C3.ai (AI.US) stock jumped 30% on Friday after the tech company posted upbeat results for the third quarter, with CEO Thomas Siebel seeing a "dramatic change" in sentiment and sees the company becoming profitable in fiscal 2024..

-

The provider of artificial intelligence company recorded a narrower-than-expected loss of 6 cents per share ex-items, while analysts expected loss of 22 cent. Revenue of $66.7 million also beat market projections of $64.2 million.

-

Gross came in at 76%, down slightly from the 80% during the year-ago period

-

C3.ai had $790 million of cash/equivalents on the balance sheet at the end of third quarter, which is down from $859 million last quarter and may mean that the company is burning cash at a quick pace.

Company expects to reach non-GAAP operating profitability by FQ4'24, which would be a significant improvement compared to recent quarterly trends, including the non-GAAP operating loss margin of 23% during FQ3. Source: C3.ai

-

"As we enter Q4 FY 23, we are seeing tailwinds from improved business optimism and increased interest in applying C3 AI solutions to address an increasing range of applications across a broad range of industries," Chief Executive Thomas Siebel said in a release. "The overall business sentiment appears to be improving. This is a dramatic change from what we experienced in mid-2022."

-

"The company is starting to gain momentum in building significant enterprise opportunities in its pipeline with its suite of innovative enterprise AI solutions," said Wedbush analyst Daniel Ives.

-

Company expects fourth quarter revenue in the region of $70 million to $72 million in revenue, above analysts’ estimates of $69.9 million. Executives also anticipate a $24 million to $28 million adjusted loss from operations.

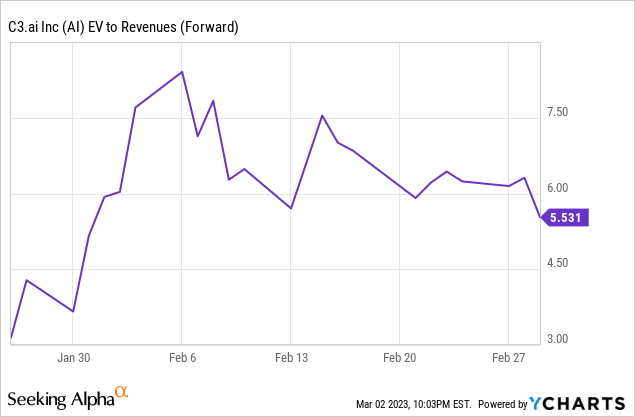

C3.ai's stock currently trades at 5.5x forward revenue, which is hard to quantify given the unclear revenue growth as the company is moving towards a consumption-based pricing model. However, even if the company were to grow consistently over 25% over the long term, the lack of profitability should be treated as a warning sign. Source: Seeking Alpha/ YCharts

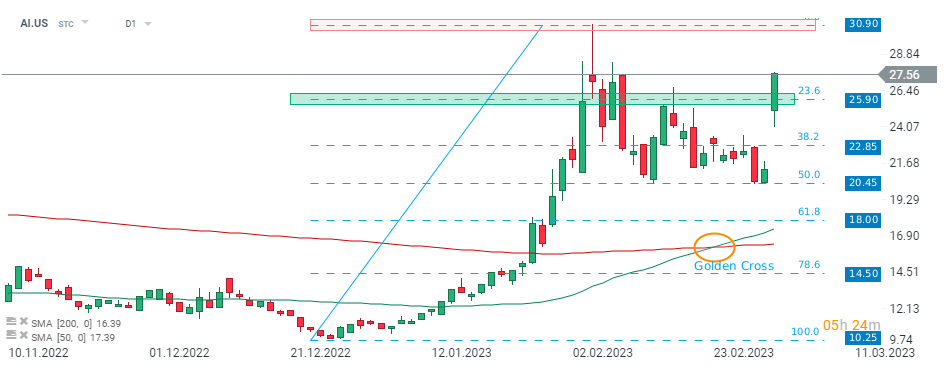

C3.ai (AI.US) stock launched today's session with a massive bullish price gap and easily broke above local resistance at $25.90, which coincides with 23.6% Fibonacci retracement of the last upward wave. If current sentiment prevails, the upward move may accelerate towards the recent high at $30.90. Also medium-term 50-day SMA (green line) crossed above the long-term 200-day SMA (red line). This formed a ‘golden cross’ formation, which supports market bulls. Source: xStation5

UK CPI moderates as expected, as pound stabilizes, and Lagarde’s future at ECB in question

US OPEN: Market under pressure from AI

Hollywood on Edge: Another Round in the Battle for Warner Bros.

Norwegian Cruise Line surges 7% amid disclosed Elliott Management 10% stake 📈

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.