Summary:

-

The capitalization of the virtual currency market breaks below the $200 billion mark

-

European Parliament’s Committee proposes new regulations for ICOs

-

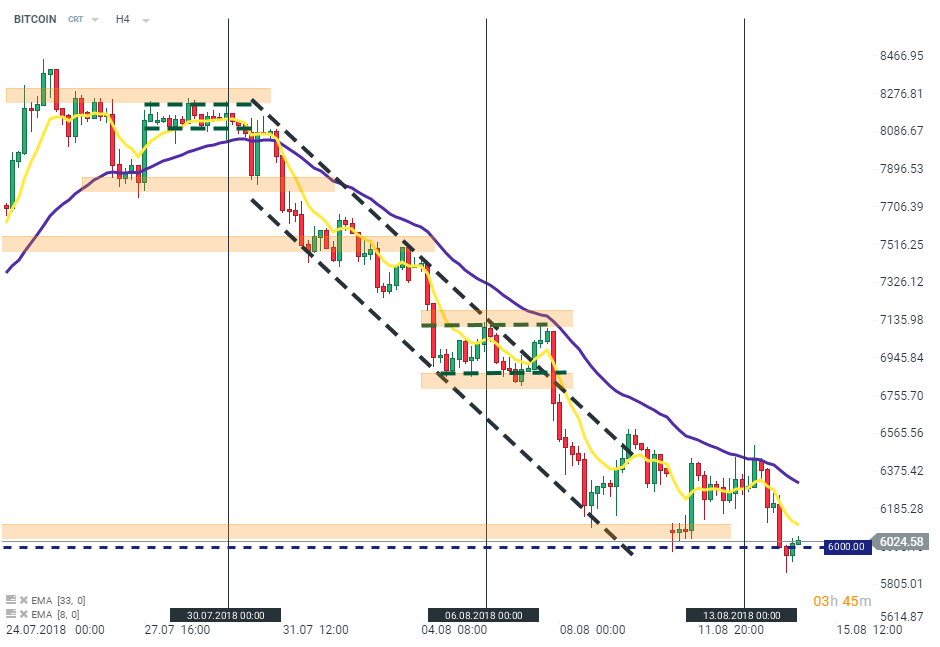

Bitcoin (BITCOIN on xStation5) remains in the vicinity of the $6000 handle after dipping below for a while

Crypto bears are once again attacking the cryptocurrency market sending valuations of major virtual currencies significantly lower. Bitcoin broke below the $6000 handle while altcoins where underperforming as well. In turn we have witnessed the capitalization of the cryptocurrency market moving below $195 billion mark. The capitalization excluding Bitcoin sits a notch below $90 billion. Let’s start the news section with ICO-linked draft proposed by the European Parliament’s Committee on Economic and Monetary Affairs as well as Turks moving their TRY holdings to the cryptocurrency market.

The ongoing rout on the Turkish lira market encourages Turks to locate their holding elsewhere. Cryptocurrency market seems to be a destination of choice according to the trading volume data from the Turkish cryptocurrency exchanges. Btcturk, the Turkish cryptocurrency exchange, saw a 350% increase in trading volume over the timespan of one day. 38% of these transactions were referred to Bitcoin. This is quite interesting as Turks are selling their TRY holdings due to the latest volatility of the currency while at the same time they are locating their money on the cryptocurrency market despite the fact that it was often criticized for its unusual and hectic price swings.

BITCOIN investors launched new week in downbeat moods. The most famous digital currency has broken below the psychological $6000 handle but managed to recoup part of the losses since. The cryptocurrency is trading around the mentioned level at press time therefore we may have to wait for clearer signal regarding the possible future price movements. Source: xStation5

The European Parliament’s Committee on Economic and Monetary Affairs proposed a news draft regulation linked to the cryptocurrency sphere. The document proposing new regulations for initial coin offerings (ICO) was published on Friday after the European Union has been working on it since last year. This Committee’s proposal could allow to regulate ICO token sales. Nevertheless, this framework sets some requirements for crowdfunding service providers. However, as this is just a draft it may be altered greatly before implementing (if it is going to be implemented) therefore we may have to wait some time until we get a glimpse of what a final regulation may look like.

RIPPLE plunged below $0.25 for a while. The cryptocurrency is trading a notch above this mark at press time. What’s more, the cryptocurrency has reached the new 2018’s low recently. Source: xStation5

Secondly, let’s mention that the capitalization of the cryptocurrency market has decreased to below $200 billion. Let us recall that this figure stood above $350 billion at the beginning of June. Bitcoin, which accounts for more than the 50% of the whole market capitalization, lost over 20% in that period while Ethereum, second biggest cryptocurrency by market cap, subtracted as much as 54% from its value since the beginning of June. One can see that investors are less eager to pay such higher prices for cryptocurrencies therefore we may see their prices settle at depressed levels. All in all, that would not be a bad scenario for the market as many vendors and institutions stay reluctant towards allowing digital currency payments due to their high volatility and with that hurdle out of the way an increased adoption of such means of payment could be possible.

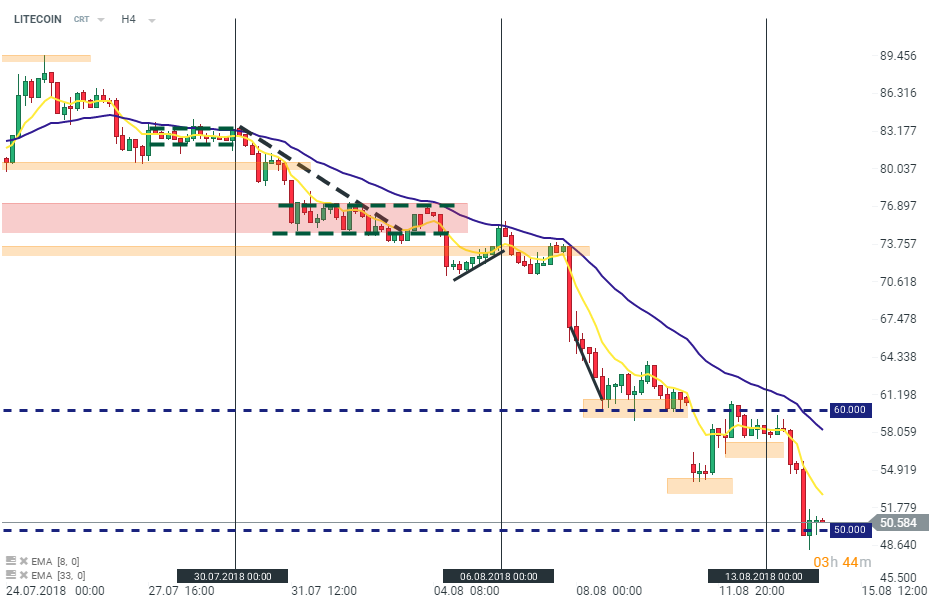

LITECOIN, like other major coins, trades lower today. The digital currency has even dipped below the $50 handle for a while but managed to bounce higher from there. Nevertheless, the price remains in the close vicinity of the aforementioned level therefore investors should stay cautious. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.