Summary:

-

Soft indicators from Australia saw notable declines in December

-

Theresa May makes concessions ahead of today’s House of Commons meeting

-

The US Treasury Department reported the country’s borrowing needs were higher than previously thought

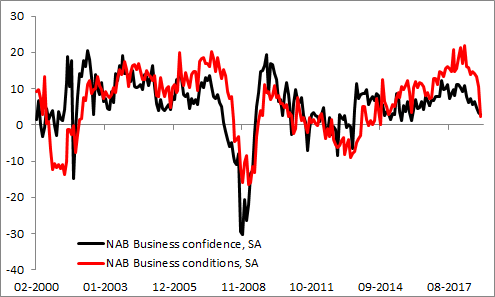

Business conditions plunge

The session across Asian market has been quite calm with no substantial moves in either stocks or currencies. The Chinese Shanghai Composite is trading 0.1% lower while the Hang Seng (CHNComp) is showing a slight 0.2% decline. In Japan, where the trading day already came to an end, we saw a mild 0.1% increase in the NIKKEI 225 (JAP225). These results came after major indices on Wall Street moved down on Monday with the NASDAQ (US100) falling as much as 1.1%. The tech stocks tumbled mainly due to Nvidia as the company informed that it cut its fourth-quarter revenue guidance, reflecting weaker than forecast sales of its gaming and datacentre platforms. Founder and CEO of Nvidia added that “Q4 was an extraordinary, unusually turbulent, and disappointing quarter. Looking forward, we are confident in our strategies and growth drivers.” The stock finished the first trading day with a 13.8% decline weighing substantially on the index.

Australian business conditions plummeted in December suggesting fragile economic activity ahead. Source: Macrobond, XTB Research

Australian business conditions deteriorated sharply in the final month of 2018 producing the largest drop since the GFC. The index reached its lowest level since lat 2014 falling to 2 from 11. Business confidence remained unchanged leaving the index at 3 points. The details showed that the deterioration in business conditions was broad-based embracing many states and industries. For example, the component reflecting trading, profitability and employment conditions all saw notable declines in December. Keep in mind that shrinking business activity could result in a string of adverse implications for the Australian economy affecting the labour market or investment expenditure (CAPEX). The data also showed that new orders declined staying below the trend. Having in mind that the money market is currently pricing in a rate cut in Australia in roughly 60%, there is quite limited room for the Aussie to depreciate massively. This is also the case today. For all the awful reading the Australian dollar is trading pretty flat mirroring chiefly the US dollar underperformance. Only the British pound is moving below its flat line against the greenback, but this is only a tiny decline. Overall, we have not seen significant moves across the FX space.

The AUDUSD failed to break through 0.7235 at the second attempt but it could try to do so once again. The more notable support for bulls is placed nearby 0.7040. Source: xStation5

Pound treads water as May makes concessions

The British currency is trading little changed in early trading hours in Europe awaiting another crucial day in the House of Commons. It needs to be said that PM Theresa May has recently backed a plan to scrap the most contentious part of her Brexit deal (backstop) ahead of the vote in the House today. She also promised the House another chance to block no-deal Brexit. Therefore, one may suspect that the House could vote for some changes being put in the May’s Brexit plan. If it happens the revamped deal will need to be submitted to the European Union, and then if it agrees to possible changes MPs in the House could vote it again. The pivotal question remains whether the EU would be able to make further concessions to the United Kingdom? What if the EU refuses potential changes? Then, the House could vote on the old version of the May’s agreement but only if there is a clear shift in the will of the House. The next "meaningful vote" is scheduled for February 13. Options like a second referendum, a general election are unlikely to be on the table and such amendments should be rejected. On the other hand, the Labour Party could insist to hold another no-confidence vote in the government trying to get rid of PM May.

Possible options which could be considered in the House of Commons on Tuesday. Source: BBC

In the other news:

-

The US Treasury Department expects to issue $365 billion in net marketable debt from January through March, up $8 billion from its estimate in October - a response to a widening budget deficit

-

NZ trade balance produced a 265 million NZD surplus in December, over the year there was a 5.9 billion NZD deficit

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.