Summary:

-

Australian dollar moves higher after PM Turnbull has been ousted

-

RBNZ’s Orr warns the central bank could cut interest rates

-

Japanese inflation remains lacklustre in July

As the week is slowly coming to an end all eyes have been turned to Jackson Hole where central bankers from around the world have gathered to discuss various economic challenges particularly important for monetary policy. Nevertheless, evenly important things happened overnight when Australian Prime Minister Malcolm Turnbull was ousted by his party rivals in a bruising leadership contest. Scott Morrison, the treasurer, will become the new prime minister after his won an internal ballot 45-40 over former Home Affairs Minister Peter Dutton. Note that Turnbull is the fourth Australian PM over the past decade being ousted internally. This is outstandingly tumultuous week for Australian politics and for Turnbull himself as well. At the beginning, he managed to survive the voting aimed at forcing him to leave his post, but then things changed when Peter Dutton decided to try to do it again. Yesterday we wrote that Turnbull chose to wait until Friday to make a decision on his leadership which was particularly AUD negative. Today the Aussie is getting a boost rising over 0.5% against the US dollar as of 6:46 am BST. Why did markets cheer after the Morrison’s success? First of all, Turnbull’s ousting ends the period of political chaos which is alway financial markets negative. Secondly, Morrison is considered as a stable choice providing more predictability for the economy.

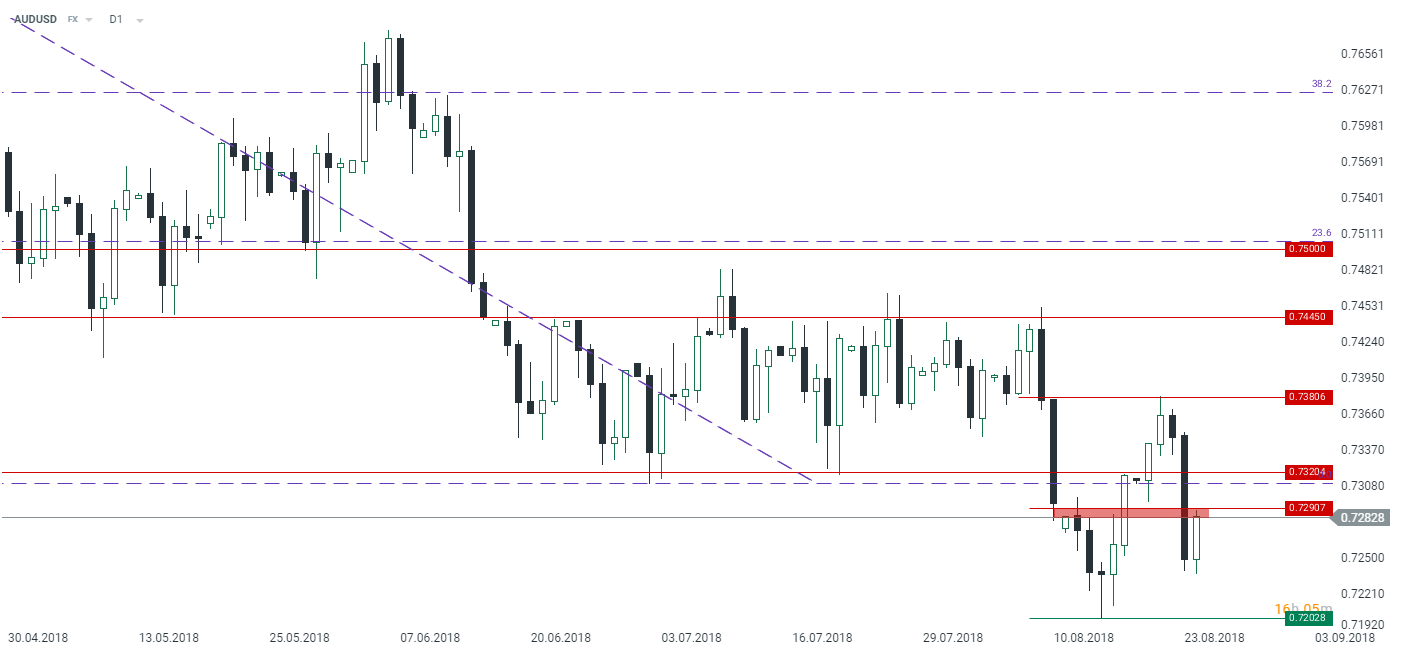

The Australian dollar is striving to get back above its crucial technical level of 0.7290 following upbeat news from the political scene. This move is necessary to allow the pair to continue its rebound with the huge level placed at 0.7320. Source: xStation5

While the Aussie dollar is experiencing long-awaited relief, the NZ dollar has been given further signals that the balance of risks for monetary policy in New Zealand could be already tilted to the downside (even as Orr said that the rate outlook is evenly balanced). Speaking in Jackson Hole the RBNZ governor Adrian Orr said that he do not rule out an interest rate cut reiterating that there is no rush to be raising borrowing costs. Notice that interest rate market participants price in a rate cut in 20% till February 2019. Beside these particularly dovish comments Orr sounded quite positively. He suggested that fundamentals for New Zealand are pretty sound and his is optimistic about global growth. When it comes to the exchange rate he is ‘very pleased’ with the NZ dollar rate behaviour which has clearly supported the domestic economy. He also enumerated some risks to the quite buoyant economic outlook including stubbornly low inflation and business investment. To sum up, as for now there is no point in expecting the rate hike in New Zealand which could leave the NZ dollar exposed in the face of rising rates elsewhere - the NZD’s advantage is dissipating. Finally, let us mention the trade data from New Zealand producing a beat in terms of exports in July. Exports grew 5.35 billion NZD from 4.91 billion NZD and even as imports increased to 5.49 billion NZD from 5.02 billion NZD. A trade deficit slightly widened to 143 million NZD from 113 million NZD but well above market expectations.

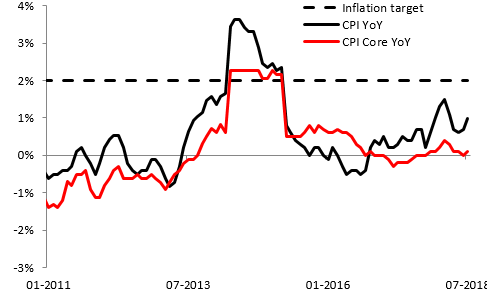

Last but not least, Japanese inflation which does not seem to be in a position to accelerate any time soon. Headline price growth in July increased to 0.9% from 0.7% in annual terms but it missed the consensus of 1%. Core inflation excluding fresh food stayed at 0.8% but also fell short of expectations whereas ‘super-core’ inflation stripping out fresh food and energy ticked up to 0.3% from 0.2% matching the median estimate. What can conclusions be drawn? Well, even as the Bank of Japan has recently tweaked its rhetoric, Japanese inflation remains still way off the BoJ’s target suggesting that even if the central bank decided to tighten up monetary conditions, it would not be done due to inflationary risks but more due to risks of keeping interest rates too low for too long.

Inflation in Japan keeps moving a long way off the BoJ's aim. Source: Macrobond, XTB Research

Inflation in Japan keeps moving a long way off the BoJ's aim. Source: Macrobond, XTB Research

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.