11.9%, which is considerably lower than competitors such as Nvidia and Broadcom, who maintain margins around 75%. This marks a decline from the 17% margin reported a year earlier.

Source: Bloomberg Finance L.P., Past performance is not a reliable indicator of future results.

Another key issue investors focused on regarding SMCI was the completion of key financial reports. Super Micro is under investigation due to allegations from short-seller Hindenburg Research in August 2024. Both the Department of Justice and the Securities and Exchange Commission have launched probes, with subpoenas being issued for certain documents toward the end of 2024.

The company has faced further complications after Ernst & Young resigned as its auditor in October 2024, citing issues with governance and transparency. However, an internal special committee found no evidence to support these claims.

The Nasdaq exchange has extended the deadline for submitting its 2024 annual 10-K report, as well as its first and second-quarter 10-Q filings to February 25, and SMCI has assured that it will meet this deadline. Notably, the last official report presented by the company was released on August 6, 2024, covering Q4 23/24. Delays in report releases pose a potential delisting risk for the stock.

To support its growth initiatives, Super Micro has announced a $700 million private placement of convertible senior notes due in 2028, carrying an interest rate of 2.25%. The company has also amended its existing senior convertible notes to pay 3.5% interest, up from 0%.

The company's stock has experienced significant volatility, currently trading at a forward price-to-earnings ratio of under 15 times fiscal 2025 estimates and about 11 times fiscal 2026 estimates. While it has increased by 40% year-to-date, it remains down around 50% from the previous year.

Following these developments, analysts have adjusted their views on Super Micro. Wedbush raised its price target from $24 to $40 but maintained a neutral rating. Northland increased its target from $54 to $57, maintaining an outperform rating, while JPMorgan raised its target from $23 to $35, keeping an underweight rating.

It is worth noting that the surge in high-performance server purchases stemmed from a confluence of factors: booming enterprise data centres, the rise of cloud computing and edge computing, the rollout of 5G networks, and the burgeoning field of artificial intelligence, all demanding ever-greater processing power.

What is Super Micro Computer Inc and why is it so successful?

Super Micro Computer, Inc. (Supermicro) is an American multinational corporation that specialises in computer hardware, particularly server solutions. Founded in 1993 by Charles Liang, A Taiwanese-American entrepreneur, the company initially focused on producing motherboards but expanded its product line to include server systems, chassis, power supplies, networking equipment, and storage solutions.

As of now Super Micro is a leading manufacturer of servers for data centres, cloud computing, enterprise IT, big data applications, and high-performance computing (HPC). With its integrated hardware-software platforms, the company empowers customers to deploy and run AI applications faster and more efficiently.

Super Micro stands out from the competition with its expertise in liquid-cooled server racks, a technology ideal for the growing demands of AI hardware. Liquid cooling, unlike traditional air cooling, efficiently removes heat from densely packed servers, making it ideal for high-performance computing environments like AI.

When is SMCI entering the S&P 500?

SMCI will be joining the S&P 500 on March 18, 2024. Super Micro scored a big win. The news drove the stock price to an 18% gain in just one session. Inclusion in the S&P 500 carries two key benefits for Super Micro. Firstly, it acts as a symbolic validation of the company's position as a major player in the current economy. This symbolic status could attract a broader spectrum of investors, potentially boosting stock purchases. For instance, risk-averse investors may find comfort in selecting a tech company meeting the S&P 500 membership criteria.

Secondly, fund managers responsible for overseeing portfolios mirroring the S&P 500 will need to acquire Super Micro shares to align with the index's composition accurately. This dynamic could generate positive momentum as these investors accumulate shares in the tech company, and their inclination to retain these shares can contribute to stability in Super Micro's stock value.

How has Super Micro Computer Inc (SMCI) been performing ?

The company had its initial IPO in 2007 where SMCI went public at $8, and now its stock trades at about $1,163.00.

Super Micro initially went unnoticed post-IPO, appearing as a small player in the server market. Nevertheless, the company successfully established a specialised position by constructing servers tailored for demanding tasks, known for their high performance and efficiency.

According to Reuters the company sold 6.4 million shares and selling shareholders offered 1.6 million giving the company an initial market capitalisation of $229 million. The company's market capitalisation stands at $65.47 billion as of March 2024.

The company now operates on the Nasdaq under the symbol “SMCI”.

Super Micro's valuation has soared this year, with its stock price now trading at 53 times future earnings estimates, compared to just 15 earlier in 2024.

While the stock may appear relatively pricey at first glance, it might not be the case when you factor in the long-term potential in the field of AI. It's crucial to bear in mind that the current valuation considers earnings projections for the upcoming year but doesn't fully account for the earnings potential in the more distant future.

Consequently, its revenue experienced a compound annual growth rate (CAGR) of 17% from fiscal 2007 to fiscal 2020 (concluding in June 2020). Subsequently, in the period from fiscal 2020 to fiscal 2023, the pace of revenue growth escalated, reaching a three-year CAGR of 29%, driven by the expansion of the artificial intelligence (AI) sector.

To meet this surging demand, Super Micro leverages its partnership with Nvidia, a leader in high-performance GPUs crucial for AI processing. Numerous leading AI platforms worldwide, such as OpenAI's ChatGPT, rely on Nvidia's GPUs to handle intricate AI operations. This collaboration allows them to produce pre-built AI servers that are optimised for tackling complex AI tasks. The expansion of this market motivated numerous enterprises to invest in Super Micro's ready-made AI servers. Presently, the company distributes its premium servers to over 1,000 clients spanning across more than 100 countries.

It also fuels their impressive growth projections, with expected revenue rising 33%-47% in fiscal 2024. As highlighted by the CEO Charlers Liang in the latest quarterly report, the market is experiencing “unprecedented demand for AI and other advanced applications requiring optimised rack-scale solutions.

Chart: SMCI.US

Source: xStation 5

Source: xStation 5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Earnings

As seen on the Super Micro’s website the company is on a record-breaking run! They recently achieved a milestone quarter, exceeding $3 billion in revenue for the first time. This is a staggering accomplishment, considering it surpassed their entire annual revenue just three years ago. The company's optimism is high, with forecasts predicting a fiscal year revenue surge of around 100%, reaching over $14 billion. And analysts suggest this explosive growth might just be getting started.

Second Quarter Fiscal Year 2024 Highlights

- Net sales of $3.66 billion versus $2.12 billion in the first quarter of fiscal year 2024 and $1.80 billion in the same quarter of last year.

- Gross margin of 15.4% versus 16.7% in the first quarter of fiscal year 2024 and 18.7% in the same quarter of last year.

- Net income of $296 million versus $157 million in the first quarter of fiscal year 2024 and $176 million in the same quarter of last year.

- Diluted net income per common share of $5.10 versus $2.75 in the first quarter of fiscal year 2024 and $3.14 in the same quarter of last year.

- Non-GAAP diluted net income per common share of $5.59 versus $3.43 in the first quarter of fiscal year 2024 and $3.26 in the same quarter of last year.

For the third quarter of fiscal year 2024 ending March 31, 2024, the Company expects net sales of $3.7 billion to $4.1 billion, GAAP net income per diluted share of $4.79 to $5.64 and non-GAAP net income per diluted share of $5.20 to $6.01. The Company’s projections for GAAP and non-GAAP net income per diluted share assume a tax rate of approximately 13.8% and 15.8%, respectively, and a fully diluted share count of 60.1 million shares for GAAP and fully diluted share count of 61.0 million shares for non-GAAP. The outlook for third quarter of fiscal year 2024 GAAP net income per diluted share includes approximately $28 million in expected stock-based compensation, net of related tax effects of $14 million that are excluded from non-GAAP net income per diluted share.

Cash flow used in operations for the second quarter of fiscal year 2024 of $595 million and capital expenditures of $15 million.

Final Thoughts

Consequently, Super Micro remains an attractive investment, driven by its promising long-term outlook and the belief that the demand for AI might be in its early stages. According to certain forecasts, the AI market could surpass $1 trillion by the decade's end.

Super Micro Computer Inc. has undergone a remarkable evolution, marked by significant milestones and substantial revenue growth. From achieving its first $3 billion quarter to forecasting a doubling of revenue in the current fiscal year, the company's trajectory demonstrates its position as a formidable player in the tech industry.

However, it's essential to acknowledge potential risks associated with investing. Market volatility, regulatory changes, and industry competition are factors that could impact investment outcomes. Therefore, individuals should educate themselves thoroughly about the company and market conditions before making any investment decisions. With its innovative solutions and expanding market opportunities, Super Micro appears poised for continued success, suggesting a promising future ahead.

What’s Next for Global Stock Markets?

What is Next for the AI Trade?

Investing during a crisis: Strategies and Tips

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.