Technology giant Alphabet (GOOGL.US) will report Q2 earnings today, after the Wall Street session. The market will pay attention to the development of AI but also advertising revenues (the main component of the company's revenues) and the situation of the Google Cloud business. The issue of generative AI, which Google is working on intensively, may have the strongest impact on investors' imagination and expectations. Also key will be the situation of Google's globally dominant browser, which is facing increasing competition in search from Microsoft Bing and Opera (OPRA.US), among others. The report will be one of the most significant for Google in many years as speculation continues around the fact that competitive AI will reduce the dominance of Google's browser in Internet traffic.

Analysts Q2 estimates:

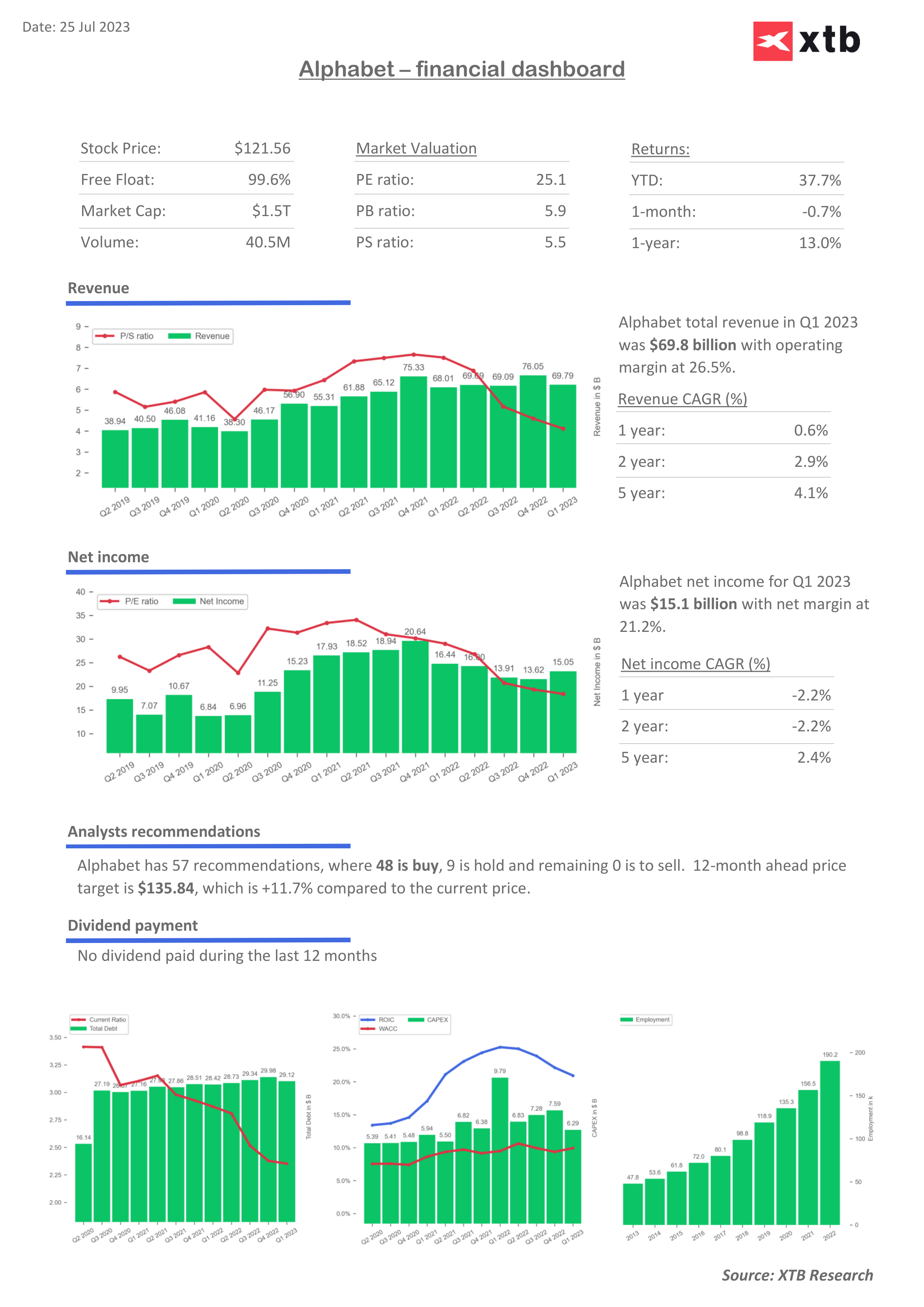

- Revenues: $72.75 billion vs. $69.8 billion in Q1.

- Earnings per share (EPS): $1.32 vs. $1.17 in Q1.

- Advertising revenue: $57.45 billion vs. $54.55 billion in Q1

- Google Cloud revenue: $7.83 billion vs. $7.45 billion in Q1

- YouTube revenue: $7.41 billion vs. $6.69 billion in Q1

- Operating margin: 27.6% vs. 25.35% in Q1

- Investments: $8.01 billion

Wall Street is expecting early signs of recovery in the digital ad spending segment by what Google's results could significantly affect the sentiment of shares of ad-based companies including Meta Platforms (META.US), and Snapchat (SNAP.US). A leading topic will be how a company's base, cyclical search advertising-oriented business will fare in the new competitive AI environment. As a general rule, the advertising business may be highly sensitive to a possible economic downturn. The existing strength of consumers may favor an increase in advertising budgets - but it probably won't be by leaps and bounds because the macro environment is uncertain in the long term.

Challenging times fo Google

- Google's browser dominance has been challenged by a number of companies including Bing and Scandinavia's Opera, which benefits from a direct partnership with OpenAI. For the moment, Bloomberg analysts remain calm and expect Google searches to grow by 3.7% y/y. According to Bloomberg Intelligence, a strong economy and high consumer spending may herald Google's search growth and justify a recovery in the advertising sector and, as a result, an increase in the company's EPS forecast;

- Investors will pay attention to Google Cloud's margins, which, although not the company's core business, has a sizable share of net income. The previous quarter was quite successful for the cloud business. Wall Street also expects job cuts of nearly 6% (a record) to have a positive impact on net income;

- Higher Google R&D spending is almost certain because the company wants to maintain its technology dominance - investing in data servers and other AI infrastructure. As is standard, the markets will turn their attention to the company's forecasts and will intensely analyze whether the company expects an unfavorable, challenging economic environment, how it assesses future AI earnings and how it sees the second part of the year.

- Alphabet's share price has risen 36% since the start of the year - still below the Nasdaq's massive 42% rise.Bernstein analysts pointed out that the market's somewhat subdued expectations for Google could help the eventual dynamic rebound.

Wall Street expects the company to maintain its dominant services revenue percentage and expects news updates on AI models under development, most notably Google Bard. Faced with new artificial intelligence challenges, Google founder Sergey Brin recently returned to the company.

Alphabet (GOOGL.US) shares are moving in an uptrend, and the price recently bounced off the lower price channel defined by the Andrews Fork and the 200-session moving average on the H4 interval. In the vicinity of $118 one should look for key short-term support for the company's shares. If it is broken - the base scenario will become a test of the 38.2 Fibonacci retracement of the upward wave from the fall of 2022, near $111. At this level we also see local peaks from September 2022. Source: xStation5

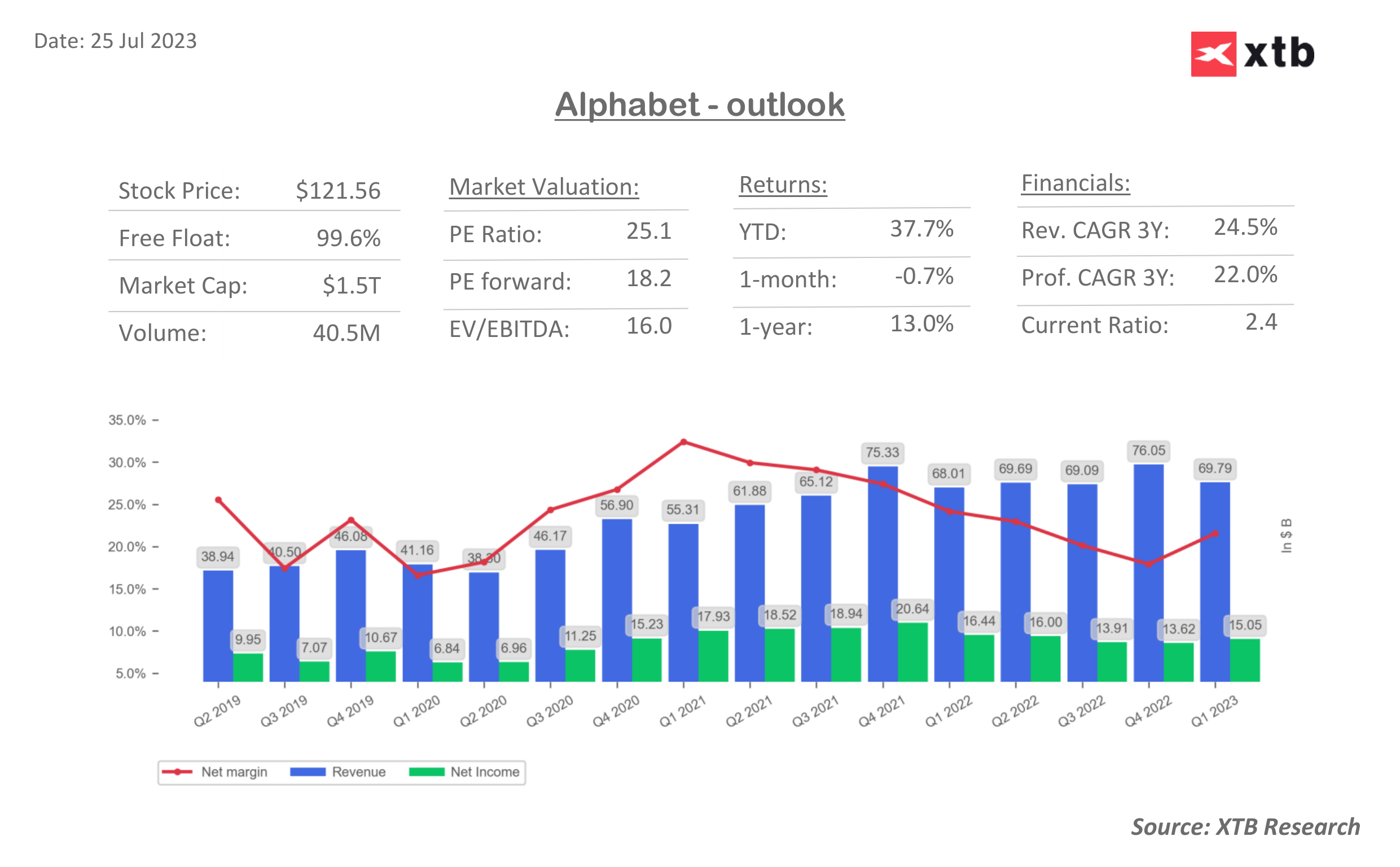

Alphabet valuation and analysts sentiment

Kongsberg Gruppen after earnings: The company catches up with the sector

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

Is a recovery on the cards? A deep dive into why bitcoin is weighing on tech stocks

Morning wrap: Tech sector sell-off (06.02.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.