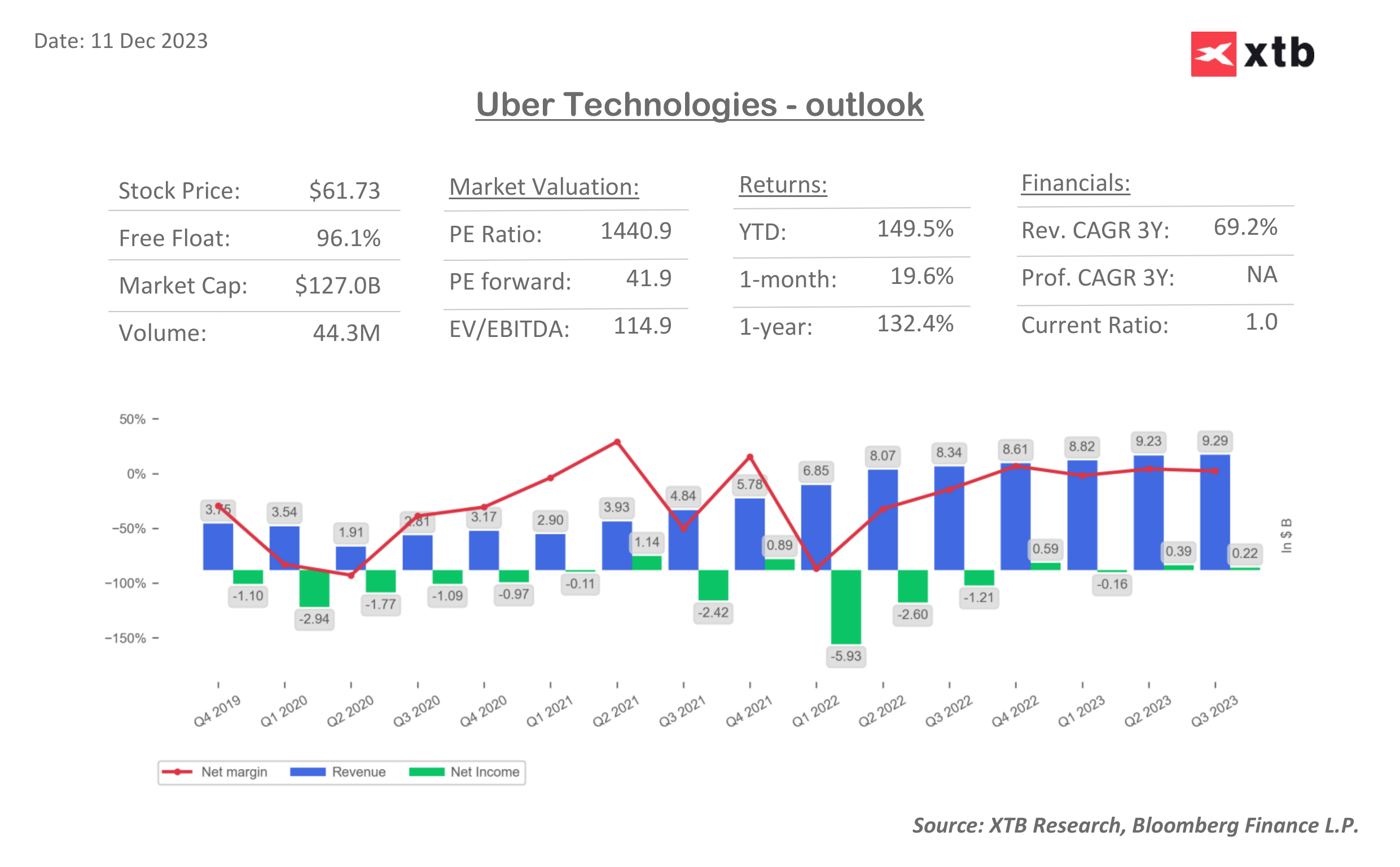

After navigating through months of a stock market roller coaster, Uber's shares have experienced a remarkable upswing, surging by nearly 150% this year, making its return comparable to Bitcoin. This notable achievement positions Uber at the threshold of a significant opportunity. Mark your calendars for December 18, as Uber is poised to make a momentous leap by joining the 'elite' group of companies listed on the largest U.S. index, the S&P 500, where it will replace Sealed Air Corp.

After navigating through months of a stock market roller coaster, Uber's shares have experienced a remarkable upswing, surging by nearly 150% this year, making its return comparable to Bitcoin. This notable achievement positions Uber at the threshold of a significant opportunity. Mark your calendars for December 18, as Uber is poised to make a momentous leap by joining the 'elite' group of companies listed on the largest U.S. index, the S&P 500, where it will replace Sealed Air Corp.

This move places Uber among an exclusive group of companies that have earned this prestigious distinction, with the most recent additions being Tesla in 2020 and Epam Systems in 2021. The significance of Uber’s inclusion is underscored by its staggering $130 billion market capitalisation, a figure which nearly quadruples the average S&P 500 company's capitalisation of about $31 billion. But does getting into the ranks of the 500 largest U.S.- listed companies and meeting all the requirements really signify the opening of a whole new chapter for the company?

What to expect from the 'S&P 500 phenomenon' ?

On Wall Street, the 'S&P 500 phenomenon' has been a well-established content for years. In a nutshell, it revolves around the positive impact of joining this index has on a company’s stock price. This influence stems not only from the greater 'confidence' and prestige associated with the company itself but also from heightened institutional interest. The influence of Exchange-Traded Funds (ETFs) tracking the S&P 500 on these companies' valuations is particularly notable, as these funds are compelled to make immediate purchases upon a company’s index inclusion. It is worth noting that ETFs on the S&P 500 index are the largest funds of their kind in the world.

As of early 2023, U.S. funds, including ETFs, tracking the S&P 500 had total assets of an impressive $5.7 trillion. Given the sustained momentum on Wall Street and an 18% surge in the benchmark, it’s reasonable to conclude that these assets have likely experienced double-digit growth since then. Their valuation now accounts for about one-eighth of the entire stock market’s value, with the three largest ETFs tracking the S&P 500 boasting a combined value of about $1.2 trillion. This compelling data shows that Uber stands to benefit significantly from substantial revenue streams, subject to further improvement in stock market sentiment, in the long term.

Historically, joining the S&P 500 index has temporarily supported sentiments, but this in itself does not determine a company's stock market 'success'. Tesla gained nearly 19% since its debut. Epam Systems in its 2021 debut turned out to be exceptionally weak, moments after its initial rally, supply was triggered, dominating the stock to this day. On the chart above, we can see the price change of each company's shares, 365 days after the S & P 500 debut. Source: XTB Research, Bloomberg Finance LP

Historically, joining the S&P 500 index has temporarily supported sentiments, but this in itself does not determine a company's stock market 'success'. Tesla gained nearly 19% since its debut. Epam Systems in its 2021 debut turned out to be exceptionally weak, moments after its initial rally, supply was triggered, dominating the stock to this day. On the chart above, we can see the price change of each company's shares, 365 days after the S & P 500 debut. Source: XTB Research, Bloomberg Finance LP

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Concerns about 'S&P 500 phenomenon'

Of course, while the act of joining the index holds significance, especially at a time when indexes are rising and funds are forced to buy shares it is also worth considering the flip side - the possibility of forced selling. What's more, the fact that the company has already entered the S&P 500 index means that it's hard to expect its stock to benefit once again from speculation around its possible inclusion. Nevertheless, Uber stands out as it will help it attract more investor attention.

It seems rather naïve to expect an automatic boost in Uber's stock value solely due to its S&P 500 inclusion. Oppenheimer & Co. analysts suggest that while this move will accelerate and improve the overall conditions for its stock to rise through, factors like a share buyback program and improved investor sentiment stemming from ongoing efforts to generate shareholder value play pivotal roles. Evidently, Uber’s success hinges on a variety of factors beyond the upcoming index inclusion event on Monday 18, including a proficient board of directors and enhanced profit margins.

Net margins and higher free cash-flow

Given that the company still operates in a low-margin business, sustained scale and expansion remain crucial aspects. However, the true driver for enhancing returns for shareholders lies in improving margins. So far, the current management has efficiently steered the company’s trajectory, transforming Uber from its 2019 state of ‘cash burn’ and concerns about whether it could ever achieve profitability, with galloping costs and rising competitors.

Intriguingly, in the aftermath of the Covid-19 pandemic, Uber Eats emerged as a significant revenue generator, outshining the traditional transportation business–an unforeseen shift. Without the introduction of Uber Eats and the ability to construct an entirely new business within its existing framework, Uber might have faced a less promising fate in the wake of the pandemic, making the prospect of joining the S&P 500 a distant aspiration. The competence and determination exhibited by management have not only altered Uber’s trajectory but have also translated into collective rewards for the company and its shareholders.

Over the past four quarters, the company has generated $1 billion in profits, and in Q3 it reported $221 million on revenues of $9.29 billion. Achieving this entailed difficult decisions, such as the necessity to lay off nearly 3,500 employees. Also, lower delivery costs have contributed to improved margins. Uber’s ambitious aspirations align it with major technology giants like Google and Microsoft, aiming to dominate the transportation and delivery market.

Key to its sustained success in the stock market lies in a gradual improvement in margins, a trend that is already underway. While Uber’s gross margins have experienced a decline since 2018, its net margin has risen from close to -80% in Q1 2020 and -40% in mid-2022, to a positive 2.93% today. Notably, with the current margin at around 3% there is considerable upside potential, supporting optimistic expectations for higher earnings per share.

Uber Technologies stock chart (D1)

Shares of Uber Technology (UBER.US), D1 interval. In the short term, the impact of Uber joining the S&P 500 index on the stock price is not clear, and it seems that a lot will depend on whether market sentiment does not deteriorate by next Monday. If this is the case, joining the S&P 500 may give the market an argument to take profits - 'sell the news' scenario. On the other hand joining the S&P 500 in the long term is beneficial for the company both in the medium and long term. Source: xStation5

Shares of Uber Technology (UBER.US), D1 interval. In the short term, the impact of Uber joining the S&P 500 index on the stock price is not clear, and it seems that a lot will depend on whether market sentiment does not deteriorate by next Monday. If this is the case, joining the S&P 500 may give the market an argument to take profits - 'sell the news' scenario. On the other hand joining the S&P 500 in the long term is beneficial for the company both in the medium and long term. Source: xStation5

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

Please be aware that information and research based on historical data or performance does not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk.

FAQ

Uber's inclusion in the S&P 500 means that it will now be included in a major stock market index. This will likely increase the company's visibility and liquidity, and could make it easier for investors to buy and sell its stock.

There are a number of potential benefits to being added to the S&P 500. These include:

- Increased visibility and liquidity

- Easier access for investors

- Reduced trading costs

- Potential for higher valuations

There are also a number of risks associated with being added to the S&P 500. These include:

- Increased scrutiny from regulators and investors

- Potential for increased volatility

- Possibility of becoming a takeover target

It is difficult to say whether Uber's stock price will go up or down in the short term after being added to the S&P 500. However, in the long term, it is likely that the inclusion will be a positive for the company.

Whether or not you buy Uber's stock is a personal decision. The company is still a relatively young company. However, it has a large and growing market opportunity, and it is well-positioned to take advantage of new technologies. You should do careful research about the company and its industry. Make sure that you understand the risks involved in investing in Uber. Diversify your portfolio to spread out your risk.

Investing during a crisis: Strategies and Tips

US Presidential Election 2024: Kamala Harris vs Donald Trump. Which candidate is better for stock markets?

Understanding ISAs: A Tax-Efficient Way to Save and Invest

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.