Tesla (TSLA.US) and NIO (NIO.US) - two electric vehicle manufacturers - are one of the hottest stocks this year. Share price of Tesla increased 426% so far this year while NIO gained a stunning 1,060%! In this short analysis we take at valuations of both companies and future outlook.

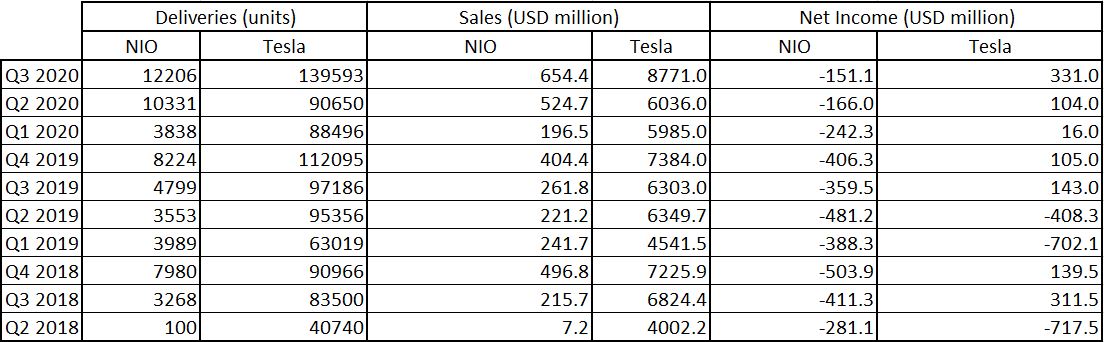

Deliveries, sales and net income data for Tesla and NIO. Source: Bloomberg, XTB

Deliveries, sales and net income data for Tesla and NIO. Source: Bloomberg, XTB

Before we take a look at valuation ratios for Tesla and NIO it should be noted that there is a massive difference in size of operations between the two. Tesla delivered almost 320 thousand vehicles in the Q1-Q3 2020 period while NIO delivered only 26.3 thousand. Apart from that, Tesla can be seen as a mature company already as it has managed to deliver 5 quarterly profits in a row. Meanwhile, NIO remains a cash-burning machine, just as Tesla used to be in its early years.

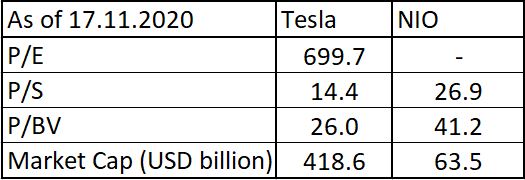

Valuation of Tesla and NIO. Source: Bloomberg, XTB

Valuation of Tesla and NIO. Source: Bloomberg, XTB

Taking a look at valuation ratios we can see that NIO is more "expensive" than Tesla. Price-to-sales and Price-to-book-value ratios are much higher for the Chinese company than for its US peer. Price-to-earnings ratio cannot be used for comparison as NIO still has not turned any profits and, in turn, P/E for the stock cannot be calculated. Tesla delivered 12 times as many vehicles as NIO did this year but its market capitalization is less than 7 times capitalization of NIO. While Tesla looks "cheaper" than NIO it should be noted that valuations of both companies are sky-high compared to valuations of stocks from more traditional sectors.

Outlook

When it comes to future outlook it looks slightly better for NIO. Why? Chinese government pledged that new energy vehicles will account for 25% of all car sales in the country by 2025. While Tesla also sells its cars in China, NIO is getting an edge in the country. Moreover, Tesla is selling cars in North America, Europe and Asia while NIO is yet to expand beyond its home market. Some unconfirmed rumours surfaced earlier this quarter that NIO may be considering launching European sales in 2021. Last but not least, NIO has been selling all the cars it has produced in recent months. This means that the carmaker fails to capture full demand for its cars because of limited production capacity. Increasing production will incur big costs therefore NIO is expected to remain unprofitable for some time. On the other hand, Tesla's growth is likely to slow due to its already big scale.

Tesla (TSLA.US) is trading in an ascending triangle pattern. Stock opened at the upper limit of the pattern yesterday but was unable to hold there and trimmed part of the gains. Source: xStation5

Tesla (TSLA.US) is trading in an ascending triangle pattern. Stock opened at the upper limit of the pattern yesterday but was unable to hold there and trimmed part of the gains. Source: xStation5

NIO (NIO.US) has been swinging between 38.2 and 61.8% retracement of a recent downward move yesterday. The stock is likely to experience some post-earnings volatility today and the aforementioned retracement are levels to watch. Source: xStation5

NIO (NIO.US) has been swinging between 38.2 and 61.8% retracement of a recent downward move yesterday. The stock is likely to experience some post-earnings volatility today and the aforementioned retracement are levels to watch. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

Markets attempt to rally on positive news from Iran

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.