Cameco (CCJ.US) stock fell 15.0% after the Canadian uranium producer joined forces with power plant operator Brookfield Renewable Partners in order to acquire nuclear power equipment maker Westinghouse Electric in a deal worth $ 7.88 billion, including debt. The deal, which is expected to close in the second half of 2023, comes amid growing interest in nuclear power due to the energy crisis in Europe and high oil and gas prices.

“Bringing together Cameco’s expertise in the nuclear industry with Brookfield Renewable’s expertise in clean energy positions nuclear power at the heart of the energy transition and creates a powerful platform for strategic growth across the nuclear sector,” the companies said in a statement.

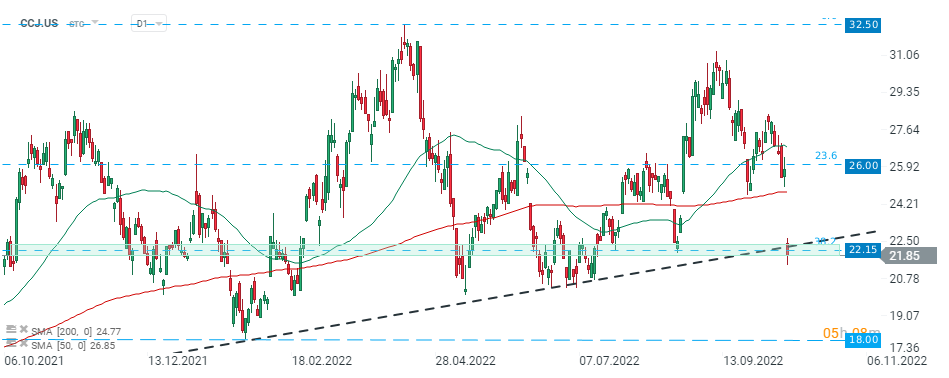

Cameco (CCJ.US) stock launched today's session with a massive bearish price gap and later broke below key support at $22.15, which coincides with upward trendline and 38.2% Fibonacci retracement of the upward wave launched at the beginning of pandemic. If current sentiment prevails, downward move may accelerate towards support at $18.00 where lows from January 2022 are located. Source: xStation5

Cameco (CCJ.US) stock launched today's session with a massive bearish price gap and later broke below key support at $22.15, which coincides with upward trendline and 38.2% Fibonacci retracement of the upward wave launched at the beginning of pandemic. If current sentiment prevails, downward move may accelerate towards support at $18.00 where lows from January 2022 are located. Source: xStation5

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

US jobs data surprises to the upside, and boosts stocks and pushes back Fed rate cut expectations

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.