We have just received a mix of US data and the news is clearly bad:

- Initial claims 229k (expected 215k, previous 229k revised to 232k)

- Housing starts 1549k (expected 1701k, previous 1724k, revised to 1810k)

- Building permits 1695 (expected 1787k, previous 1823k)

- Philly Fed activity index -3.3 (expected 5.3, previous 2.6)

This shows clearly weakening economy even ahead of the major tightening from the Fed, contrasting the message from Chairman Powell that the US economy was well positioned to face significant tightening. While an immediate reaction to the data is minor, it compounds the challenge for the central bank and this challenge (that might result in a recession) is the main reason why the US500 is already 1100 of the 21 ATH.

EURUSD gains modestly after a weak data package from the US. So far May lows are holding but the trend remains negative.

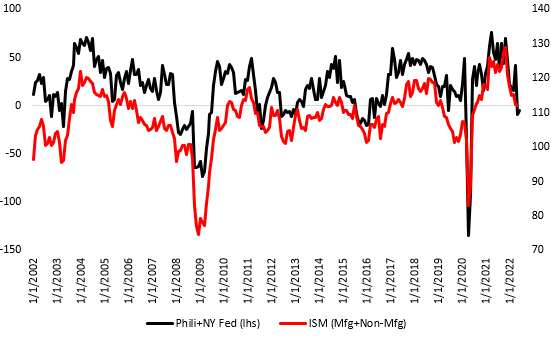

Not a rosy picture. Philly Fed + NY Fed indicators remain negative for the second straight month, heralding a slide in ISM into contraction territory. Source: Macrobond, XTB Research

Not a rosy picture. Philly Fed + NY Fed indicators remain negative for the second straight month, heralding a slide in ISM into contraction territory. Source: Macrobond, XTB Research

Daily summary: Equities rally as markets await Trump-Xi talks; precious metals decline on risk-on (27.10.2025)

BREAKING: Fed Dallas Manufacturing above estimates 📈 EURUSD stable around 1.163

BREAKING: Ifo Index Slightly Above Expectations. DE40 limits jump from the session start

Economic calendar: Fed’s interest-rate decision on Wednesday 📄

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.