- Alphabet is approaching the historic milestone of $100 billion in quarterly revenue, highlighting the effectiveness of its AI and cloud growth strategy.

- Rising capital investments (around $85 billion in 2025) put short-term pressure on margins but strengthen the foundation for long-term growth.

- Google Search, YouTube, and Google Cloud remain the main growth engines, supporting Alphabet’s position as a global technology leader.

- Alphabet is approaching the historic milestone of $100 billion in quarterly revenue, highlighting the effectiveness of its AI and cloud growth strategy.

- Rising capital investments (around $85 billion in 2025) put short-term pressure on margins but strengthen the foundation for long-term growth.

- Google Search, YouTube, and Google Cloud remain the main growth engines, supporting Alphabet’s position as a global technology leader.

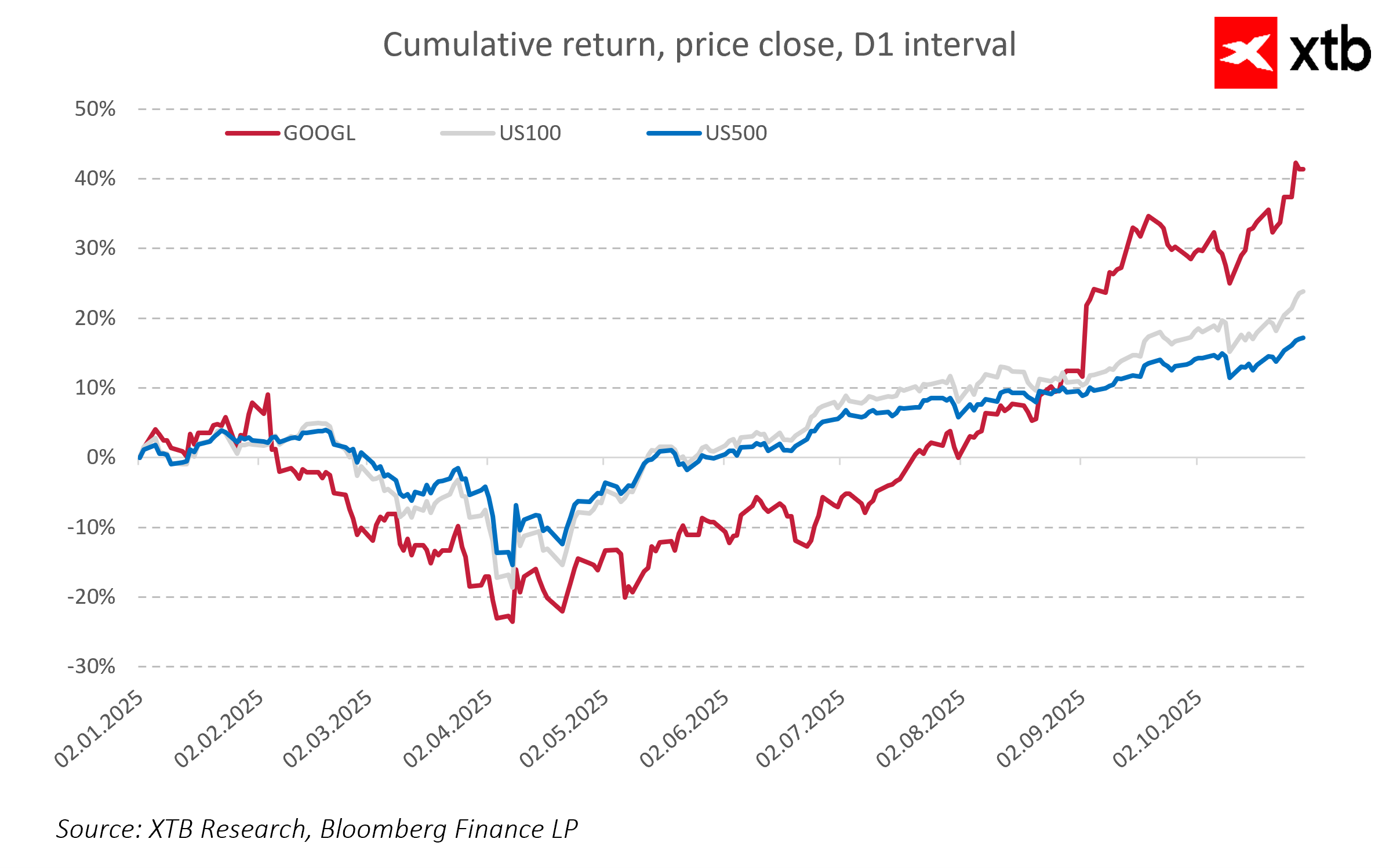

Alphabet is set to release its third-quarter 2025 earnings after market close. What can we expect from the tech giant, and will the AI-driven rally continue? Today's report will be one of the most important tests for the market, showing whether Alphabet's record investments in AI and Google Cloud translate into real revenue and profit growth. After Tesla's mixed earnings report, investors will be closely watching to see if Alphabet can confirm the durability of the AI trend and maintain its position as a technology leader.

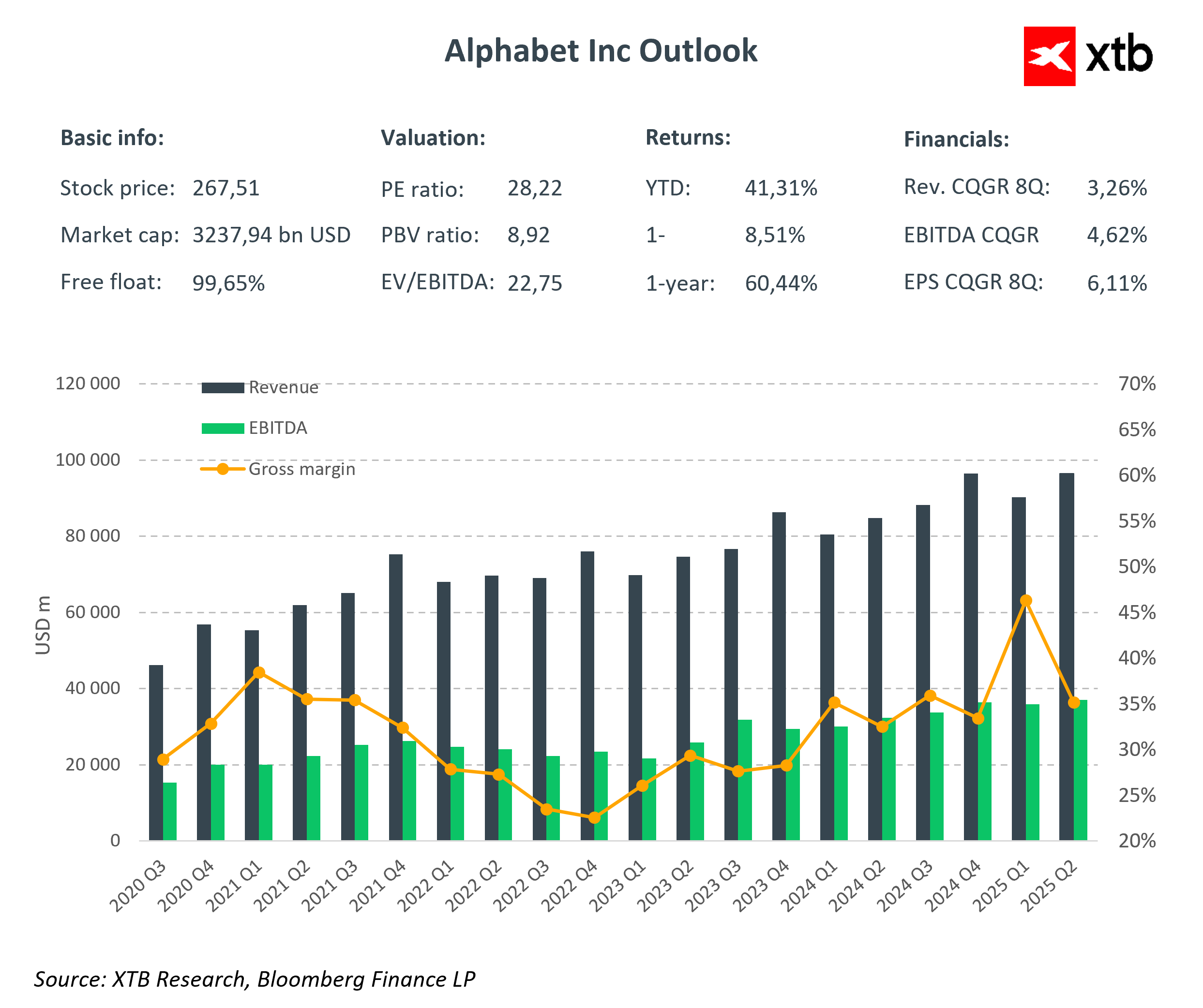

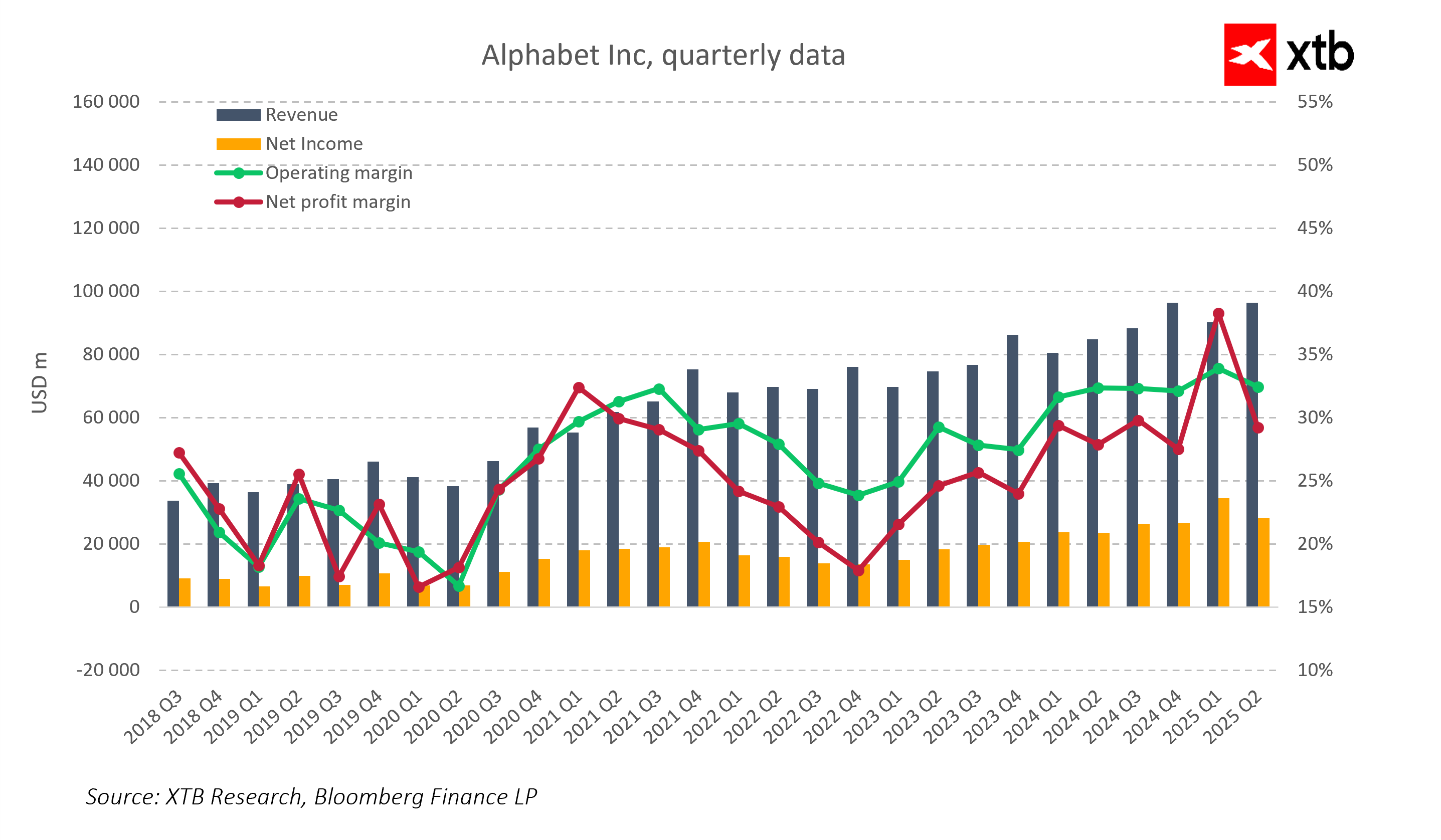

Markets are forecasting revenues in the range of $99.5–99.7 billion, representing roughly 13 percent year-over-year growth. There is a strong possibility that this could be the first quarter in history where Alphabet surpasses $100 billion in revenue, marking a symbolic milestone and confirming the effectiveness of its AI investment strategy and Google Cloud expansion.

The Q3 report is expected to show continued strong revenue growth, driven primarily by digital advertising and cloud services. Key drivers remain Google Search, YouTube, and Google Cloud, which are the pillars of Alphabet’s business model.

Earnings per share (EPS) are projected at around $2.29, representing a 7–8 percent year-over-year increase. Profits are expected to grow moderately, as high capital expenditures on AI and cloud infrastructure exert short-term pressure on margins. However, markets remain focused on the long-term potential of these investments, which could solidify Alphabet’s position as a global technology leader.

Capital expenditures for 2025 are expected to reach approximately $85 billion, a record level. These funds are being allocated to expanding data centers, developing AI hardware and software, and hiring technology specialists. While rising operating costs and depreciation put pressure on profitability, the market expects margins to gradually improve as operations scale and infrastructure utilization increases.

Google Search remains the primary revenue driver, maintaining a market share above 90 percent. Alphabet continues to enhance AI capabilities in search, enabling users to create more complex queries and receive multimodal, contextual responses. As a result, user engagement is rising, and the average query length has doubled. New AI features are already available on over 300 million devices, while AI Overviews reach more than 2 billion monthly users across over 200 countries and 40 languages, generating at least 10 percent more queries globally. Advertising revenue from Search and YouTube is estimated at $55–56 billion, representing 10–12 percent year-over-year growth.

The second key growth pillar remains Google Cloud, with projected revenues of around $14.5 billion, up 30 percent year over year. The segment continues to accelerate, although margins remain under pressure from high development and expansion costs. For investors, this is one of the most important indicators of Alphabet’s long-term competitiveness.

Q2 2025 results, which exceeded market expectations ($96.4 billion in revenue and $2.31 EPS), set a high benchmark ahead of the Q3 report. Investors will be closely watching management commentary on AI development, investment plans, and future projections for Google Cloud, as well as potential updates on the commercialization of new AI-based products and their impact on revenue composition.

In summary, a solid report is expected, confirming Alphabet’s position as a technology leader and showing that investments in AI and cloud are translating into real business growth. While high capital expenditures may constrain margins in the short term, the long-term outlook remains very positive, and maintaining strong growth in key segments will be crucial for the company’s valuation and investor confidence.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.