This week we have two important central bank events. The first is Jerome Powell’s testimony to Congress and the second is the ECB meeting. Both of these events could move financial markets, and below we analyse the markets that could be most vulnerable to changes in the aftermath of these events.

Bond yield correlations: what to watch.

An interesting development in the past year is the fact that short-term bond yields have moved in lockstep in Europe, the UK and the US. Since US Treasuries are central to the global financial system, any change in their direction can have a major impact on financial markets, especially when correlations are strong.

To get a sense of the strength of the corelation between the major global bond yields, we analysed the correlations between the 2-year Treasury yield, the German 2-year yield and the 2-year UK Gilt yield. We looked at the 1-year correlation, the YTD correlation and the 1-month correlation. The results are illuminating, as you can see below:

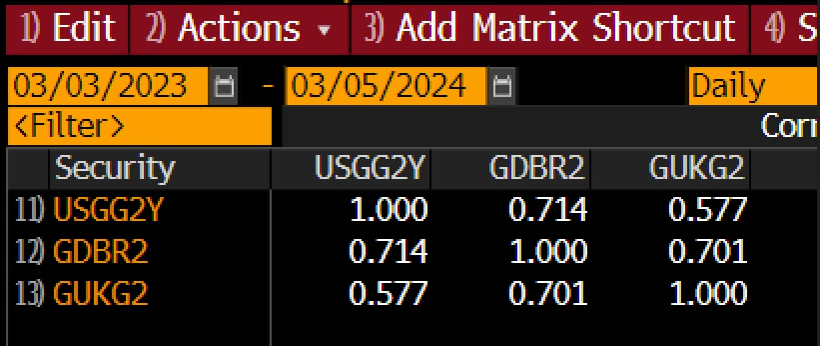

1-year correlations:

Source: XTB and Bloomberg

On an annual basis the correlation is strongest between the German 2-year yield and the US 2-year Treasury yield, and they have moved together 71% of the time. In contrast, the correlation between the 2-year Gilt yield and the 2-year Treasury yield is not as strong, and these two yields moved together 57% of the time. The UK Gilt yield is more closely correlated to the German yield, and they have moved together 70% of the time over the last 12 months.

It is rare for different assets to maintain such close correlations for 12 months, but this is understandable since central banks moved in unison to fight inflation during 2023. However, the more recent correlations shed an interesting light on what could come next.

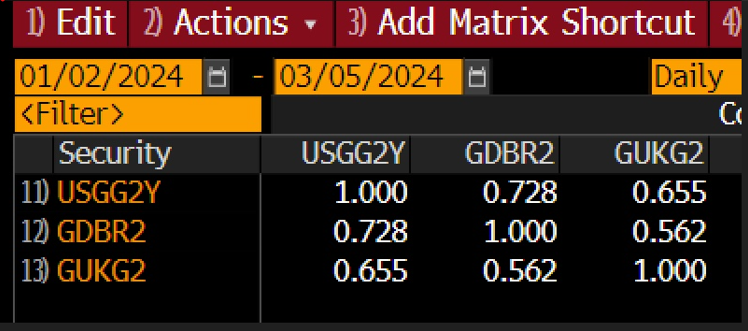

YTD correlations:

Source: XTB and Bloomberg

As you can see, the relationship between US and German 2-year yields has been a notch closer since the start of the year, and they have moved together 72% of the time. The more interesting shift is the increasingly positive correlation between the US and the UK 2-year yields, which has increased to 65% from 57% a year ago. This may be down to the improving UK economic outlook for 2024 compared with 2023.

In contrast, the UK 2-year yield has become less correlated to the German 2-year yield so far this year. This had been 70% and has slipped to 56%, as the German economic outlook darkens, which could force the ECB to be the first of the major central banks to cut rates this year. It also corresponds with the 1.4% decline in EUR/GBP YTD, as the pound benefits from a stronger yield differential with Germany.

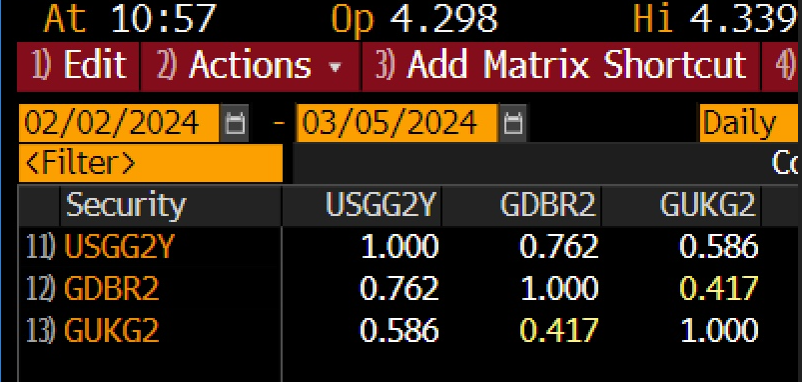

1-month correlations:

Source: XTB and Bloomberg

The 1-month correlations are also worth watching, and they are showing a decline in the relationship between UK and US 2-year yields, back towards the 12-month norm, and a further increase in the correlation between German and US 2-year yields. UK and German yields have been negatively correlated since the start of February, as the economic fortunes of Germany and the UK diverge.

Overall, US Treasuries are one of the world’s most important asset classes. The 2-year Treasury yield seems to be moving the 2-year German yield, and to a lesser extent the 2-year UK Gilt yield. Usually, bond yields are not so correlated, so the strong positive relationships between bond yields could be considered an anomaly, and they may not last.

When will the correlations brake down?

However, for now, if Jerome Powell moves the dial for US interest rate expectations when he testifies to Congress this week, and this causes movement in US bond yields then we could see German bond yields continue to move in line with US yields. The market expects Powell to state that the Fed is in no rush to cut interest rates, which may put further upward pressure on both US and German bond yields, but only in the short term.

The economic outlook for Germany is much weaker than the economic outlook for the US for this year. Thus, the ECB meeting on Thursday could be notably more dovish than Powell’s testimony on Wednesday. If the ECB is considerably more dovish than Jerome Powell then two things may happen: 1, German bond yields could diverge from US Treasury yields and 2, German bond yields could turn lower, and we may see them reverse some of the 46bps they have increased by so far this year.

The asset prices that could move on the back of Jerome Powell testimonies

In the next few days there is a lot of event risk that could impact bond yields and interest rate expectations. It is worth noting that US 2-year bond yields have the highest positive correlations to other bond yields, although the link with the S&P 500 has broken down and is currently insignificant. However, the 2-year Treasury yield has some significant negative correlations, including with gold and the gold price moves inversely to the 2-year yield 66% of the time, the Aussie dollar moves inversely to the Aussie dollar 66% of the time, and inversely to GBP 60% of the time. If we see any movement in Treasury yields this week, these are the asset classes to watch.

Daily summary: Weak US data drags markets down, precious metals under pressure again!

Datadog in Top Form: Record Q4 and Strong Outlook for 2026

US Open: Wall Street rises despite weak retail sales

Coca-Cola Earnings: Will the New CEO Withstand the Pressure?

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.