- The British pounds has been under a severe pressure amid Brexit uncertainty

- Markets do not see any rate hike until mid-2019

- Fiscal expansion can be GBP positive

- Thursday budget vote the first step towards the Brexit deal

The pound has been under a huge pressure during recent months for the one single reason – increased odds of leaving the EU without any deal and causing economic chaos. Let us recall – a 2 year period from triggering the Article 50 ends in March 2019 and the UK must leave the EU with or without agreement. For the business it’s imperative that it remains in some kind of a customs union to avoid a major break of economic ties. However, negotiations are stuck as the minority coalition partner, the DUP, rejects any hard border with Ireland whereas pro-Brexiters do not want to accept staying within the customs union for an unspecified amount of time. This uncertainty will not be resolved on Thursday, but the two events may help set direction for the pound.

Budget Vote

Key Brexit negotiations are not taking place in Brussels but in London because the Conservative-DUP coalition is not unanimous and even if Theresa May could find a deal with the EU and perhaps find support for it at home using some Labour votes, pro-Brexiters can topple her if they see such scenario. One of the opportunities could be the vote on budget that will take place this Thursday but May’s government made a smart move of using some extra fiscal room to bolster spending in sensitive areas and making it very unpopular to vote against the proposal. Therefore, this hurdle will likely be cleared, paving the way for negotiations with the EU but it will not improve May’s position materially and thus the uncertainties will prevail.

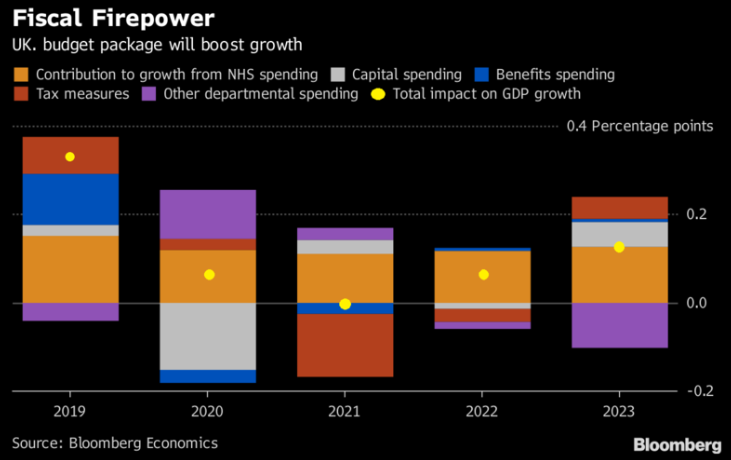

May’s government announced a moderate fiscal expansion – in the absence of Brexit uncertainty that could be GBP positive. Source: Bloomberg

May’s government announced a moderate fiscal expansion – in the absence of Brexit uncertainty that could be GBP positive. Source: Bloomberg

The Bank of England decision

If you look past the Brexit uncertainty, the UK economy looks as it deserved a rate hike. Inflation remains above the target, unemployment is low and wages are rising and external position (trade balance and current account) have improved materially. Yet a “no-deal” scenario could quickly derail this outlook and it’s no wonder that markets do not see a hike until the second half of 2019. However, if there is a deal a hike would arrive much sooner (perhaps as soon as the deal is confirmed) and that could be very bullish for the GBP.

GBPUSD implications

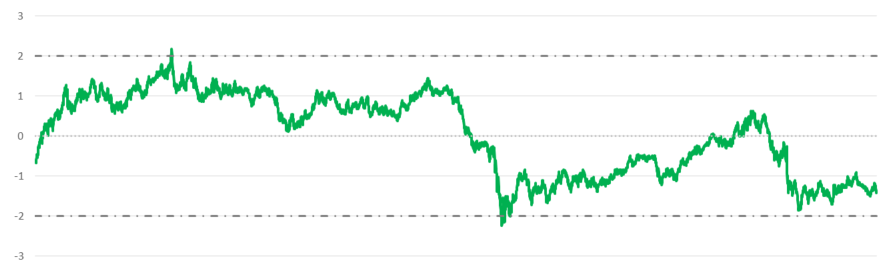

The pound remains very depressed, especially against the US dollar. Looking at the long run deviation from the average real (inflation adjusted) rate we can see that the rate is not far from -2 standard deviations, signaling that the currency is greatly undervalued. A positive message from the Bank of England may help but it’s Brexit deal that will be absolutely crucial for the pound.

GBP fundamental position looks greatly undervalued. Source: Macrobond, XTB Research

GBP fundamental position looks greatly undervalued. Source: Macrobond, XTB Research

We can see a very major support on GBPUSD chart at 1.2650 – there are many key local lows and highs around it and it could be used by the bulls after the latest steep sell-off, at least until there’s more clarity regarding the Brexit deal.

GBPUSD faces a major test of the 1.2650 support. Source: xStation5

GBPUSD faces a major test of the 1.2650 support. Source: xStation5

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.