AUDUSD continues its rally, adding another 0.3% amid broad dollar weakness and the newest GDP print for Australia. Data came in lower than expected, but it underlined constantly growing inflationary pressures, which reinforced market’s bets on hawkish RBA.

AUDUSD defended today the 50.0 Fibonacci level (around 0.656), currently approaching the test of the next resistance around 0.658-0.659, which coincides with 61.8 Fibonacci level. If the worries about further economic slowdown in China don’t outweigh the interest rate differentials, the pair should remain confidently above EMA100 (dark purple). Source: xStation5

What shapes AUDUSD today?

-

Australia’s GDP grew 0.4% quarterly (2.1% y/y), led by strong private investment and household consumption. Public investment and government spending also supported growth. Offsetting factors included drawdowns in inventories and net trade, as imports rose faster than exports. Price pressures increased, driven by energy, rents, food, and labour costs. The reading came in lower than expected (Bloomberg consensus: 0.7% q/q), but the well pronounced inflationary development reaffirms market’s hawkish RBA expectations, with broad dollar weakness further contributing to the gains in the pair.

-

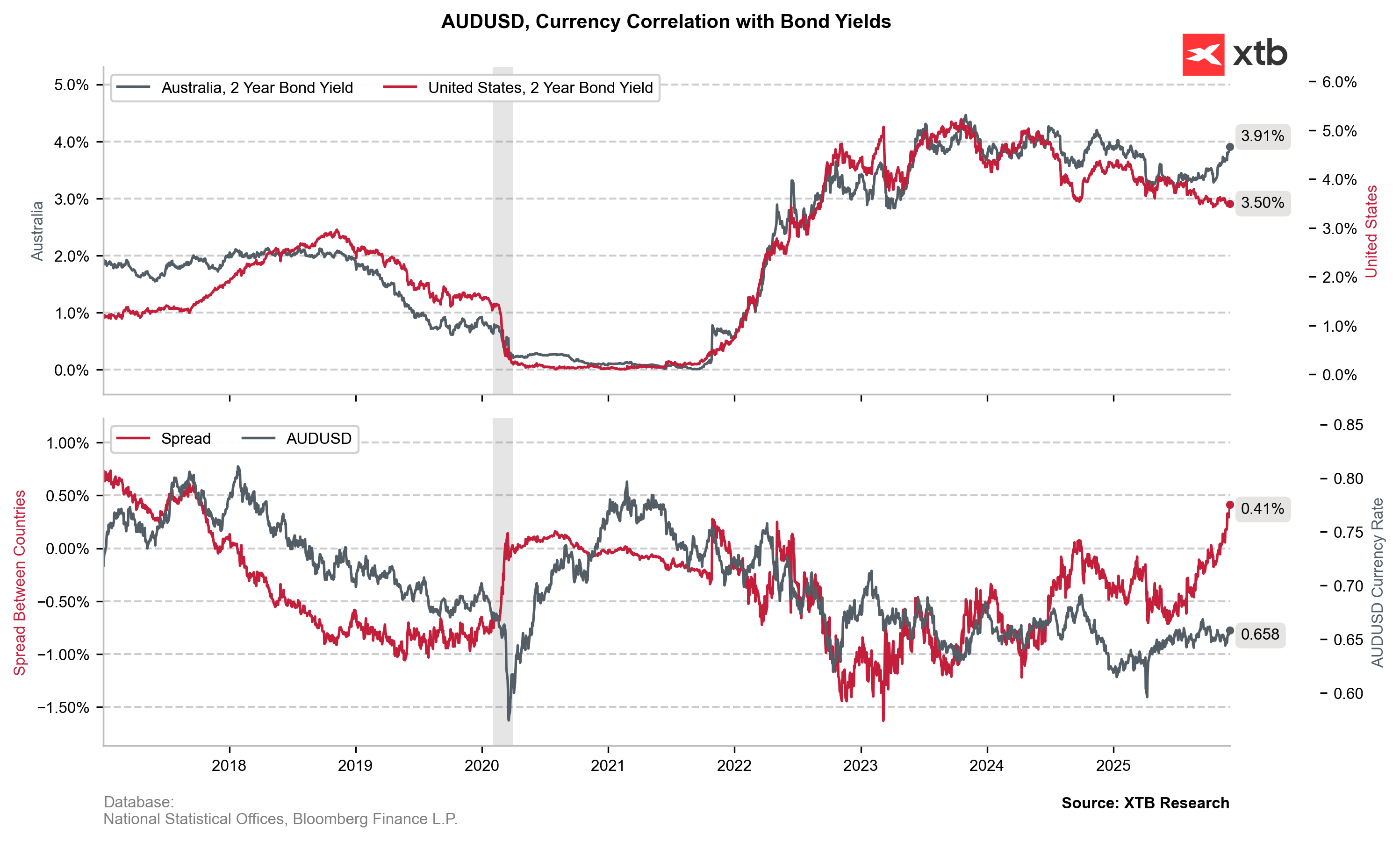

The spread between 2-year Australian and US government bonds has reached its highest level since late 2017. The US monetary policy reflects both short-term expectations easing and a more dovish long-term outlook, driven by the anticipated succession of Jerome Powell by a Trump nominee, to be announced in early 2026. Overnight, President Trump referred to his chief economic adviser, Kevin Hassett, as a “potential Fed chair.” Markets view Hassett as one of the most pro-low-rate candidates on the unofficial shortlist, which is otherwise dominated by current or former Fed officials.

-

AUD also got some additional support from higher than expected services PMI in China (52.1 vs 52 expected). The country's services sector expanded in November, but growth slowed slightly (previously: 52,6). New orders and export demand improved, supported by easing Sino-US trade uncertainty, yet employment continued to contract and profit margins remained under pressure. Input costs rose for the ninth month, while firms’ future activity expectations weakened, highlighting ongoing challenges.

The spread between Australia and US 2-year bonds surged to its highest since late 2017 over last month. Source: XTB Research, Bloomberg Finance LP

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.