GBPUSD tested a resistance zone ranging below the 1.27 mark in the first half of May but bulls failed to push the pair above. A pullback was launched later on and the pair dropped over 2.5% over the past two weeks or so. However, it should be said that recent moves on the pair are driven primarily by USD, which is supported by rising yields amid debt ceiling uncertainty.

While GBPUSD has been pulling back this week, the outlook for the British pound became more bullish. This is because recent data releases from the United Kingdom signal that the Bank of England may turn more hawkish. Data released on Wednesday showed core CPI inflation accelerating to 6.8% YoY - the highest level since March 1992. Persistence of inflation led interest rate traders to boost their hawkish BoE bets. Money markets are now pricing in almost 110 basis points of cumulative BoE tightening by the end of this year, with the main rate seen rising to 5.50%! As recently as a week ago (May 19, 2023) money markets priced in less than 50 basis points of cumulative tightening by the end of the year with a rate peak slightly below 4.9%.

Market is pricing in much higher BoE rates today compared to a week ago. Spike in market pricing was triggered by a higher-than-expected CPI reading for April. Source: Bloomberg

Market is pricing in much higher BoE rates today compared to a week ago. Spike in market pricing was triggered by a higher-than-expected CPI reading for April. Source: Bloomberg

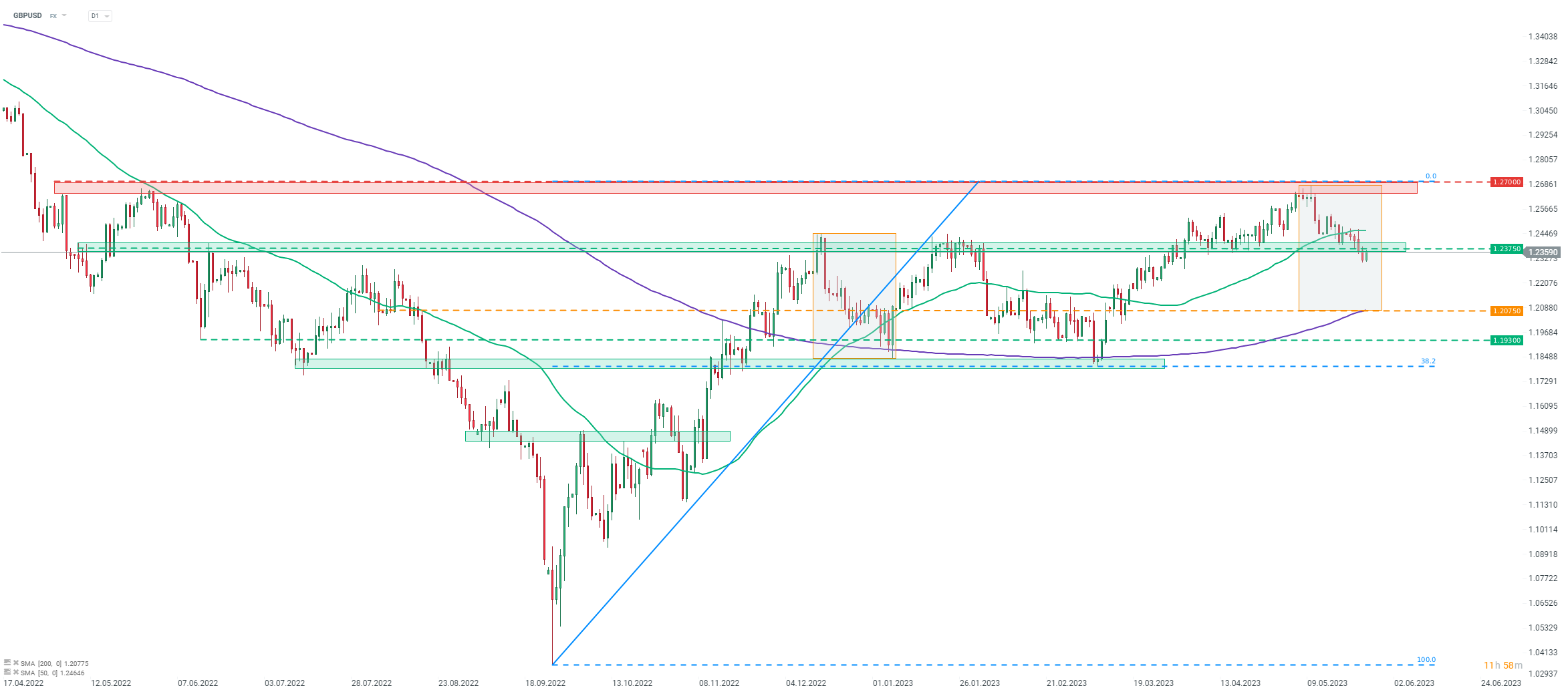

GBPUSD

Taking a look at GBPUSD at D1 interval, we can see that the pair has broken below the 1.2375 support zone yesterday and an attempt to break back above it can be observed today. Should bulls fail and the pair once resumes downward move, the 1.2075 area will be on watch. This zone is marked with 200-session moving average (purple line), which halted declines in early-March, as well as the lower limit of the Overbalance structure. A break below would, at least in theory, hint a bearish price reversal and could hint that a deeper drop is looming.

Source: xStation5

Source: xStation5

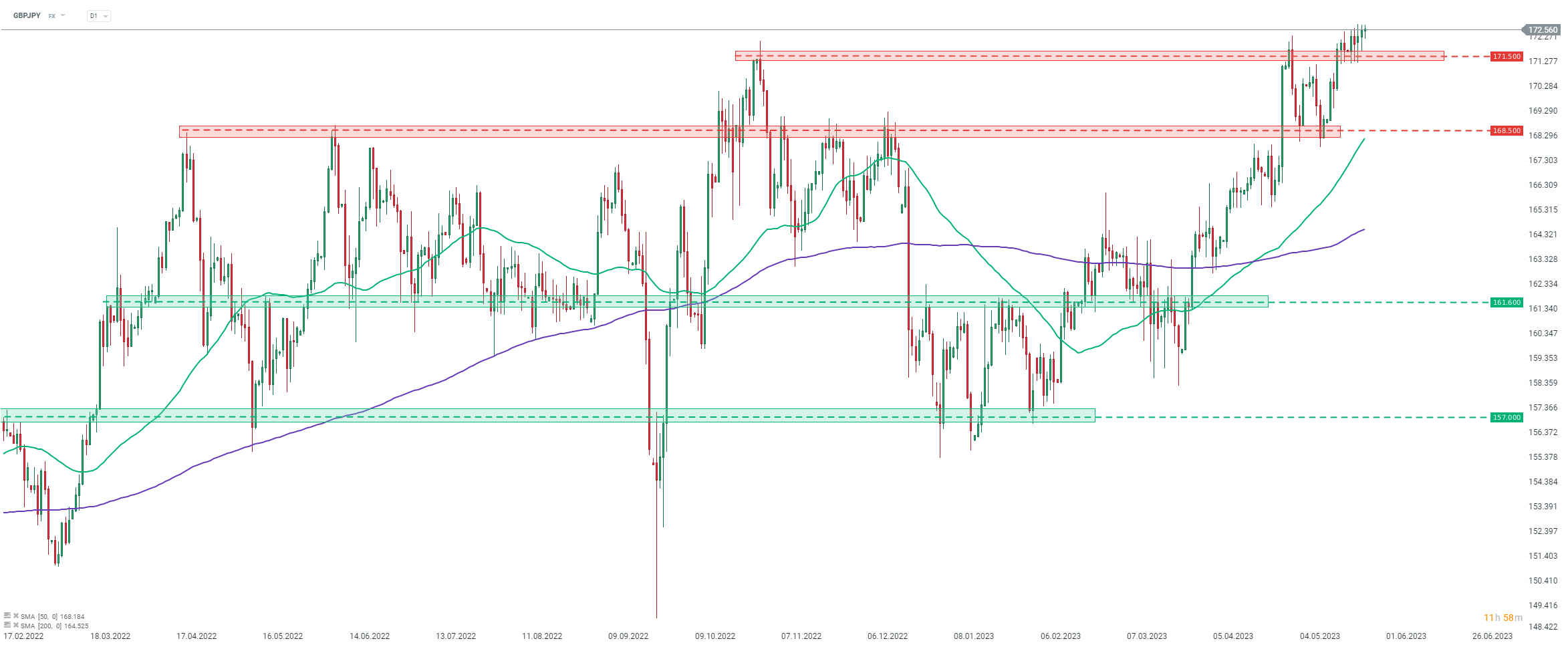

GBPJPY

As we have already said in the opening paragraph, recent weakness in GBPUSD is driven by USD strengthening. However, if we look at other GBP-tied pairs, we can see that GBP has been holding quite firmly recently. Taking a look at GBPJPY chart at D1 interval, we can see that the pair managed to break above the 171.50 resistance zone and reached the highest level since early-2016.

Source: xStation5

Source: xStation5

Politics batter the UK bond market once more, as Starmer remains under pressure

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.