-

PM Truss apologizes but insider continue to demand her resignation

-

BoE rejects FT report on another delay to QT start

-

Markets price in 100 bp of tightening for next BoE meeting (November 3, 2022)

-

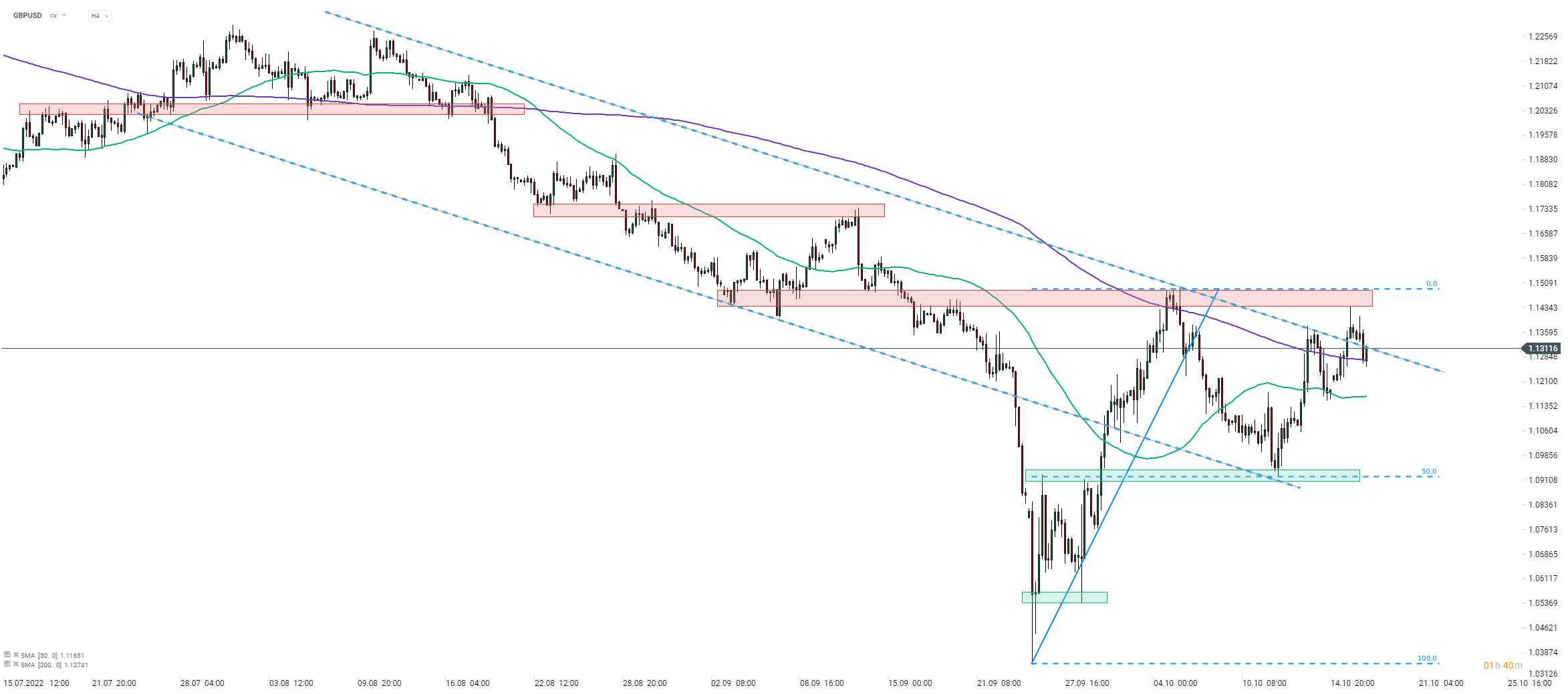

GBPUSD attempts to break out of the downward channel

GBPUSD is pulling back below 1.13 handle as UK outlook remains uncertain. Prime Minister Liz Truss apologized for her mistakes, saying that those were largely fixed. By saying fixed she meant replacing Chancellor of Exchequer and withdrawing from a lot of her tax cut plans. However, reputational damage has been done already and while Truss does not plan to resign, majority of her party members want her to. According to a YouGov poll, 55% of Conservative party members want Truss to resign while only 38% believe she should remain in the position. In addition, 55% said that they would vote for Rishi Sunak should they get another chance to decide between Sunak and Truss. Interestingly, a poll showed that 63% of Tory members see former PM Boris Johnson as a good replacement for Liz Truss. This only serves to show that while tax cuts were scrapped or delayed for now, political uncertainty may continue to linger over GBP.

Also, there is some uncertainty over the future Bank of England actions. Emergency bond purchases ended as planned and now traders want to see whether QT begins as planned at the end of October. Financial Times came out with a piece this morning saying that the launch of QT may be delayed further as BoE wants to see gilt market regain stability. However, the FT report was later rejected by BoE as inaccurate, suggesting that active bond sales may indeed start at the turn of October and November.

GBP lost some steam as BoE rate hike bets started to be pared back following recent developments. However, the market still prices in 100 basis points of tightening during a meeting on November 3, 2022. Note that this rate decision will come after both - presentation of medium-term budget and launch of QT - so it will be watched very closely by market participants. A look at GBPUSD chart at H4 interval shows that the pair attempted to move above the upper limit of the downward channel this week but has failed to deliver a meaningful breakout yet. A jump back above 200-period moving average (purple line), that now acts as a support, is positive but will it be enough to allow the pair to leave the downward channel for good? If this is the case, market attention will shift to the resistance zone ranging below 1.1500 handle, that halted upward move at the beginning of October.

Source: xStation5

Source: xStation5

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

NFP preview

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.