Apple (AAPL.US), the third-largest company in the U.S., reported its Q4 2025 results today. The stock rose modestly after the release — by just under 2%. Both revenue and earnings per share beat Wall Street expectations. The biggest surprise by far was the strength of iPhone sales in China and, more broadly, the very strong growth in iPhone revenue overall. Notably, Apple’s China sales had been weak over the past three years, making the current rebound an outright surprise for analysts. Outside of Apple’s report, Visa (V.US) also released results, with its shares down about 1.5%, while storage and data media maker SanDisk (SNDK.US) is up nearly 14%.

Apple Q4 2025 results

-

EPS: $2.84 (+18% YoY, a new all-time EPS record); $42.1B net income

-

Products revenue (total): $113.74B vs $107.69B est. (+16% YoY)

-

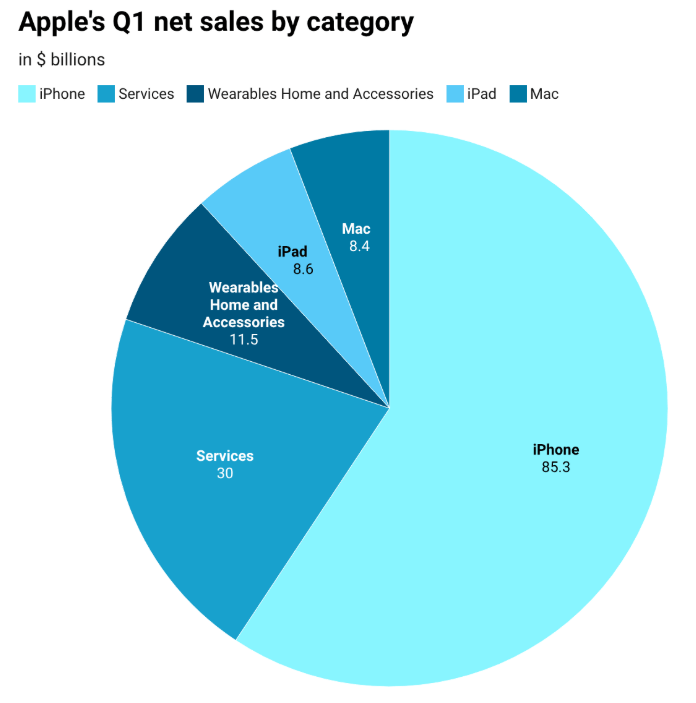

iPhone revenue: $85.27B vs $78.31B est. (+23% YoY)

-

Services revenue: $30.01B vs $30.02B est. (+14% YoY)

-

iPad revenue: $8.60B vs $8.18B est.

-

Mac revenue: $8.39B vs $9.13B est.

-

Wearables, Home & Accessories revenue: $11.49B vs $12.13B est.

-

Americas revenue: $58.53B vs $59.06B est.

-

Greater China revenue: $25.53B vs $21.82B est. (+38% YoY)

-

Operating expenses: $18.38B vs $18.18B est.

-

Operating cash flow: approx. $54B

-

Installed base: over 2.5B active devices

-

Dividend: $0.26 per share

Outlook

-

Apple expects 13–16% YoY revenue growth in the current quarter (Q1 2026).

Apple stock (D1)

Apple shares are trading around $262 in after-hours. In its commentary, the company said it is pleased with record iPhone sales (with demand described as the strongest in its history across the markets where Apple operates) as well as strong Services performance.

Source: xStation5

iPhone and Services revenue together exceeded $115B in Q4.

Source: Apple, Datawrapper

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.