-

Historic Revenue & AI Success: Alphabet exceeded $100 Billion in quarterly revenue for the first time, validating its aggressive AI investments with spectacular results.

-

Google Cloud Profitability Surge: The Cloud segment delivered an +85% jump in operating income, raising its margin to 23.7% and confirming its role as the primary growth engine.

-

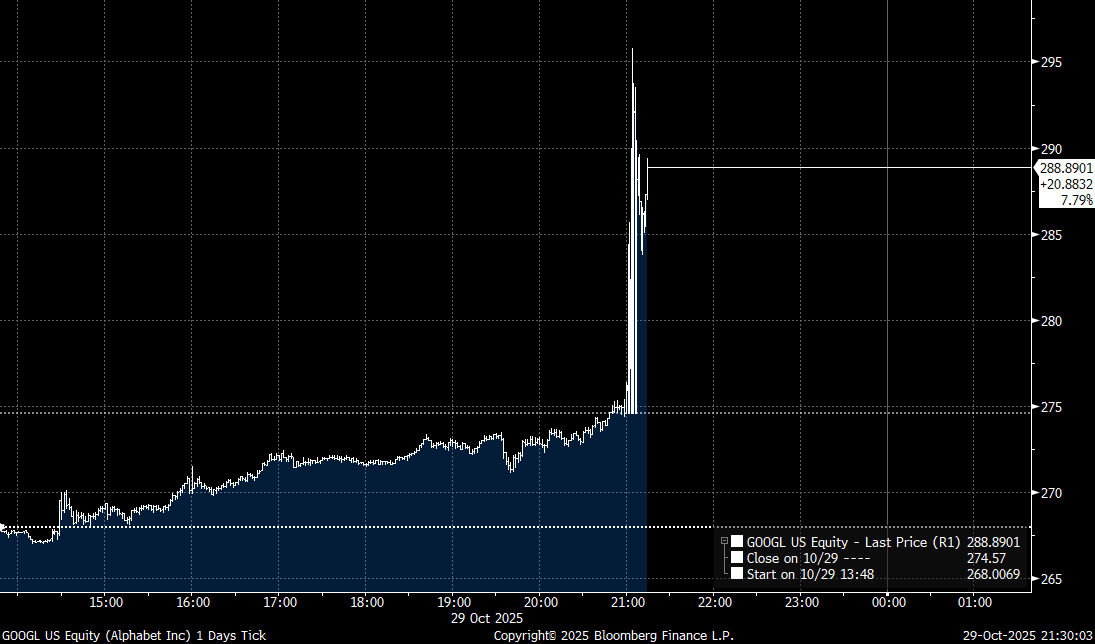

Shares Hit New Highs: Despite an EU fine, Alphabet shares surged 7% after-hours, reaching new records and confirming investor confidence in the successful AI synergy with core business.

-

Historic Revenue & AI Success: Alphabet exceeded $100 Billion in quarterly revenue for the first time, validating its aggressive AI investments with spectacular results.

-

Google Cloud Profitability Surge: The Cloud segment delivered an +85% jump in operating income, raising its margin to 23.7% and confirming its role as the primary growth engine.

-

Shares Hit New Highs: Despite an EU fine, Alphabet shares surged 7% after-hours, reaching new records and confirming investor confidence in the successful AI synergy with core business.

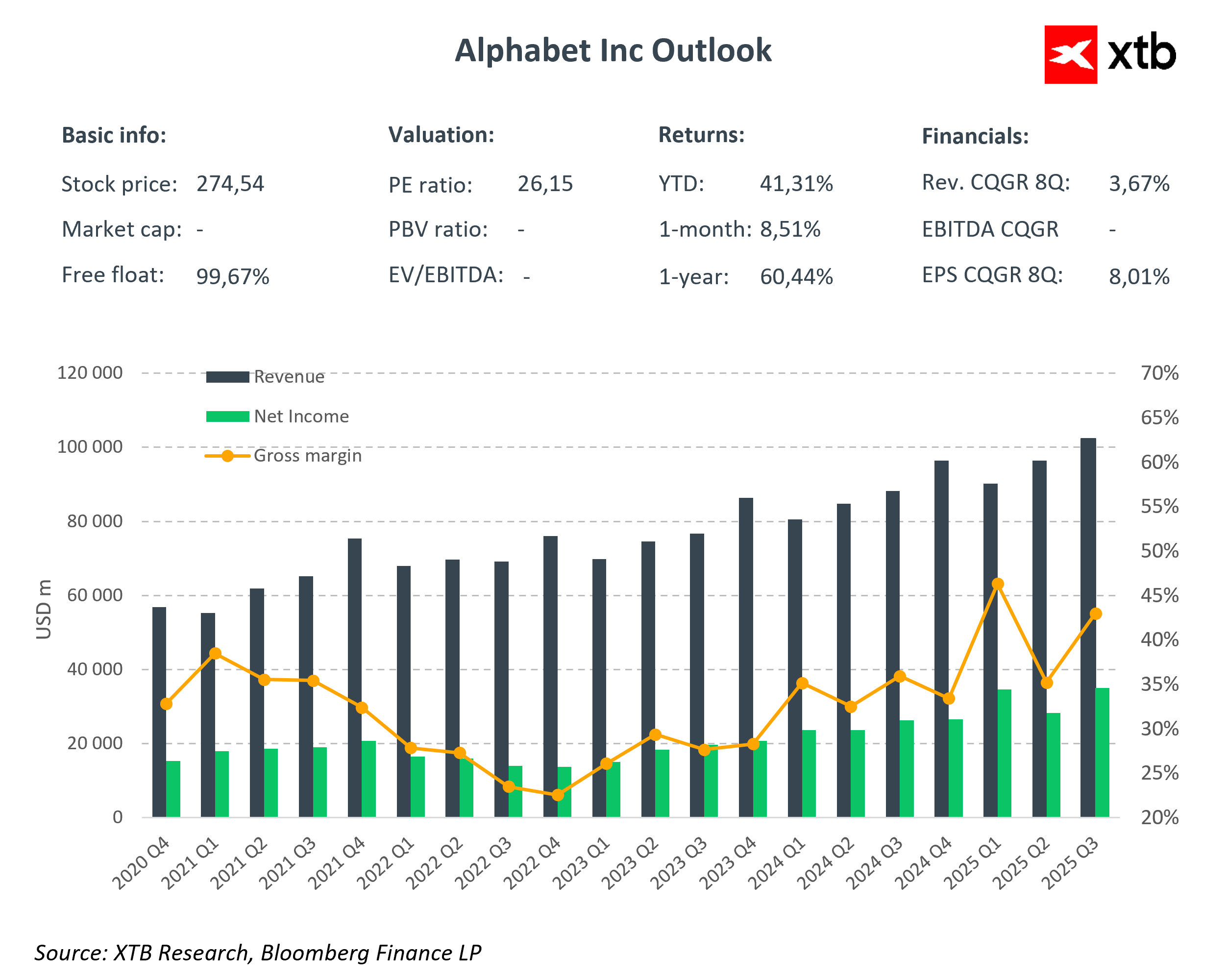

The American tech giant, now primarily a powerhouse in data centers and Artificial Intelligence (AI) rather than just search and web browsing, has decisively surpassed financial expectations. The company reported its first-ever $100 billion quarterly revenue, sending shares to new historical highs, despite absorbing a significant EU-related fine. Investors have fully embraced the aggressive capital expenditure strategy aimed at building AI infrastructure, with Alphabet's results providing clear evidence that these massive investments are now yielding tangible returns.

Alphabet has successfully demonstrated that the AI race does not necessitate the cannibalization of its traditional business model. The Q3 2025 results marked a historic milestone: quarterly revenues exceeded $100 billion for the first time, with all major segments reporting double-digit growth. Earnings Per Share (EPS) of $2.87 smashed the analyst consensus by 27%, causing the stock to jump to new records immediately after the announcement.

The undeniable star was Google Cloud, which not only increased revenue by 34% year-on-year to $15.2 billion but, more spectacularly, dramatically improved its profitability. The segment's operating income surged by 85%, pushing the operating margin to 23.7% from 17.1% a year ago. This confirms that the colossal investments in AI infrastructure are rapidly translating into measurable business efficiency.

Alphabet's Detailed Q3 2025 Financial Results

The company presents brilliant results, with the first-ever revenue exceeding $100 billion. Source: Bloomberg Finance LP, XTB

Revenue and Profitability:

-

Total Revenue: $102.3 Billion (+16% YoY), exceeding the $99.9 Billion consensus (+2.5%). This is the first quarter with revenue over $100 Billion—a symbolic milestone in company history.

-

EPS: $2.87 (+35% YoY), significantly above the $2.26 consensus (+27%).

-

Net Income: $35.0 Billion (+33% YoY).

-

Operating Margin: 30.5% (including the EU fine) or 33.9% without the fine.

Business Segments:

-

Google Search & Other: $56.6 Billion (+15% YoY), above the $55.0 Billion consensus.

-

YouTube Ads: $10.3 Billion (+15% YoY), above the $10.0 Billion consensus.

-

Google Cloud: $15.2 Billion (+34% YoY), significantly above the $14.8 Billion consensus.

-

Subscriptions, Platforms & Devices: $12.9 Billion (+21% YoY).

-

Google Network: $7.4 Billion (-2.6% YoY) – the only segment to record a decline.

Segment Profitability:

-

Google Services: Operating Income $33.5 Billion (+8.7% YoY), Operating Margin 38.5%.

-

Google Cloud: Operating Income $3.6 Billion (+85% YoY), Operating Margin 23.7% – the strongest growth dynamic.

-

Other Bets: Operating Loss $1.4 Billion (deepening by 28%).

Capital Expenditure and Outlook:

-

Q3 2025 CapEx: $24.0 Billion (+83% YoY), above the $22.4 Billion consensus.

-

New 2025 CapEx Guidance: $91–93 Billion (up from previous $85 Billion).

-

Google Cloud Backlog: $155 Billion (a 46% QoQ increase).

-

Headcount: 190,167 (+4.9% YoY).

Key Takeaways and Commentary

Historical Milestone

Alphabet crossed the $100 billion quarterly revenue barrier for the first time in history, achieving $102.3 billion. Sundar Pichai, the CEO, noted: "Alphabet had a wonderful quarter, with double-digit growth in every main part of our business." Shares initially gained only 2% in after-hours trading but soon accelerated to a 7% gain, demonstrating that Alphabet can continue to appreciate, even at historical peaks. It is worth noting that the company boasts one of the lowest valuation multiples among all key technology firms, particularly the Mag7 group, while delivering decisively the best results in this group this quarter, as Microsoft and Meta suffered losses post-earnings.

Alphabet shares are up over 7% in after-hours trading, setting new historical highs. Source: Bloomberg

Google Cloud – The Star Performer

Google Cloud was the biggest positive surprise, with revenues of $15.2 billion (+34% YoY) and operating income of $3.6 billion (+85% YoY). The segment's operating margin rose to 23.7% from 17.1% a year prior, proving rising operational efficiency. The order backlog at the end of the quarter reached $155 billion, a 46% quarterly increase, signaling strong prospective revenue growth in the near future. The growth is primarily fuelled by AI infrastructure – the TPU and GPU platforms for clients developing AI solutions. Anthropic announced an expansion of its use of Google's TPUs to as many as 1 million units by 2026.

Search and AI – Synergy Instead of Cannibalization

Google Search & Others generated $56.6 billion in revenue (+15% YoY), exceeding expectations. Notably, the integration of AI into the search engine has helped Google continue to attract a massive user base. AI, instead of replacing earlier solutions, supports and increases their productivity, alleviating previous investor concerns about the cannibalization of the traditional search method.

YouTube and Subscriptions – Model Diversification

YouTube Ads reached $10.3 billion (+15% YoY), but the growth in the subscription segment is even more impressive – Subscriptions, Platforms & Devices grew by 21% YoY to $12.9 billion. Alphabet now has over 300 million paid subscriptions, mainly driven by YouTube Premium (125 million subscribers) and Google One. Clearly, the company is not only developing new segments but also has solid foundations that deliver better results year after year.

EU Fine – A One-Time Burden

Financial results were weighed down by a $3.5 billion European Commission fine for anti-competitive practices in the ad tech market. Without this penalty, operating income would have been $34.7 billion (+22% YoY) with a margin of 33.9%. Google has announced an appeal, and the market generally treats this as a non-recurring factor.

Gemini AI – Growing Adoption

The Gemini application reached 650 million monthly active users as declared in Q3 2025, compared to 350 million in April 2025. The platform now processes 7 billion tokens per minute via direct client API. While Gemini still trails ChatGPT (estimated at 600 million monthly users), its integration with the Google ecosystem (Gmail, Maps, Search) drives rapid adoption. Many observers consider Google’s models to be best-in-class, and close cooperation with Anthropic may lead to even greater development in the AI model domain. Alphabet is also a leader in the quantum computing race, which further brightens the company's long-term outlook.

Outlook

The Q3 2025 results confirm Alphabet's strong competitive position and the effectiveness of its AI strategy. Double-digit growth across all core business segments, the spectacular profitability improvement in Google Cloud, and the rising order backlog ($155 billion) signal positive momentum will continue. Key factors to monitor are the return on aggressive AI infrastructure investments and the impact of antitrust regulations. Wall Street remains highly positive, with 65 out of 78 analysts recommending 'Buy,' 13 'Hold,' and none recommending 'Sell.' Alphabet shares have risen over 45% in 2025, reaching new historical highs after the earnings release.

The year-to-date increase is approx. 45%, and including after-hours trading, exceeds 50%. Source: xStation5

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.