The weekly series of interest rate hike decisions will begin tomorrow at 05:30 BST by the Reserve Bank of Australia (RBA). Analyst consensus assumes that the Bank will raise rates 15 basis points, or to 0.25%. It is worth remembering that if this scenario materializes, it will be the first rate hike in Australia in over a decade.

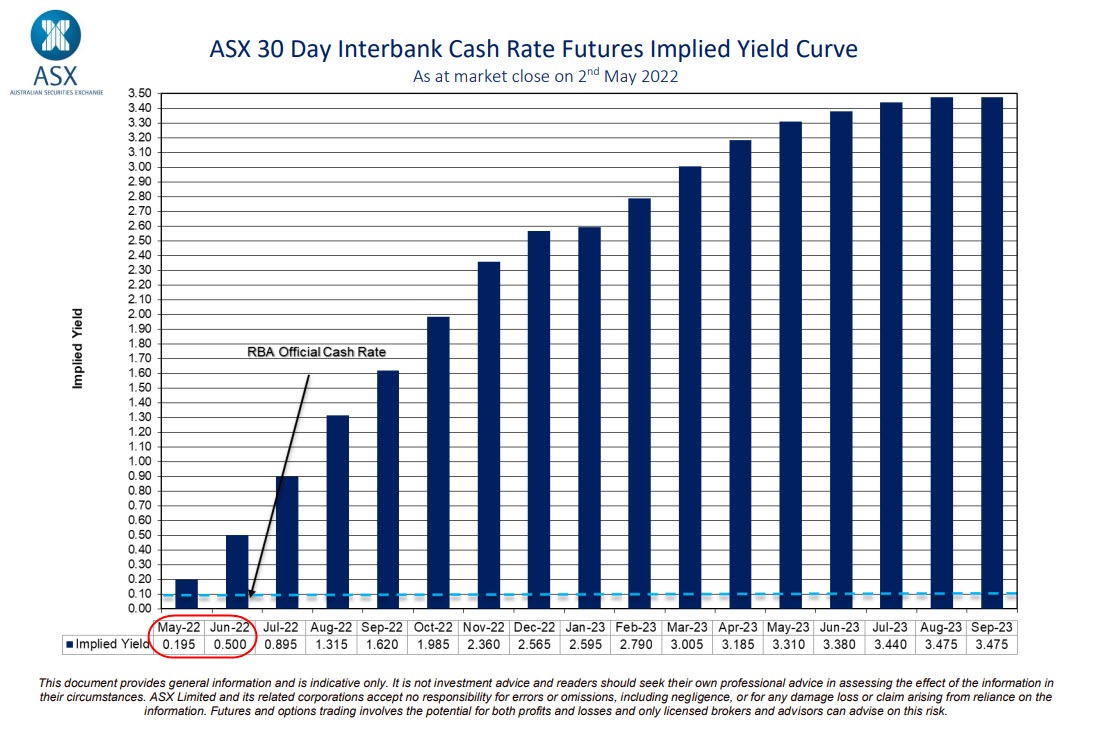

Any additional signal of a possible hawkish turn by the Bank will have a positive impact on the valuation of the Australian dollar. The decision to raise rates by 15 points has already been priced in by the market, so the lack of surprises may bring a different effect. It is also worth remembering that Wednesday is the day of the FOMC decision in the USA, which if it materializes a hawkish turn in the macro policy, can erase any positive impact of the rate hike on the Australian dollar. Source: ASX

AUDUSD pair chart, D1 interval. The Aussie has been moving in a strong downtrend against the dollar for nearly a month. The currency was strongly influenced by the hawkish policy of FED and difficulties in China's economy. From a technical point of view, the pair is heading towards the psychological support at the level of 0.5. Source: xStation 5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.