Tomorrow at 05:30 BST, the Reserve Bank of Australia (RBA) will announce its decision on interest rates. Recent inflation data have largely ruled out further monetary easing in Australia following the cautious 25-basis-point cut in August, while an overall improvement in economic conditions removes arguments for additional rate reductions.

AUDUSD has been in a clear uptrend since April, driven mainly by broad-dollar depreciation (inverted USDIDX in blue). After notable swings in September, the pair has gained only 0.5% MTD. Nevertheless, a hawkish stance by the RBA, combined with aggressively priced easing in the U.S., should help maintain the trend in the coming months. Source: xStation5

What to expect from tomorrow’s RBA decision?

The RBA is expected to leave rates unchanged at 3.60% (Bloomberg consensus). The third and final 25-bp cut in August was precautionary, aiming to shield the Australian economy from a potential slowdown due to Donald Trump’s tariffs.

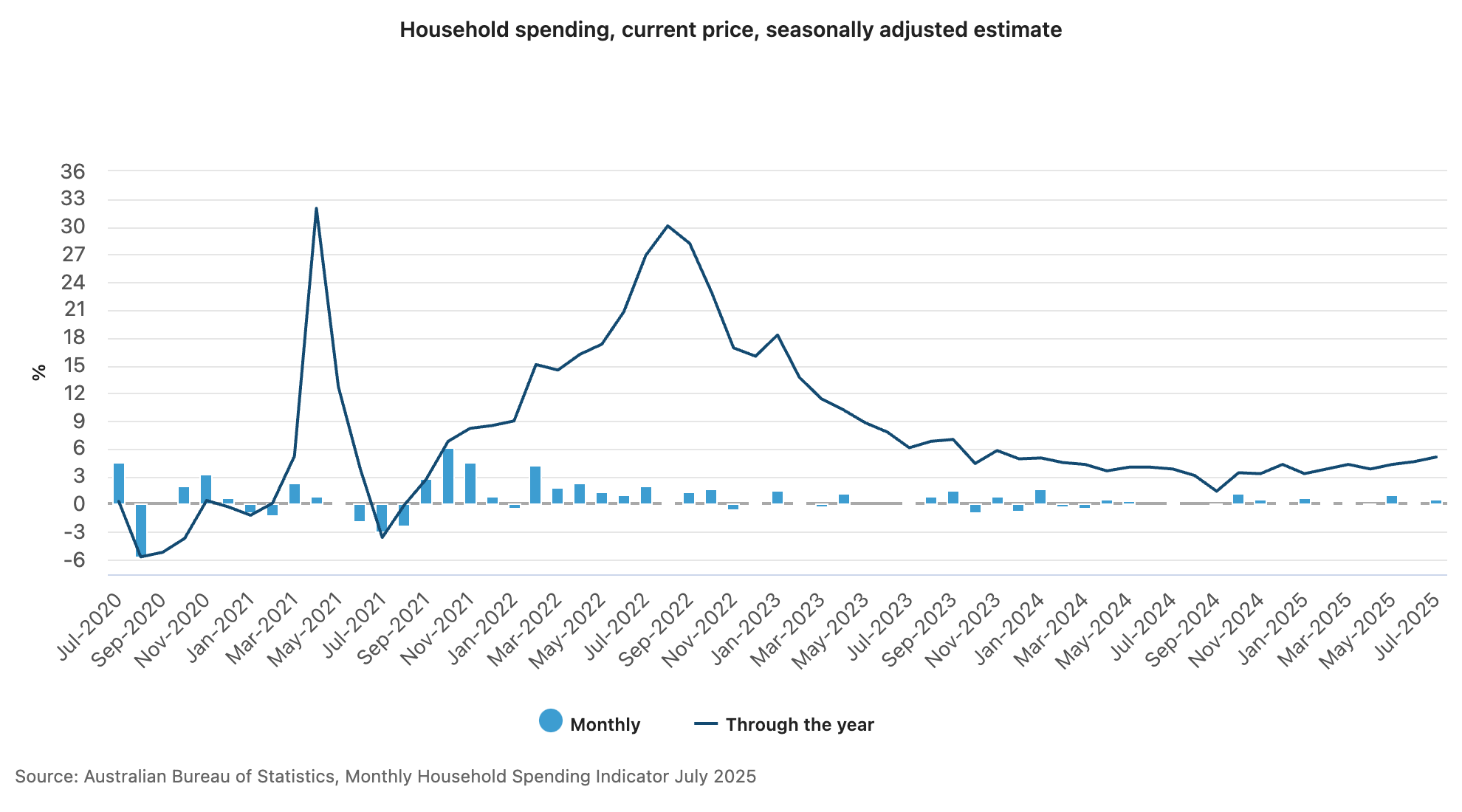

Q3 economic activity proved stronger than trade-related uncertainties, which could have dampened activity. Consumer spending is in a clear uptrend (June saw the largest year-on-year increase since November 2023, at 5.1%), and GDP surprised on the upside (1.8% vs 1.6% consensus).

Household spending in Australia continues its upward trend. Source: Australian Bureau of Statistics

Inflation rises again, labour market remains steady

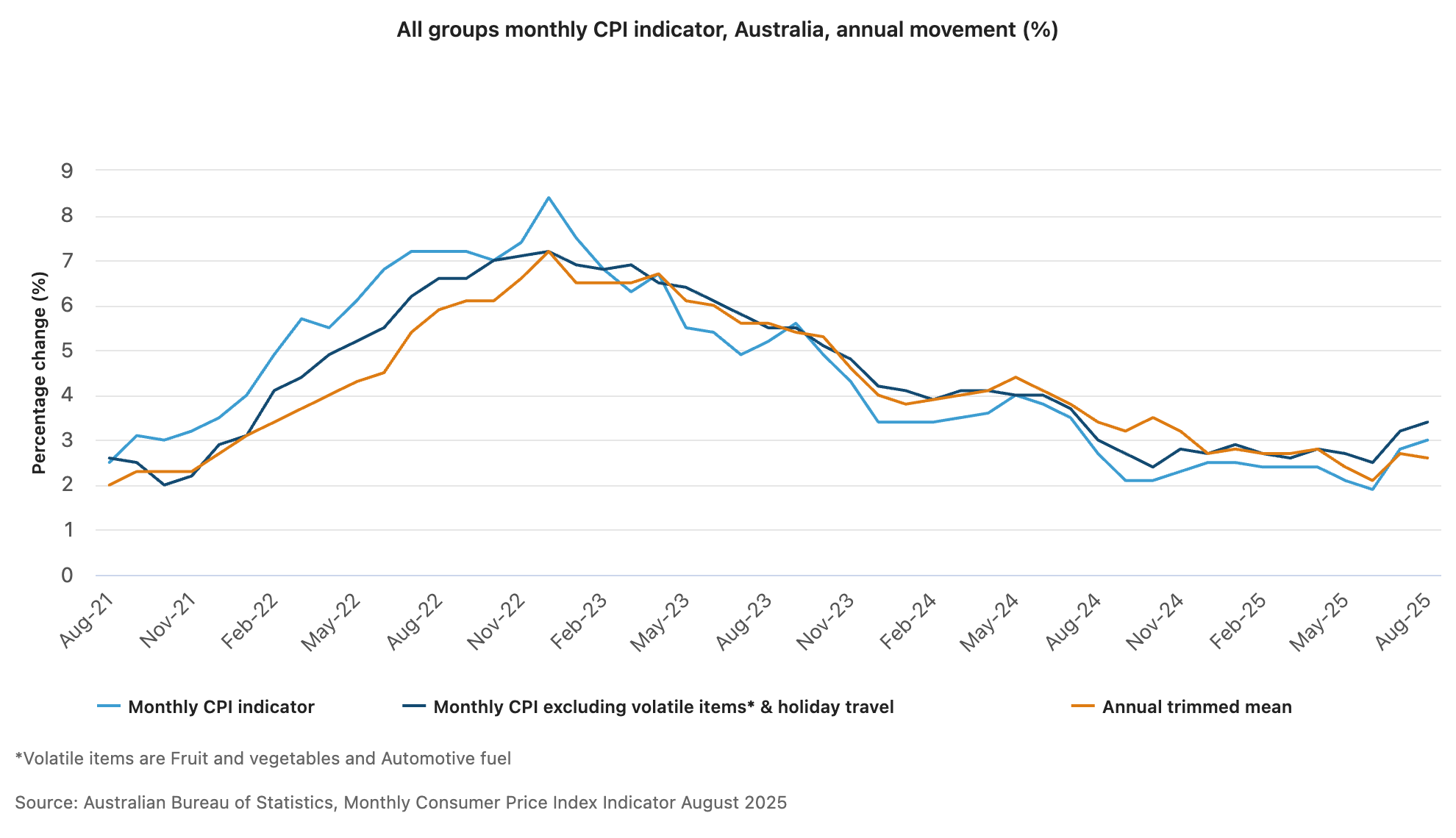

The chance of another rate cut has been ruled out by the latest monthly inflation reading. Australian CPI rose 3.0% YoY in August versus 2.8% in July, slightly above forecasts. The increase was partly due to base effects but highlighted persistent pressure, especially in services such as restaurant meals, takeout, and audiovisual services. Housing and rents also rose noticeably, potentially adding to Q4 wage pressures.

Markets have sharply reduced rate-cut expectations following the inflation increase, with major banks and financial institutions withdrawing forecasts for a November cut. Opinions on November remain divided, reflected in market-implied swap probabilities of roughly 50% for another reduction. Some institutions expect rates to remain unchanged through the year-end.

The labor market remains tight but stable, which, amid visible price pressures, reduces the case for further easing. Australian payrolls have alternated between missing and beating economist expectations (recently a surprise decline of 5k jobs, previously an increase of 26.5k), indicating no clear trend and a difficult-to-interpret labor market stagnation. Meanwhile, unemployment has held at 4.2% for two months after falling from 4.3%, with the RBA emphasizing quarterly data due to lower volatility.

The monthly CPI in Australia rose to 3%, with core CPI at 3.4%, the highest since July 2024. Source: Australian Bureau of Statistics

The monthly CPI in Australia rose to 3%, with core CPI at 3.4%, the highest since July 2024. Source: Australian Bureau of Statistics

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.