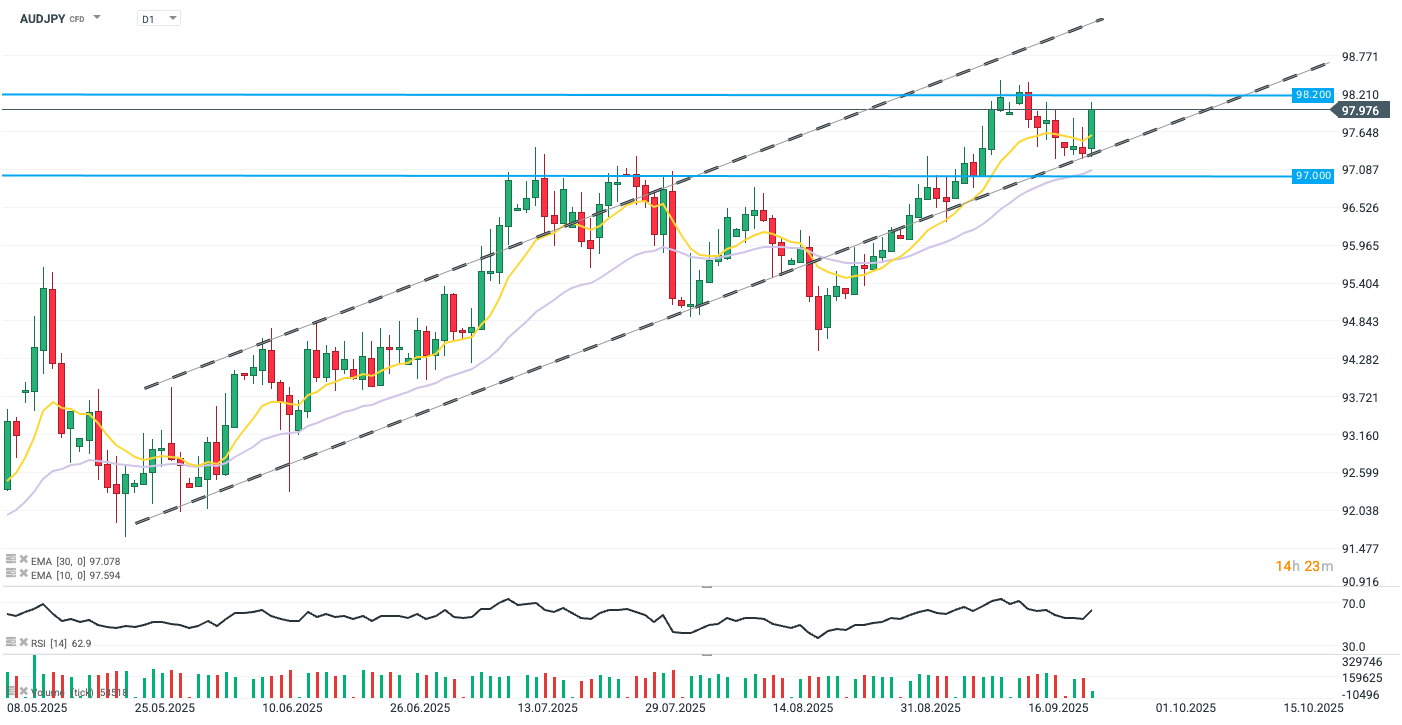

AUDJPY rebounds bullishly by 0.7%, with yen giving up the most against the Australian dollar among all G10 currencies. Dynamic appreciation of AUDJPY has been motivated by trend-supporting data from both economies, particularly higher monthly inflation reading in Australia that caps expectations for further monetary easing in the country.

AUDUSD rebounds from the lower bound of the well pronounced increasing channel. Today’s gains erase the recent correction which pushed the pair off of its highest levels since the start of 2025. Source: xStation5

What is shaping AUDJPY today?

-

Australia’s consumer price index rose 3.0% in August from a year earlier, up from 2.8% in July and slightly above forecasts. The increase was partly due to base effects but highlighted persistent pressures, particularly in services such as restaurant meals, takeaway food, andf audiovisual services. Core inflation was mixed: the trimmed mean eased to 2.6%, while the measure excluding volatile items climbed to 3.4%. Housing costs also ticked higher, suggesting upside risks for third-quarter inflation after months of moderation.

-

Markets quickly adjusted rate expectations after the inflation surprise, with major banks and financial institutions abandoning calls for a November cut. Odds of a move dropped to 50% from nearly 70% before the data, with investors now expecting rates to stay at 3.6% until at least May 2026. Analysts flagged the labour market as the key variable for policy direction, though its volatility makes a near-term cut less likely. The RBA continues to emphasize quarterly CPI as its preferred guide.

-

On the JPY side, Japan’s private sector activity is visibly slowing, as indicated by September’s flash PMIs. The composite index hit the lowest in four months, with manufacturing falling more than expected from 49.7 to 48.4, the lowest since March, due to sharp order declines and weaker exports. Services’ expansion helped to offset the downturn in manufacturing with solid activity and sales, reflecting robust domestic demand. Cost pressures persisted, selling prices rose, and employment growth slowed to a two-year low.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.