AMD, the biggest competitor to Nvidia in the production of data center and AI-related chips, while being highly competitive on price, has published its financial results for Q2 2025:

-

Revenue: Q2 2025: $7.69bn, vs. consensus of $7.43bn; Q2 2024: $5.84bn, YoY dynamics: +32%

-

Adjusted EPS (non-GAAP): Q2 2025: $0.48, vs. consensus of $0.49; Q2 2024: $0.69, YoY dynamics: –30%

-

EPS (GAAP): Q2 2025: $0.54; Q2 2024: $0.16, YoY dynamics: +238%

-

Adjusted Operating Profit: Q2 2025: $897m, vs. consensus of $903m; Q2 2024: $1.26bn, YoY dynamics: –29%

-

Net Profit (non-GAAP): Q2 2025: $781m; Q2 2024: $1.13bn, YoY dynamics: –31%

-

GAAP Gross Margin: Q2 2025: 40%; Q2 2024: 49%; a decrease of 9 pp

-

Non-GAAP Gross Margin: Q2 2025: 43%, vs. consensus of 54.1%; Q2 2024: 53%; a decrease of 10 pp

-

CAPEX: Q2 2025: $282m, vs. consensus of $176m; Q2 2024: $154m; an increase of 83%

-

R&D Expenses: Q2 2025: $1.89bn, vs. consensus of $1.72bn; Q2 2024: $1.58bn; an increase of 20%

Business Segments

-

Data Center: $3.2bn (+14%) – demand for EPYC, but slowed down by the embargo on MI308 GPUs for China.

-

Client: $2.5bn (+67%) – a record quarter thanks to new Ryzen processors.

-

Gaming: $1.1bn (+73%) – a strong rebound, with demand for Radeon cards and consoles.

-

Embedded: $824m (–4%) – the only segment to be in the red.

Forecast for Q3 2025 vs. expectations:

-

Revenue: $8.7bn ± $0.3bn (consensus: $8.37bn)

-

Non-GAAP gross margin: approx. 54% (consensus: 54.1%)

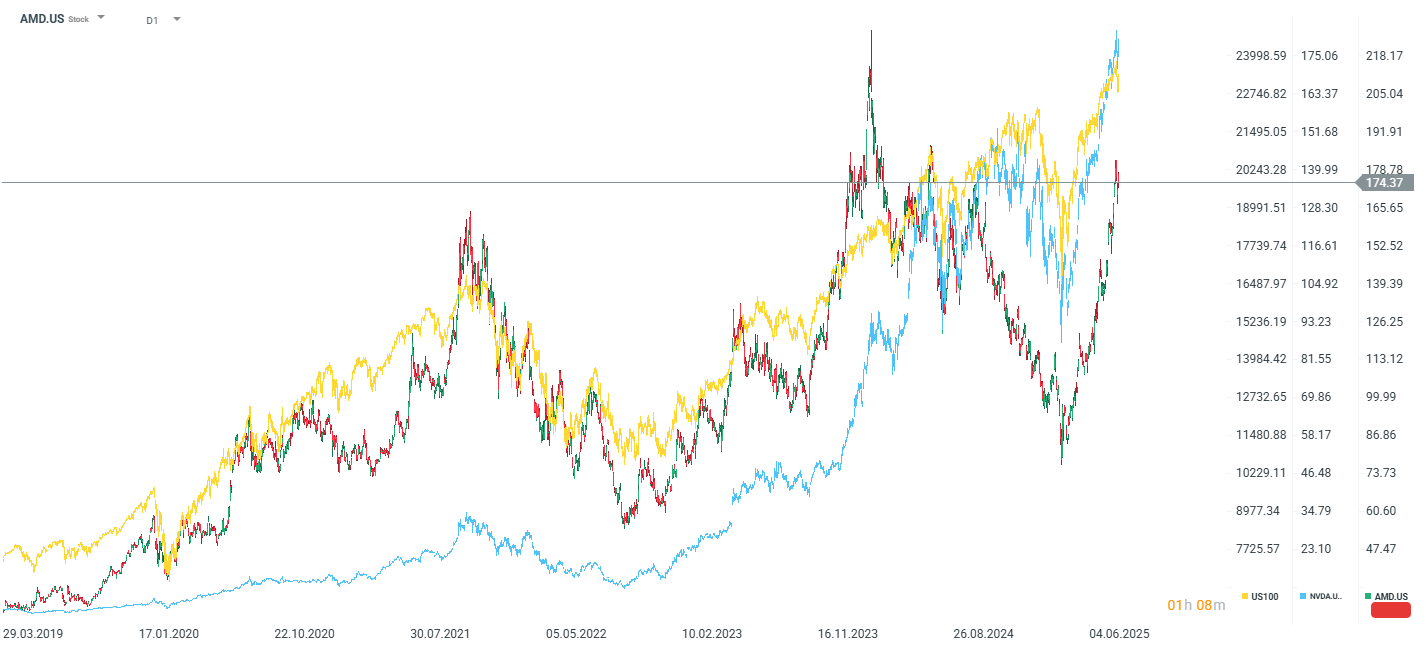

AMD loses nearly 4% after results

The company shows a non-GAAP EPS that is significantly lower than last year. There is also a decline in operating profit and margin. The sharp drop in margin is caused by one-time write-downs related to restrictions on exporting AI GPUs to China. However, this situation has a chance of changing in the near future. Nevertheless, the market is still wondering whether the restrictions on exports to China will lead to significant operational costs for the company. High CAPEX and R&D expenses are raising investor concerns about pressure on lower cash flows in the coming quarters. Despite good revenue results and an optimistic forecast for Q3, the current assessment has focused on short-term problems related to margins and uncertainty regarding China. In the initial reaction, shares lost over 5%, but the loss has now been reduced to just under 4%. The company's shares are approximately 30% below their historical highs, but have rebounded by about 130% since the low in early April.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.