What is currently influencing the AUD/USD exchange rate?

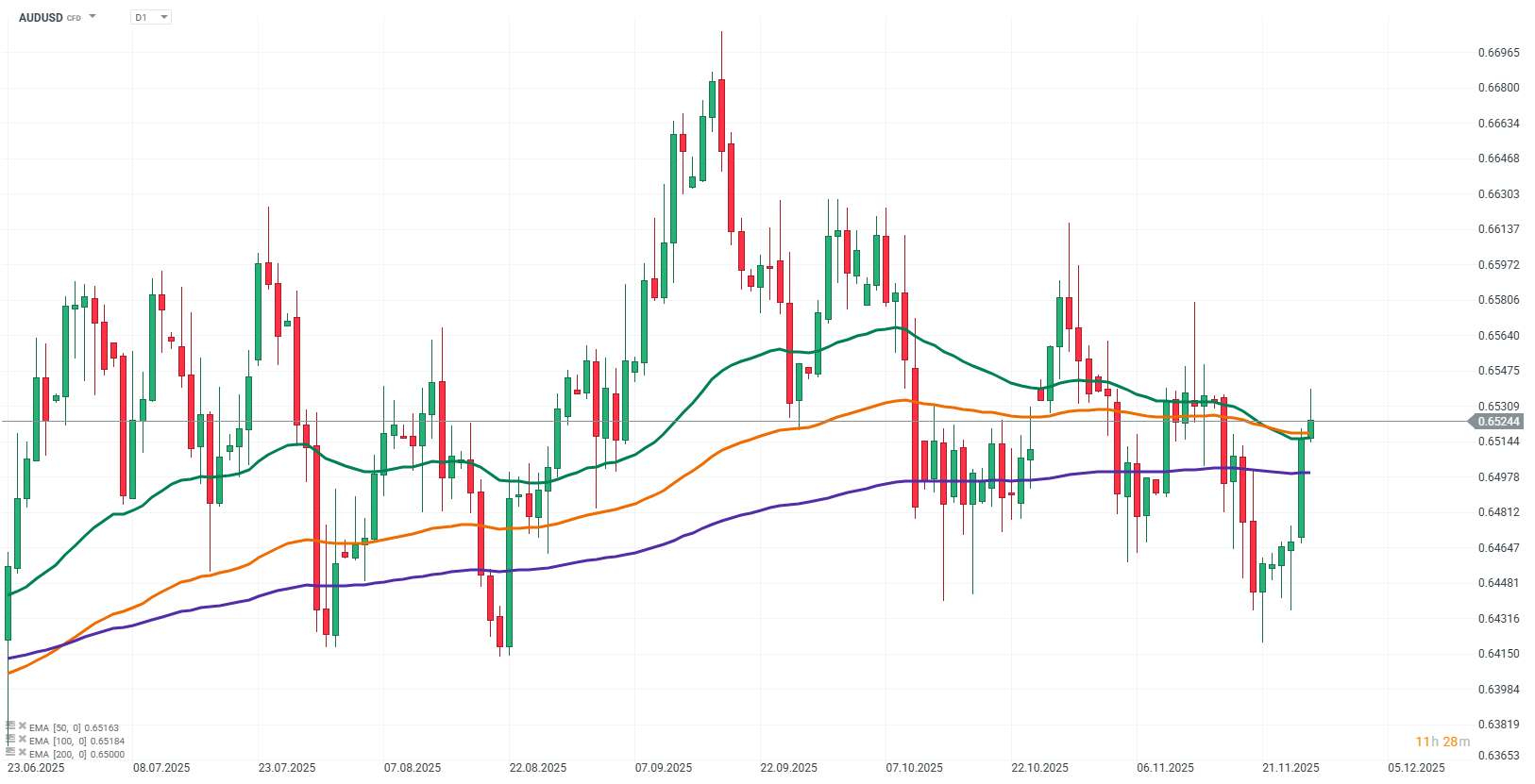

The AUD/USD pair is moving higher today, with market dynamics shaped primarily by macroeconomic factors coming from both Australia and the United States. The pair is currently trading in the 0.6520–0.6540 USD range per Australian dollar. Persistently high inflation in Australia strengthens expectations that the Reserve Bank of Australia will not rush to cut interest rates, which supports the value of the Australian currency. At the same time, the US dollar is weakening, as investors increasingly assume that the Federal Reserve may soon shift toward a more accommodative monetary policy stance. The combination of these factors helps sustain the upward trend in the AUD/USD pair.

Source: xStation5

What is driving the AUD/USD today?

High inflation in Australia and RBA policy

The latest inflation readings from Australia have once again surprised markets with their strength, showing that price pressures remain significantly higher than previously expected. Core inflation also remains above the central bank’s target, reinforcing the belief among investors that the RBA is unlikely to ease monetary policy in the near term. Keeping interest rates unchanged creates favorable conditions for further strengthening of the AUD. Inflation data have also improved the technical picture, increasing investor demand for the Australian currency.

Rising expectations for Fed rate cuts and a weaker US dollar

In the US macroeconomic environment, expectations are growing that the Federal Reserve may soon take a more dovish stance. The increasing likelihood of a rate cut reduces the attractiveness of the US dollar, which in turn supports developed-market currencies such as the AUD. This divergence in the outlook for monetary policy between the two central banks currently works in Australia’s favor. Additional support comes from improved global sentiment, which encourages flows into more cyclically sensitive currencies.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

This content has been created by XTB S.A. This service is provided by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, entered in the register of entrepreneurs of the National Court Register (Krajowy Rejestr Sądowy) conducted by District Court for the Capital City of Warsaw, XII Commercial Division of the National Court Register under KRS number 0000217580, REGON number 015803782 and Tax Identification Number (NIP) 527-24-43-955, with the fully paid up share capital in the amount of PLN 5.869.181,75. XTB S.A. conducts brokerage activities on the basis of the license granted by Polish Securities and Exchange Commission on 8th November 2005 No. DDM-M-4021-57-1/2005 and is supervised by Polish Supervision Authority.