Tensions in the Middle East are on the rise

United States conducted a pre-emptive strike aimed at high-profile Iranian officials at the airport in Baghdad, Iraq. Qassam Soleimani, one of the top Iranian commanders, was killed in a missile attack. Soleimani is said to be responsible for numerous terrorist attacks that took place in the Middle East and it is rumoured that he was preparing strikes on high-profile US officials. Iran vowed to retaliate. Crude price is surging today with Brent trading nearly 4% higher. However, did fundamental situation change? What could Iran do and how could it affect the oil market?

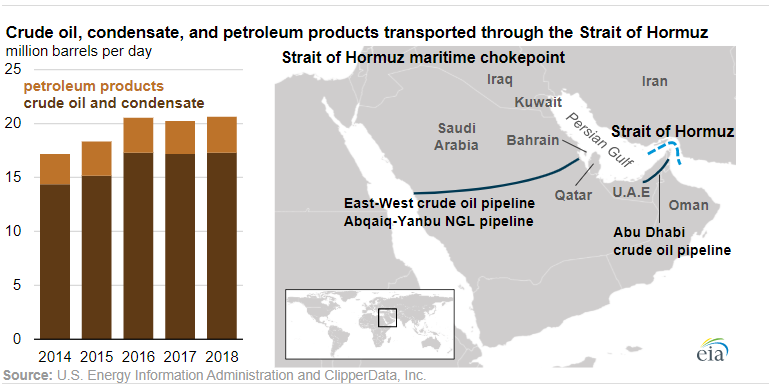

Strait of Hormuz is the key chokepoint for the oil market

Around 21 million barrels of oil pass through the Strait of Hormuz each day - around a fifth of the global demand. Should the Strait become paralyzed by geopolitics, oil prices could experience volatile swings. Let us remind that when Saudi refineries were attacked, around 4 million barrels of output were lost. In response, oil jumped as much as 15% in just a single day! The Strait is used by some of the biggest oil producers like Saudi Arabia, Iraq, Kuwait and the United Arab Emirates. Having said that, blockage of the Strait could paralyse the global oil market.

Over 21 million barrels of oil pass through the Strait of Hormuz each day. Alternate shipping routes exist but they would be insufficient to stabilize the market in case the Strait of Hormuz is paralyzed. Source: EIA

Over 21 million barrels of oil pass through the Strait of Hormuz each day. Alternate shipping routes exist but they would be insufficient to stabilize the market in case the Strait of Hormuz is paralyzed. Source: EIA

What can Iran do?

Iran could block the Strait of Hormuz, seize tankers or even attack them. Of course, such actions would see a quick response from third party countries and this could lead to an outright war in the Middle East. Iran has blocked the Strait numerous times in the 70s and has conducted attacks on tankers in the late 80s. Blockage of the Strait or outbreak of war would trigger massive price increases on the oil market.

Is it possible to ship oil via alternate routes?

Maritime transport is cheap, fast, effective and can be used to deliver goods to almost every part of the world. Land transport is also possible thanks to pipelines. However, transport capacity of all pipelines in countries that currently ship via Strait of Hormuz amounts to around 10 million barrels per day. Nevertheless, the vast majority of pipelines used by Iraq run through Saudi Arabia therefore it cannot be used to ship oil from both countries at the same time. Taking it into an account, transport capacity shrinks to 6.8 million barrels per day. It is not enough to substitute for the maritime transport. Having said that, should the Strait get blocked, one should expect stoppages in oil deliveries. In such a situation, crude price could jump above the $100 per barrel.

Iran may lose patience

United States can pressure Iran to leave the Strait of Hormuz open by threatening to impose additional sanctions. However, it should be noted that Iran lost many contractors due to the sanctions and its GDP has shrunk by around 10% last year. It means that Iran could lose it patience and trigger another “war” on the oil market. This is not a good information for the global economy as costs of transportation and energy would rise.

BREAKING: Massive increase in US oil reserves!

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.