Minutes from the latest ECB meeting have just been released, however, it did not cause any major moves on the markets because the sentiment was affected by Lagarde's earlier comments.

Here are key takeaways from the document:

- Many members expressed preference for raising the benchmark ECB interest rates by 75 basis points.

- Some argued that raising interest rates by less than 75 basis points would send the wrong message and run the danger of being seen as being at odds with the 2% inflation target.

- Compromise was in some ways seen as broadly equivalent to raising rates by 75 basis points at the present meeting.

- The suggestion by ECB's Lane to increase the ECB interest rates by 50 basis points was backed by the vast majority of members.

- The present 2025 projection might be viewed as not considerably different from 2%.

- Some participants said they would prefer to reduce the number of APP more quickly.

- It was felt that over the long term, the risks to the fundamental inflation estimates could be more fairly assessed.

- A 50 basis point hike at the current meeting would allow the Governing Council to tighten monetary policy for a longer period of time.

- A notable change in the external environment was the recent strengthening of the euro, which would probably mean slightly lower inflationary pressures for the euro region in the future.

Earlier ECB president Lagarde provided additional hawkish comments. Lagarde said that inflation is way too high and warned ECB doubters to "revise their positions''. Lagarde reassured that the ECB will stay the course with rate hikes. She also pointed out that inflation expectations are not de-anchoring and reaffirmed the central bank's resolve to keep tightening policy further.

As one can see, there is little left of the dovish tone which was sparked by rumors regarding possible rate cuts. On the other hand, EUR weakens slightly, which is caused by rising yields in the US. At the same time, yields in Germany are also growing strongly.

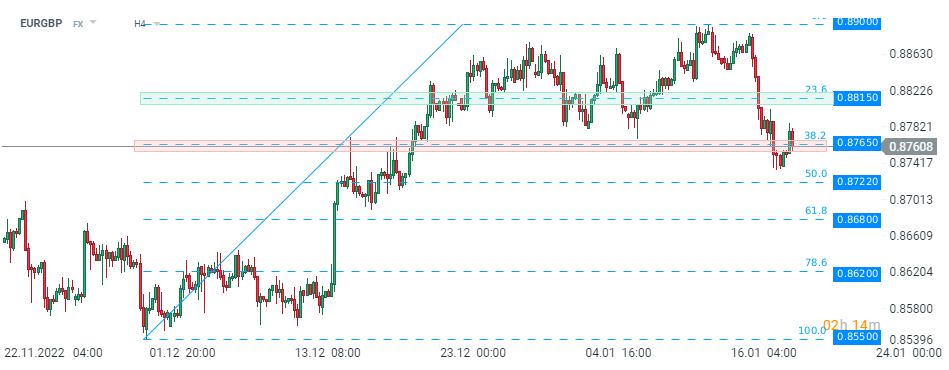

EURGBP barely reacted to the today’s ECB Minutes. Pair is testing local support at 0.8765. Source: xStation5

EURGBP barely reacted to the today’s ECB Minutes. Pair is testing local support at 0.8765. Source: xStation5

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Economic calendar: Indices and EURUSD await US retail sales report

Morning wrap (10.02.2026)

Market wrap: Novo Nordisk jumps more than 7% 🚀

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.